I think 2024 is certainly going to be an interesting year, one that will chart the course for the rest of the decade. The Presidential Election is almost certain to be a circus, but I think financial markets could be chaotic as well. We have had the fastest rate hiking cycle in history over the last couple years, and many market commentators think that the rate hikes are over and we will start to see rate cuts this year. We still have an inverted yield curve, which is never a good sign. We have a complicated macroeconomic landscape, which spells trouble for almost all financial assets, but I think we also have the ingredients for a commodities supercycle. As far as 2024 goes though, all eyes will be on the Presidential Election.

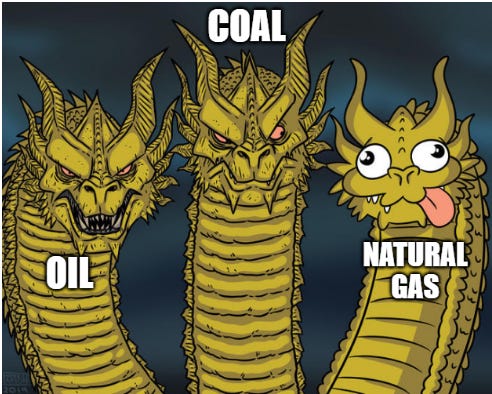

I might have been a bit melodramatic with the title, but I think 2024 is going to be a wild ride as far as geopolitics go. I talked about the main issues of the election, the candidates, and conflicts that could get worse next year. Today, I’ll be writing about what I think 2024 holds from the perspective of markets and macroeconomics. I think we are looking at a three headed monster for the macro picture: we have the debt problem of the 1940s, the inflation problem of the 1970s, and valuations similar to the 2000 tech bubble.

This Time Is Different

I know, I know. These are four of the most dangerous words in finance and investments. I want to make it clear that I’m not saying that you can ignore valuations, and just buy big tech or QQQ 0.00%↑ and set it and forget it. I’m saying that this time is different, because we have a bunch of different problems all at once. Every situation has its own nuances and pressure points, but today’s situation looks like slow motion train wreck waiting to happen. We have the debt problem of the 40s, and we seem to add a trillion to the national debt every couple months (the total now sits above $34T).

I think we are also going to have the inflation problem similar to the 70s. I talked in more detail about inflation in a post last April, and despite the CPI coming down in recent months, I think inflation will come back with a bit of a lag when oil prices go higher.

Over the last century the purchasing power of the dollar has dropped dramatically, and I think we are probably headed towards an inflationary decade. We will see fits and starts with inflation, but I think average inflation will be higher over the next decade. Markets are cyclical and I think that points to higher inflation as several underlying cross currents have reversed in the last couple years.

Stocks (S&P 500 & QQQ)

The last problem (and potentially the most dangerous to broader markets) is the overvaluation, which in some ways mirrors the valuations from the dot com bubble. We can debate whether AI is the latest bubble or if it’s the holy grail for some of the megacap tech companies, but you certainly can’t buy stocks like Apple AAPL 0.00%↑, Microsoft MSFT 0.00%↑, or Nvidia NVDA 0.00%↑ at cheap valuations. The concentration of major stock indices like the S&P 500 SPY 0.00%↑ and the Nasdaq 100 have only served to exacerbate the rich valuations.

As long as the money keeps flowing into the market cap weighted indices, the valuations can keep getting more ridiculous, but I think investors looking to buy and hold will probably be disappointed with their returns in three to five years. The concentration in the largest tech stocks is a double edged sword. What works on the way up (lots of buying for the largest companies), works in reverse on the way down, as those same stocks will see lots of selling. With the current fundamentals and valuation, you won’t have many active investors looking to buy these stocks unless they get a lot cheaper in my opinion.

Bonds

Bond funds like TLT 0.00%↑ have had a nice bounce over the last couple months, but I think investors could be playing with fire owning long bonds in 2024. Interest rates could come down in 2024, and if they do, bonds will perform just fine. If interest rates stay flat, I think investors owning long bonds looking for returns will be trying to get blood from a stone. While many are expecting a Fed pivot and lower interest rates this year, I will believe it when I see it. If inflation comes back like I think it could, it could press the issue. I just see owning long bonds right now as trying to pick up pennies in front of a steamroller.

It might work for a while, but the risk/reward doesn’t get me excited like it does for some commodity sectors. I don’t have any issue owning short term debt (1-2 years), but I’m staying away from the longer dated bonds. If you are looking for a short-term trade, that’s one thing, but I think the long-term bond holders are in for a rough time. I prefer to stick with a money market fund for simplicity’s sake, but it is basically the equivalent of owning short-term Treasuries. I wanted to repeat a quote I included from a past post on bonds.

"In war, truth is the first casualty." - Aeschylus | “You know what the second casualty of war is? Bonds” - Forest For The Trees author Luke Gromen

Commodities

We are in year 5 of this decade, and I think that we are going to look back on this decade as a wild ride in financial markets, including the commodities market. While I think most other asset classes are going to see outflows and poor performance, I’m expecting commodities to be one that has inflows and outperformance. Some have predicted a commodities bull market of epic proportions and I certainly wouldn’t complain about this outcome.

Even if we don’t get the “greatest commodities bull market of all time” (insert your own hyperbolic description here), I think the commodities bull market is going to sneak up on a lot of people, investors included. If you’re still reading my posts and haven’t figured out that I’m a huge commodities bull by now, I don’t know if I can make it much clearer at this point. With that said, I think that certain commodities (and the related equities) have a better setup over the next couple years.

Oil

Because it is the most important commodity, I have to start with oil. The last couple years have been volatile to say the least, with the oil price bouncing all over the place, giving investors a bumpy rollercoaster ride. Oil went negative in 2020 due to financial market shenanigans, and it only took two years from there for the price to touch $120 in 2022. Over the next year, the price was basically cut in half, briefly dipping below $70 in June of last year. It took all of three months to get back above $90, and now we sit just above $70 again. We have also had the Biden administration draining part of the Strategic Petroleum Reserve through the first half of 2023, putting downward pressure on prices.

I don’t have some short to medium term prediction on oil prices. I think it’s foolish to say that oil will be at $87 per barrel (pick your exact price) in 12 months. What I will say is that the oil price will trend higher in 2024 and beyond in my opinion. I think we are headed for a major imbalance in supply and demand over the next decade. At some point in the next couple years, we are probably going to see Permian Basin production peak and start to roll over. Demand has continued to grow at a steady pace, and I don’t think that pattern will change. Would a recession slow oil demand for a time? Yes, but I don’t see it being catastrophic for oil bulls.

We also have the added complexity of a potential flareup of a larger conflict in the Middle East. We have already seen some ships heading around the Horn of Africa, instead of the shorter route through the Suez Canal, to avoid the being targeted by the Houthis in the Red Sea. There have been more than 20 attacks since October, and they hit a Maersk container ship this past weekend. The US and the rest of the usual suspects issued a statement warning of “consequences”. We also had news break yesterday that Saleh al-Arouri, a Hamas leader, was killed in a drone strike, along with six others, while in Beirut, Lebanon.

If you want frequent updates on geopolitics, I would strongly recommend following Mark Wauck’s Meaning In History Substack. It’s free for now, and the value he provides is worth a lot for people trying to stay on top of current events. Trying to keep up with all of the important events going on that might impact markets is like drinking from a firehose, and his Substack gives a concise breakdown of all the questions you might have on geopolitical events: who, what, when, where, why, and how. To be clear, the oil bull case doesn’t rest on the Israel/Gaza situation spiraling out of control, but with oil at $73 per barrel on the WTI contract, I don’t think there is much (if any) geopolitical risk in the current price of oil.

How I’m Playing It

If you agree with my opinion that the Permian Basin is due to roll over, that makes it tough to get bullish on American oil producers, especially the ones that primarily produce from the Permian Basin in Texas. If shale production is set to peak in the next couple years, the obvious next question is Cui Bono? Who benefits? Two of the companies that I think are still attractive are Petrobras PBR 0.00%↑ and Ecopetrol EC 0.00%↑. They both pay large dividends to patient investors, the worst of the political uncertainty appears to be behind us, and they both are cheaper than their American counterparts. I have talked about them in detail in previous posts, but I’m expecting continued double digit yields with potential for capital appreciation as well.

I also own Frontera Energy, which has been a dud so far. If their offshore block off the coast of Guyana pans out, the stock is going to work a lot better than it has over the last year, but that is a much smaller position for me than Petrobras or Ecopetrol. The other sector I have been focused on is the offshore services space. I think that offshore is in for a long bull market, and despite the large moves in some of the stocks off the bottom over the last couple years, I think the valuations are still attractive. Transocean RIG 0.00%↑ is my favorite deepwater pure play, despite its levered balance sheet. I think they have the best combination of management and deepwater assets, and I plan to exercise my $5 strike calls that I own in the next couple weeks to buy more shares.

Valaris VAL 0.00%↑ is the other one that I own with a focus on deepwater, but they own jackups as well. It is a small position relative to the other companies I hold, but I find the warrants that expire in 2028 attractive, with a very asymmetric setup and a long time for the offshore thesis to develop. Borr Drilling BORR 0.00%↑ is one of my more recent purchases, and they are a pure play on jackups, which looks like it could benefit quicker than deepwater rigs from rising day rates. They termed out their debt in the last couple months, and have started a significant capital return program, with a $100M buyback authorization and a quarterly dividend of $0.05. Tidewater TDW 0.00%↑ is my last holding in the space, and they are one of the main OSV (offshore service vessel) plays. Shares had a monster run in 2023, but I have no intention of selling my shares because I think we are still years away from the end of the offshore bull market and fair value is much higher in my opinion.

Coal

I talked about the coal sector in a recent post comparing it to the tobacco sector in 2000. I think we are headed for higher prices on average over the next couple years, but it will be hard for thermal coal prices to rally unless natural gas prices head higher. Metallurgical coal prices have been on a tear over the last several months, and while we could see a short term pullback, I’m still constructive on prices with a longer term time horizon. The stocks are still cheap and out of favor for ESG reasons, but I think the opportunity is still very attractive and the downside is relatively limited. Part of this is due to valuations, as stocks across the whole sector are still cheap. Capital returns are going to be a driver for investor returns, as many companies are buying back gobs of stock at dirt cheap multiples. Most of the companies have debt free balance sheets (or very low debt levels), and I think stocks in the sector are going to make investors a lot of money over the next 3 to 5 years.

How I’m Playing It

Each company in the sector is a little different, but I think you could throw darts at stocks in the coal sector and you would probably do just fine. I’m sticking with my picks of Peabody Energy BTU 0.00%↑ and Warrior Met Coal HCC 0.00%↑, which gives me exposure to thermal and met coal alike. I have complained about Peabody Energy lagging the rest of the coal sector in 2023, but I think 2024 could be the year we see some catchup. They are buying back a lot of stock, but they also have the catalyst of activist investor Elliott Investment Management selling their stake. They have continued to sell in recent weeks, so we will see how long it takes for them to completely exit, but I think higher share prices are ahead for Peabody in 2024.

Warrior has been a monster since I purchased shares, and I’m still kicking myself for not buying the December 24 $70 call options, which have basically doubled since I was looking at them a couple months ago. Warrior is a metallurgical coal pure play, and they are set to bring the Blue Creek mine online in a couple years. I think that the risk/reward on Warrior is potentially the most attractive of any stock that I own, especially since I’m expecting higher coal prices on average on a long term timeframe. I don’t want to get too far ahead of myself, but I think shares are headed for $100 in the next 3 to 5 years (probabably sooner), with the potential for a nice upside surprise.

Natural Gas

There is a reason natural gas is known to be the widow maker for commodity traders. You have massive swings in price and sentiment, and I will be surprised if natural gas has a monster year in 2024. Natural gas has been the redheaded stepchild of the energy sector, which I think will continue this year. One of the problems with natural gas is the amount of associated production from oil here in the US. The shale wells get gassier every year, and those companies will generally continue to produce oil and gas as long as oil is priced high enough for them to make a profit.

On top of this, a lot of the companies that produce primarily natural gas have shown a lack of discipline over the last year, continuing to overproduce despite low gas prices. One of the bullish catalysts that will take a couple years to develop is the LNG (liquid natural gas) export capacity coming online. We will be able to send gas to Europe, and I wouldn’t be surprised to see Henry Hub (aka US nat gas prices) start to converge with European gas prices in a couple years, which are much higher. That will take time but it is something to keep on the radar.

The energy content of natural gas is approximately 1/6 of a barrel of oil, so if you convert the current Henry Hub price ($2.76) to the oil equivalent, it’s equal to $16-17 per barrel. That’s very cheap, and normally I would be looking to buy the equities when a commodity is cheap. I do think natural gas (and the related equities) will be a potential trade to revisit in the future. I just don’t have the same conviction for natural gas participating in the commodities bull market to the same degree as oil or coal, so I’m waiting and watching for now.

Uranium

Uranium has been on a tear over the last year, and I think 2024 will be more of the same. I wouldn’t be surprised to see a pullback, but my base case is that Uranium prices head much higher over the next couple years. I have been focused on other ideas in my own portfolio (and been short on dry powder at times), so I wasn’t able to get on the Uranium train before the large run up in the second half of 2023. I was able to purchase a nice chunk of the Sprott Physical Uranium Trust and the Sprott Uranium Miners ETF URNM 0.00%↑ in the John Doe portfolio before the run, but I’m not participating in the Uranium bull market just yet because I didn’t want to chase it. If we do get a large pullback, I will be a buyer because I think the trade has at least another 2 to 3 years to go. The supply and demand gap is large, but I wouldn’t make it a large position because I would be showing up late to the party on this one.

Gold

Now we get into the precious metals segment, starting with gold. Gold is already knocking on all time highs to start 2024, and I think we eventually head much higher. I wouldn’t be surprised to see gold at $2,500 per ounce by the end of the year, and at $3,000 or $4,000 per ounce in the next 3 to 5 years. If this happens the miners probably go berserk, but mining is a crappy business and the mining stocks only work for brief bursts. When they work, it can be explosive, but I haven’t dipped my toe into the mining sector.

I am interested in some of the gold royalty companies, which don’t have the same cost inflation as the miners. Franco-Nevada FNV 0.00%↑, the 800 pound gorilla in the royalty space, is down from $160 to $110 per share due to issues and protests with the Cobre Panama mine, and I think is one of the few stocks in the gold sector that you can hold through full cycles, despite recent negative headlines. Sandstorm SAND 0.00%↑ is a smaller royalty company with a couple large assets coming online in the next couple years, but many investors have been frustrated by their management team, which has had several missteps over the last couple years. If they get their act together, there is definitely upside there, but I’m still watching from the cheap seats on the gold sector.

Silver

Silver is an interesting case, and I would say it’s a hybrid between a precious metal and an industrial metal. I wouldn’t be surprised to see silver outperform gold in 2024. I think if we see silver break through the $30 level, it will head much higher. It’s not a matter of if, it’s a matter of when. If things don’t get moving in 2024, silver probably stay stuck in the current trading range. If silver prices break out, I think we could easily see $35 per ounce or higher by the end of the year. I haven’t found any silver stocks that interest me yet, but I am looking to purchase physical silver, especially if the silver spot price drops near $20 per ounce. With the physical premiums it will be closer to $25 all-in, but I think it’s good to have some silver on hand for disaster insurance.

Copper

I have a hard time getting excited about copper. It’s an industrial metal, and many market watchers call it “Dr. Copper” as a good indicator of how strong the global economy is. We are definitely headed for an imbalance of supply and demand at some point this decade, but I don’t know if the gap will be as wide as many are predicting. One of the main drivers that people keep talking about is EV demand, but I don’t think we will get anywhere near many mainstream projections for EV volume. Part of this is due to the cost of the vehicles, but part of it will be the shortage of other commodities required for batteries, like nickel and cobalt to name a couple.

The obvious large cap copper play is Freeport-McMoran FCX 0.00%↑, but there will be smaller companies with top tier deposits that will make investors a lot of money over the next decade. Like natural gas, I will be digging deeper into copper over the next couple years, but I don’t think 2024 will be a great year for copper prices and copper companies. This doesn’t mean buying now won’t work, but I just like the risk/reward in oil and coal over copper for now.

Residential Real Estate

I’m starting to come around to reasons to be bullish. There are a lot of homeowners locked in at low mortgage rates (3% or less), and that means there won’t be a lot of movement from these homeowners. We will see what happens with supply, but homebuilders have been on an absolute tear over the last year, so if you like to look at those stocks as an indicator of how the housing market is doing, you might end up in the bullish camp. However, sales volumes have been dropping, and if we head much lower, we could go below where we were between 2008 and 2010.

With that said, I think that mortgage rates being higher is going to be a drag on the asset class on the whole. Housing affordability is at an all-time low, which I talked about in my post last week. I think it will be an important issue for this year’s election. Residential real estate is between a rock and a hard place in my opinion. You either need lower interest rates to keep prices high, or you need prices to come down if rates stay at their current level.

Commercial Real Estate

I think the commercial real estate sector is full of potential landmines. I have heard multiple people involved in the space say “Survive until 25”, meaning a lot of them are banking on interest rates coming down so they won’t have to roll debt over at much higher rates. I think multifamily apartments will be fine, but I think there are a lot of bodies waiting to float to the surface in the office sector. This could have an impact on the banks, but it’s something to keep an eye on. If we do get another selloff, I will probably be looking to get back into Vornado VNO 0.00%↑, and potentially some Apartment REITs, but I’m fine sitting on the sidelines for now.

Conclusion

I want to make it clear that I try to look at each investment with a 3 to 5 year time horizon. This doesn’t mean I will hold for that long, but if I can’t see a path to attractive returns over that timeframe, I try to look elsewhere. Personally, I’m avoiding broader stock markets, including big tech companies, bonds, and real estate (except for a couple REITs). I think we are headed into a commodities cycle that will become apparent in the next couple years, but I think several commodities sectors, like oil and coal, are going to be big winners over the next several years.

History doesn’t repeat, but it does rhyme. Could the rest of the 20s rhyme with the 1970s for these commodities? With the way my portfolio is built, I certainly hope so. I think we are in for a broad commodities bull market, and I will be looking to add exposure to uranium, gold, silver, and copper opportunistically, but I think the whole commodities space is an attractive space to be looking for investment opportunities. Could commodities take a hit if we get a severe recession? Absolutely. At the same time, I think the stuff that I am invested in is very cheap, which gives me a margin of safety that I’m comfortable with.

With my investments, I take a value oriented approach and keep a contrarian mindset. That has led me to the commodities sector over the last couple years. My approach isn’t for everyone, but there might be a stock or two that is interesting enough to take flier on. If things play out like I think they will in 2024 and beyond, my portfolio will dramatically outperform, while the broader market languishes over the next several years. You check the box for cheap valuations, huge capital return programs, and add in the expectation of rising commodity prices, and you have a recipe for returns that could be explosive without taking on too much risk.

Disclaimer

I own shares of Petrobras, Ecopetrol, Frontera Energy, Transocean, Borr Drilling, Tidewater, Peabody Energy, and Warrior Met Coal. I also own calls on Transocean and Peabody Energy, and Valaris warrants. You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.

Given your view on LT oil S/D have you considered Canadian oil sand producers with long reserve life? Seems like they would be well positioned, and have a decent jurisdiction. If considered / rejected - what made you reject?

Just started a position in PTALF , I'm going to be adding to PDS/ DRQ / NBR on pullbacks already have positions in TDW / BORR / DO / VAL/ for drillers

I think oil service sector could do as well , XOP / OIH/ XLE look good as well as XME