The Coming Inflationary Decade

Why Inflation Will Be Higher For Longer & The Asset Classes I Prefer To Fight Inflation

Summary

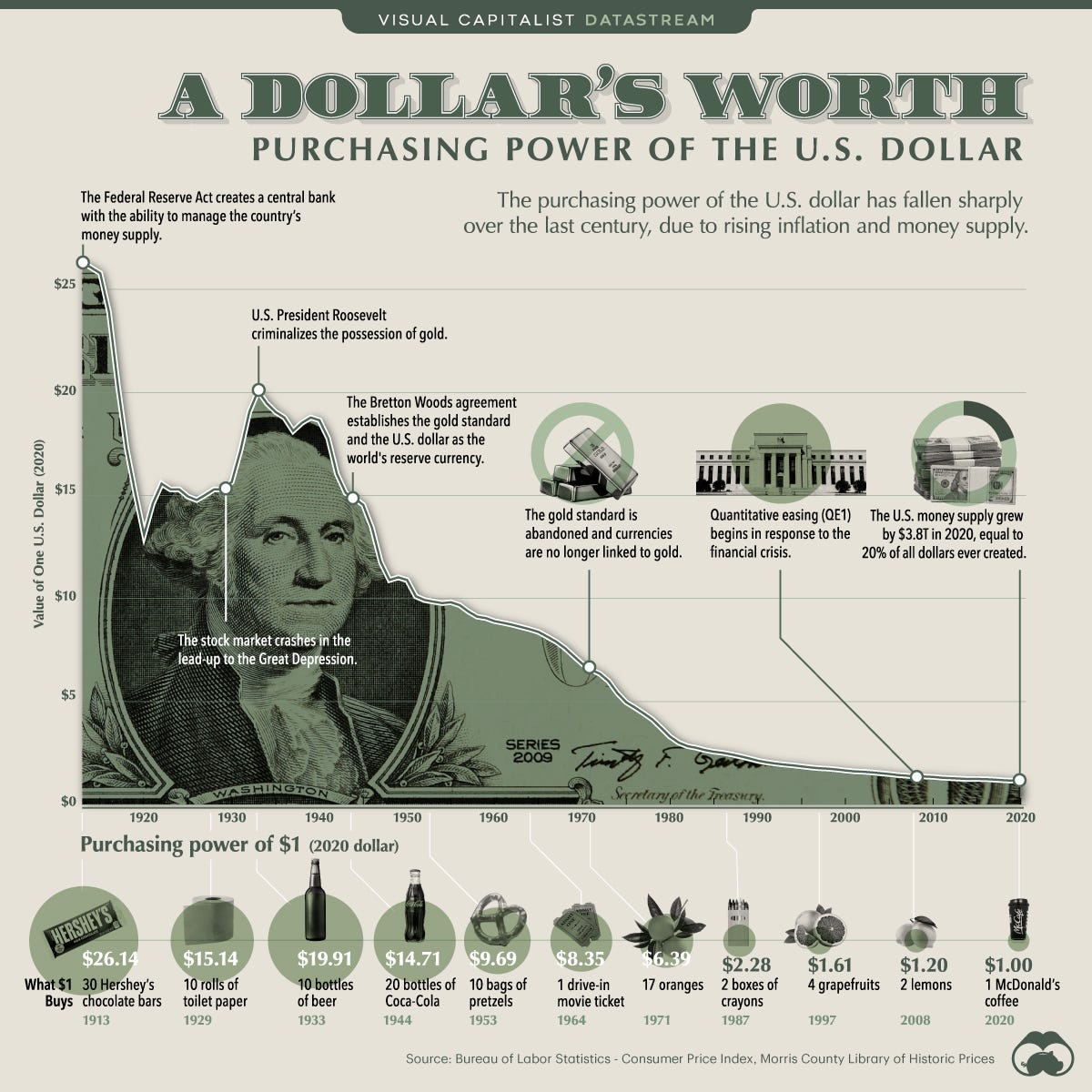

Inflation has consistently eroded the purchasing power of the dollar over the last century since the creation of the Federal Reserve.

In my opinion, inflation is significantly understated. Using Shadow Stats, you can see just how understated inflation is by using old CPI models.

Interest rates and money supply are important factors driving inflation, but there are always other cross currents that have an impact.

I think we will see higher inflation in the coming decade, with swings up and down depending on what is happening in the economy and markets.

I break down different asset classes and which ones I find attractive for an inflationary environment.

Inflation: The Silent Tax

On Tuesday I talked about Money Market Funds and why they could be a good alternative to savings accounts. I mentioned that the interest rates on Money Markets wouldn’t keep up with inflation, which has been running hot for a couple years, but 4% is a lot better than the near-zero interest rates offered by savings accounts. Today I will be jumping into inflation, where I think it is headed over the next decade, and which sectors might benefit in coming years.

Inflation has been running hot over the last couple years for the first time in decades. Inflation, also known as the silent tax, has been a long-term problem for everyone in America since the beginning of the Federal Reserve in 1913. The purchasing power of a dollar has dropped dramatically over the last century, and as long as we have a central bank, I don’t think that pattern will change anytime soon.

When I hear older generations talking about buying their first home for $10,000 (when the average annual wage in the US was $5,600), or paying for college with a summer job, or buying a '68 Mustang for less than $3,000, it’s hard not to be jealous. The generational divide is a topic for another post, but younger generations face a much different economic environment, in no small part due to continued inflation.

Another thing that I found interesting is what happens to specific items or sectors where the government gets involved. When the government starts giving out subsidies, guaranteeing student loans for college, or interfering with the medical system, it creates distortions in what should be efficient markets.

You will notice that the cost of technology has been an exception to the inflationary rule. I will touch on the deflationary impact of technology a little later, but I wanted to jump into the way we measure inflation and why the government metrics dramatically understate real inflation.

ShadowStats

In my opinion, the CPI (Consumer Price Index) is not an accurate depiction of inflation for most households. The weights for housing costs (rent or mortgage payments) and energy (which impacts transportation costs but also gets priced into pretty much everything else), don’t give an accurate view of the impact of inflation for the average Joe. A better way to look at inflation is Shadow Stats.

Shadow Stats is a website that uses the current inflation data and older CPI models from 1980 and 1990 to calculate inflation. If you have some time to spare, you should check out the website, which has various metrics, including unemployment, money supply, and GDP. While the CPI has been elevated for the last couple years, Shadow Stats paints a different picture when it comes to inflation. While the CPI has been pretty low for two decades, and even went negative in 2009, inflation measured by Shadow Stats has been much higher. The difference between CPI and Shadow Stats continued to diverge as the government massaged what went into the CPI so they could understate inflation.

There are several different motivations to understate inflation, with the obvious one being the cost-of-living adjustments for Social Security. While I could go on and on about Shadow Stats, I wanted to talk about some of the inflation cross currents before I get into sectors that I like as potential beneficiaries of an inflationary decade.