Warrior Met Coal: Asymmetric Risk/Reward Even After A Massive Run

Why Warrior Met Coal Is The Newest Addition To My Portfolio

Summary

Warrior Met Coal is a low cost metallurgical coal producer and exporter based in Alabama with a market cap of $2.43B. Shares are up more than 60% YTD and they still look very attractive to me.

They are growing production from their two existing mines, and they are developing a new mine, Blue Creek, that should begin production in 2026.

Warrior sits on top of a cash rich balance sheet, and they should be debt free in the near future. Shares trade between 5x and 6x earnings.

The bull case scenario for investors is that Warrior has plenty of cashflow to fund capex at Blue Creek, buybacks and/or dividends, and pay off the remaining debt at the same time. Warrior currently has a small quarterly dividend payout ($0.07), which puts the yield at 0.6%.

For long-term investors, the downside at the current valuation looks limited, while the upside looks massive.

I mentioned last week that I would be selling Enterprise Products Partners to reinvest in a couple new ideas. The first new stock is Warrior Met Coal HCC 0.00%↑, a metallurgical coal producer based in Alabama with a market cap of $2.43B. I think there is significant upside from the current share price as I expect the company to grow production meaningfully over the next couple years into a rising commodity price environment. I have made it one of my larger positions because I think the risk/reward is heavily skewed to the upside. While coal stocks remain out of favor for a variety of reasons, I think we are starting to see cracks in the so-called ESG agenda that pushes wind turbines and solar as renewable energy.

At the end of the day, I still think people are going to want cheap energy that thermal coal can provide, and steel production that requires met coal to feed blast furnaces around the world. Warrior’s stock still looks cheap to me, even after a 60% run YTD. Hindsight is 20/20, but my portfolio would be performing much better if I had decided to put some of the money that I put in Peabody Energy BTU 0.00%↑ in a met coal producer like Warrior, or even Alpha Metallurgical Resources AMR 0.00%↑, which has been on an absolute tear while buying back a ton of stock. I just got back into the green on Peabody, but with their buyback program continuing to rapidly reduce share count, I think its only a matter of time until that translates into a higher share price.

Warrior Overview

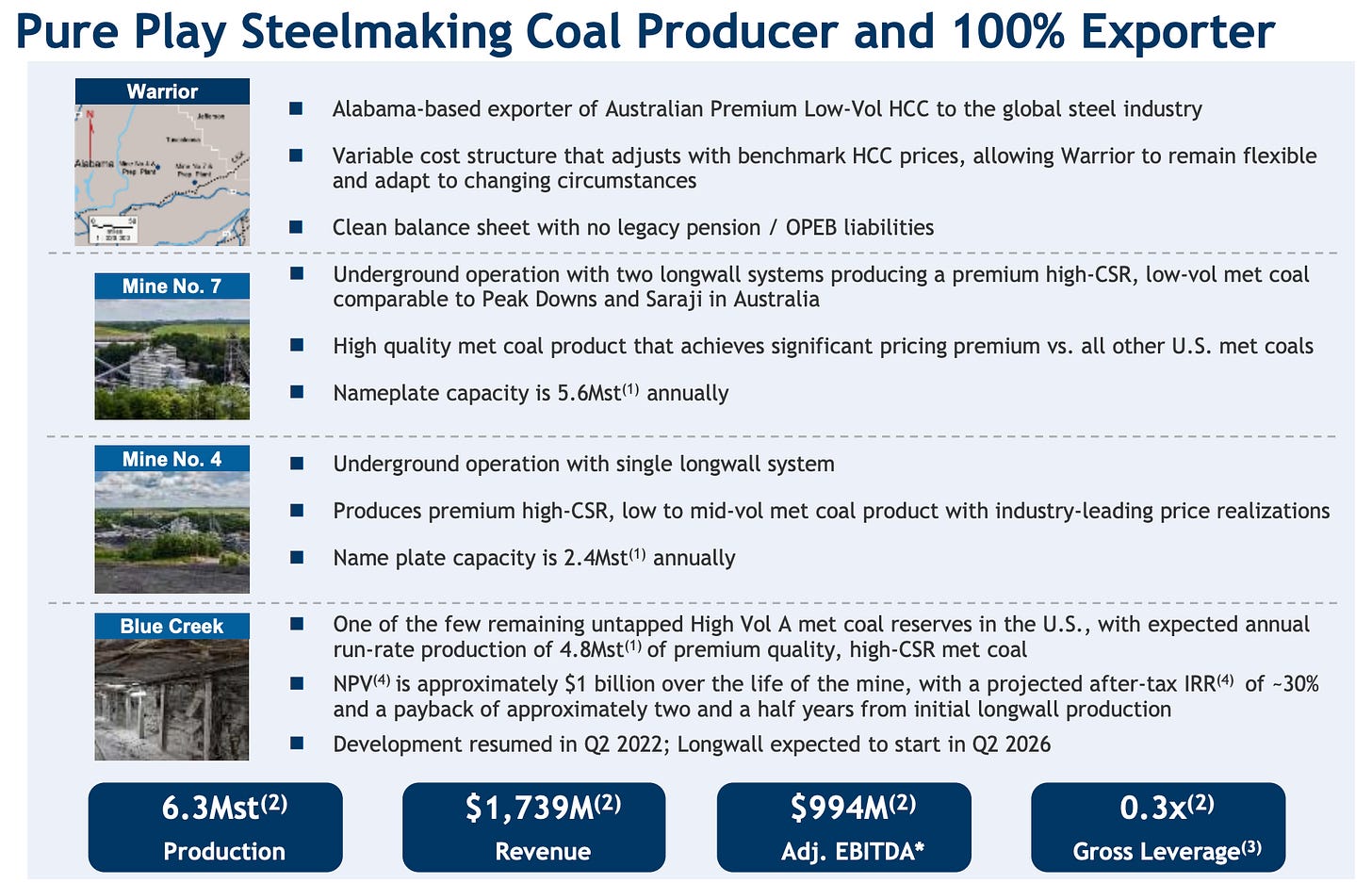

Warrior has two mines that are currently producing, with the Blue Creek mine currently under development. They have been growing their production (as well as tons sold) in 2023 from the existing mines, and Blue Creek coming online in a couple years could be a significant catalyst for the stock as well as Warrior’s business results. They say a picture is worth 1,000 words, and I figured I would pull the summary slide from Warrior’s recent earnings investor presentation.

I will get to Blue Creek later, but there are a couple things to touch on with Warrior before getting to the financials. Despite Warrior’s home base being in Alabama, they export nearly all of their coal to other markets. Europe is the largest importer, but they also export a large percentage to Asia and South America. The US is that little 1% sliver in gray on the pie chart below.

Australia is another large exporter of metallurgical coal, which places them closer to Asia, a massive and growing market for coal. Warrior’s location means that they can transport their coal to Europe quicker than some of the international competition. I’m assuming that Europe will continue to account for a large portion of Warrior’s export volume. Now that readers are familiar with Warrior’s operations, I want to get into Warrior’s financials.