Sable Offshore: So Now What?

My Thoughts On The CCC, A Recent Short Report & The Path Forward

Summary

Sable Offshore has been in the news over the last week with the California Coastal Commission’s (CCC) Notice of Violation, and a short report.

Shares are down almost 25% in the last week, so it’s been a rough week for investors.

Why the Office of the State Fire Marshal (OSFM) is the most important regulator for Sable, and why they have Federal and State regulatory authority.

The company is working directly with the Fire Marshal on pipeline repairs, valve installations, and everything else required to restart production. The production restart requires a green light from the Fire Marshal.

The Consent Decree and cooperation with the OSFM give Sable a strong argument for Federal Preemption of the CCC, if necessary.

CEO Jim Flores recently swapped his jet for 600,000 shares.

If you think I’m wrong, or you think you can add some nuance to anything I wrote below, please leave a comment. I would love to hear from anyone and everyone with something productive to add.

This post might get long so I’m going to jump right in. I have been getting a bunch of questions about Sable Offshore SOC 0.00%↑, the news around the California Coastal Commission’s Notice Of Violation, the recent short report from BWS Financial, and this week’s price action. I have a lot of thoughts about all of the above, and since I don’t want to rehash this, I’ll be making this available to everyone.

It clearly hasn’t been a fun week so far for Sable investors. It has been about a month since the announcement that the company settled with Santa Barbara County, and with this week’s selloff, it’s obvious that I was too impatient of a buyer. I thought something along the lines of “the market is going to figure this thing out sooner rather than later, first production is coming (it still is in my opinion), and the shares aren’t going to be in the $20s for long. It turns out I was right on that last part, just in the wrong direction. So the big overarching question for Sable is this: is the bull case broken?

In short, I think the answer to that question is no. I’ll be laying out the longer form version and the logic behind how I came to that conclusion. I have been going back and forth with several investors on Sable, but I think it’s worth laying out a detailed picture on where we are, and where I think we could be going in coming months. I’m going to bounce around a bit but I think it makes sense to start with the 8-K from July. The CCC has been making a lot of noise over the last couple weeks, but the Fire Marshal (OSFM) is still the most important regulator when it comes to Sable.

Fire Marshal - July 8-K

The California Office of State Fire Marshal (“OSFM”), in a letter dated July 10, 2024, stated that Pacific Pipeline Company’s (“PPC”) approved April 2021 Risk Analysis and Implementation Plan (the “2021 Plan”) remains in effect and complies with California State Assembly Bill 864. PPC had filed a supplemental Revised Risk Analysis and Implementation Plan (the “Supplemental Plan”) in response to the County of Santa Barbara’s denial of permits requested by PPC to comply with the 2021 Plan. While OSFM recognized the efforts of PPC to reduce spill response times to a spill incident and subsequent release to waterways, it determined that the Supplemental Plan is not considered as effective in mitigating the potential environmental impact compared to the 2021 Plan and it re-affirmed that the 2021 Plan remains in effect and has the best available technology.

PPC and Santa Barbara County are actively engaged in discussions to resolve the issues surrounding the prior denial by the County of permits to allow for the installation of safety valves included in the 2021 Plan, which is the subject of ongoing litigation filed by PPC. These discussions are taking place against the backdrop of OSFM’s recognition that the 2021 Plan provides the most effective mitigation of potential environmental impacts. PPC is committed to following the OSFM directive and looks forward to resolving this Santa Barbara County permit issue so that the safety valves can be installed.

In cooperation with and under the supervision of OSFM personnel, PPC is currently making pipeline repairs, installing new pump stations, and constructing multiple new control facilities for lines 324 and 325, all in preparation for restart of Las Flores Canyon processing facilities and associated Santa Ynez Unit offshore production platforms. Restart is expected in late third quarter 2024 or early fourth quarter 2024.

Santa Barbara County Settlement - August 8-K

Santa Barbara County (the “County”), on August 30, 2024, acknowledged that the County does not have jurisdiction over Pacific Pipeline Company’s (“PPC”) installation of 16 new safety valves in the County along PPC’s Las Flores Pipeline System (the “Pipeline”) in accordance with Assembly Bill 864. The County’s acknowledgement was delivered in the form of a conditional settlement agreement dated August 30, 2024 (the “Safety Valve Settlement Agreement”) among the County, PPC and PPC’s parent company Sable Offshore Corp. (“Sable”), and a subsequent acknowledgement by the County’s planning and development staff.

The Safety Valve Settlement Agreement is predicated upon a prior settlement agreement between PPC’s predecessor in interest, Celeron Pipeline Company, and the County in a federal case styled Celeron Pipeline Company of California v. County of Santa Barbara (Case No. CV 87-02188), which was executed in 1988….

PPC, Sable and the County have further agreed, in the Safety Valve Settlement Agreement, to file a stipulation to dismiss the pending lawsuit, Pacific Pipeline Company and Sable Offshore Corp. v. Santa Barbara County Planning Commission and Board of Supervisors (Case No. 2:23-cv-09218-DMG-MRW) within 15 days of final installation of all 16 underground safety valves in the County.

So heading into September, I looked at the situation and I was selling other holdings to add to Sable. They are working directly with the Fire Marshal (OSFM), which is at the top of the State and Federal regulatory food chain when it comes to Sable (I’ll explain why later), to install safety valves and perform all the necessary repairs to prepare for restarting production. All of this is in accordance with California State Law (AB 864), and the settlement with Santa Barbara County shows that the County doesn’t have the jurisdiction to prevent the installation of the valves. So if the County admitted in the settlement that they don’t have jurisdiction, and the Fire Marshal has sole regulatory oversight at the State AND Federal level, would the CCC have any jurisdiction? More on that later.

The Consent Decree: Sable’s Trump Card

If you own shares of Sable (or are interested in buying shares after this week’s bloodbath), it’s definitely worth taking the time to read the Consent Decree. I would recommend starting with the Appendix section at the very bottom before working your way through the legalese in the rest of the document, but the document provides a detailed look at the regulatory and legal process required to restart the pipelines. When it comes to the Consent Decree, the who is just as important as the what in my opinion. Below is a full list of all of the parties that signed the Consent Decree in 2020:

The Department of Justice (the USA and the State of California)

United States Department of Transportation: Pipeline and Hazardous Materials Safety Administration (PHMSA)

Office of Enforcement and Compliance Assurance

United States Environmental Protection Agency (EPA)

California Department of Fish & Wildlife: Office Of Spill Prevention and Response

California Department of Parks and Recreation

California State Lands Commission

California Department of Forestry and Fire Protection (Office of the State Fire Marshal)

California Regional Water Quality Control Board (Central Coast Region)

Regents of the University of California

Plains All American Pipeline, L.P. & Plains Pipeline, L.P. (the owner of the pipelines before Sable & Pacific Pipeline Company)

You will notice that I highlighted the Office of the State Fire Marshal (OSFM) and the Pipeline and Hazardous Materials Safety Administration (PHMSA), because I think those are the two most important parties on the list. It’s worth mentioning the DOJ, EPA, and multiple state agencies that signed the Consent Decree as well. I’ll include some sections of the Consent Decree that stood out to me, but I think the full document shows that the CCC doesn’t have much of a case to stand on.

Appendix D, Item 1: Why the Fire Marshal (OSFM) has sole regulatory oversight at the State and Federal level.

All outstanding corrective actions in PHMSA’s closed Corrective Action Order (CAO), CPF No. 5-2015-5011H, as amended, are hereby merged into this Consent Decree, as outlined below, and subject to the sole regulatory oversight of the OSFM.

Section IX, Item 25: PHMSA transferring regulatory oversight to OSFM.

Upon the Effective Date of this Consent Decree, the PHMSA CAO (corrective action order) shall close and be of no further force or effect. All outstanding terms and obligations under the PHMSA CAO as of the Effective Date and which Plains is still required to implement under this Consent Decree are set forth in Appendix D (see above).

Section XXVII, Item 107: The Consent Decree Supersedes All Other Agreements Concerning The Settlement

This Consent Decree constitutes the final, complete, and exclusive agreement and understanding among the Parties with respect to the settlement embodied in the Consent Decree and supersedes all prior agreements and understandings, whether oral or written, concerning the settlement embodied herein. The Parties acknowledge that there are no representations, agreements, or understandings relating to the settlement other than those expressly contained in this Consent Decree.

Section XXVIII, Item 108: Final Judgment By The Court

Upon approval and entry of this Consent Decree by the Court, this Consent Decree shall constitute a final judgment of the Court as to the Parties.

Section IX, Item 24: Permitting & Approval Process.

Where any compliance obligation under this Consent Decree requires Defendants to obtain a federal, state, or local permit or approval, Defendants shall submit timely applications and take all other actions reasonably necessary to obtain all such permits or approvals. Defendants may seek relief under the provisions of Section XII (Force Majeure) for any delay in the performance of any such obligation resulting from a failure to obtain, or a delay in obtaining, any permit or approval required to fulfill such obligation, if Defendants have submitted timely applications and have taken all other actions reasonably necessary to obtain all such permits or approvals.

Section XII, Item 44: Force Majeure

“Force Majeure,” for purposes of this Consent Decree, is defined as any event arising from causes beyond the control of Defendants, of any entity controlled by Defendants, or of Defendants’ contractors that delays or prevents the performance of any obligation under this Consent Decree despite Defendants’ best efforts to fulfill the obligation. The requirement that Defendants exercise “best efforts to fulfill the obligation” includes using best efforts to anticipate any potential Force Majeure event and best efforts to address the effects of any potential Force Majeure event (a) as it is occurring and (b) following the potential Force Majeure, such that the delay and any adverse effects of the delay are minimized. “Force Majeure” does not include Defendants’ financial inability to perform any obligation under this Consent Decree.

Federal Preemption

I don’t think Sable will have to resort to Force Majeure to sort things out with CCC, but it was one of the things that popped off the pages of legalese to me. One of the other things to consider, and a far more likely outcome in my opinion, is the potential for federal preemption to come into play. If you want some more reading material on federal preemption, the document quoted below talks about the different kinds of preemption and some examples of each one.

The Constitution’s Supremacy Clause provides that federal law is “the supreme Law of the Land” notwithstanding any state law to the contrary. This language is the foundation for the doctrine of federal preemption, according to which federal law supersedes conflicting state laws.

If you have been following recent events around Sable, you will probably have seen Jason Strom’s threads with his thoughts on the legal situation. All of these threads are worth a read (thread #1, thread #2 & thread #3), but they explain his thoughts on the legal situation with Sable, federal preemption, and a comparable case brought by the CCC against Granite Rock Co. in 1987.

The reader’s digest version is that I think Sable can point to the Consent Decree and the cooperation with the Fire Marshal (which represents the highest State and Federal regulatory authority in this case in my opinion), and argue that they are complying with Federal laws and regulations that preempt anything that the CCC talked about in their Notice Of Violation.

CCC: The Last Ditch Effort To Stop First Production

So the big piece of news on Sable last week was that the CCC had filed a Notice of Violation claiming that the company needs a Coastal Development Permit to continue work on the coastal sections of the pipeline. It seems to me like a Hail Mary to try to delay or stop Sable from getting the pipelines ready for first production, but again, I’m biased, so feel free to take that opinion with a grain of salt. The fact that the Notice of Violation doesn’t mention the Consent Decree is an interesting data point, but the company has moved all of the crews to other sections of the pipeline for now.

The California Coastal Commission (“CCC”) has requested additional information from PPC concerning its work and PPC is now actively engaged with CCC staff to respond to those requests. Repair and maintenance activities that are exempt from Coastal Act permitting requirements have been conducted on the pipeline under the pipeline’s existing Coastal Development Permits for the last 35+ years, and PPC believes its recent work is within the scope of those historic activities. Pending further engagement with CCC staff, PPC has moved all crews out of the Coastal Zone to other areas of the pipeline complex to proceed with remaining repairs and maintenance in compliance with the stringent safety requirements of the Consent Decree, ultimately including a full hydrotest of the pipeline to ensure it is in “as-new” condition before restart of oil and gas production. These tests will be conducted under supervision of both federal and California state agencies to ensure accuracy and compliance with the strict standards of the Consent Decree.

- Sable Offshore Update On Pacific Pipeline Company Operations, 10/7/2024

From my understanding and the conversations that I have had over the last week, the pipeline is close to being ready for the full hydrotest, but it looks like we are in a holding pattern for first production for now. I still think it happens sooner rather than later, but that’s the piece of news that all of the bulls are waiting for. If you’ve made it this far, you might be asking a question something like this: so Sable is working directly with the Fire Marshal, to install safety valves and make repairs in accordance with state law (AB 864), with permits that have been in place for more than 30 years, and the CCC calls that “various unpermitted construction activities in the Coastal Zone”?

The CCC will be having a meeting this morning, so I’m curious to see if anything comes of it. There’s also a rally before the meeting against offshore drilling, complete with an inflatable whale. As far as I know, most inflatables are made with oil products, but I digress. In all seriousness, it seems like the company is willing to work with CCC, but I don’t think they have the jurisdiction to require additional permitting, and I think Sable has a pretty strong case for federal preemption. The other piece of negative news this week was the short report from BWS Financial.

Is Being Long Sable A Pipe Dream?

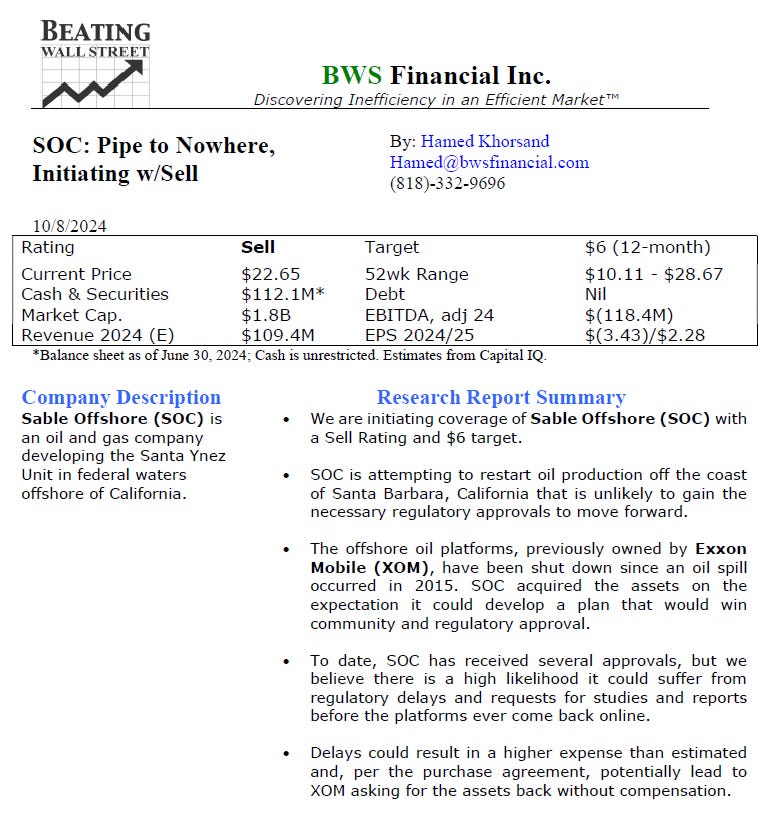

So apart from the questions around the CCC, the other main topic of inbound questions I got was on the recent short report. The image above is a summary I pulled from Twitter, but the majority of the questions were on the last two points: regulatory delays and approvals, and the possibility of Exxon Mobil XOM 0.00%↑ taking back the assets. I’ll touch on the second point first, but I’m in the camp that there is a snowball’s chance in hell that Exxon ever takes back control of the Santa Ynez Unit, the pipelines, and the Las Flores Canyon processing facility. I also have a different view on the possibility of regulatory delays.

I would understand the view that there was a high likelihood of regulatory delays if the note was written before the settlement with Santa Barbara County. That’s why I basically had a stub position before the settlement and was buying after. Unless the CCC or some other agency has an ace up their sleeve to block Sable and somehow take jurisdiction from the Fire Marshal (which has sole regulatory oversight at the State and Federal level), I just don’t see the recent noise with CCC turning into anything more than that. If you read through the 8-Ks above on the Fire Marshal and the County settlement, the Consent Decree, and the CCC’s Notice of Violation, and you come to a different conclusion, I would love to hear why.

Jets 4 Shares?

The last thing I have received questions on is the recent insider purchase by CEO Jim Flores in the form of swapping his private jet for 600,000 shares. Some people I talked to mentioned the idea of pushing expenses to the company or were worried that the transaction was a red flag. Yes, he already owns a huge percent of the company. Yes, it is a transaction that you don’t see every day. My response to people on the jet for shares swap is a question: If the CEO thought the CCC had any chance of derailing the company’s prospects of getting to first production at this stage in the game, do you think he would flush his private jet down the drain for 600,000 shares?

So Now What?

As we stand today, the Fire Marshal holds the keys to the kingdom so to speak. They have the State and Federal regulatory authority, and with the company working directly with the OSFM, I think that bodes well for the chances of a production restart in Q4. We’re not months away as far as the valves and pipeline repair goes, and I think the company will get the green light from the Fire Marshal in the next couple months. Could the CCC or other groups try to stall or delay things? Sure, but I don’t think their case is very strong, and there are several moves Sable can make depending on what happens. I think arguing for federal preemption is the most likely at this stage, but that’s not the only potential path forward.

The thing that has me excited, even after a rough start to this week for the share price, is the number of catalysts lined up for investors over the next six to twelve months. The first and most obvious is first production, and I think Sable is very close to the so-called finish line on that. One of the guys I have been chatting with has been ranting and raving about the potential of the year end reserve report, but you also have the expectation of refinancing the Exxon debt. I would guess that we see that by the end of Q1 in 2025, but that might change if first production doesn’t happen by the end of this year. If you can look out further than that, you have talk of $1.00 per share per quarter in dividends, but a lot of different things have to happen before we get to that point.

Is The Bull Case Broken?

I have been talking about Sable frequently since the settlement with Santa Barbara County, but I still think it’s one of the most interesting situations out there. Am I biased? Sure. I own shares and calls on Sable, so I definitely have skin in the game so to speak. Am I annoyed with the market reaction this week to the CCC news and the short report? Absolutely. Do I think any of the recent developments break the bull case for Sable. Absolutely not. Could that change if something material changes? Yes, but I just don’t see it happening at this stage in the game. If anyone can point out flaws in my logic, or poke holes in my argument, I would love to hear why I’m wrong. I just don’t think I am.

Disclaimer

I own shares and calls on Sable Offshore. You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.

Curious what you think the timeline is for establishing Federal Preemption? Also cutious what other "hail Mary" type delays may come up. Excellent writeup

What was the price of the 600,000 shares? It seems like it is a win win for Flores? The company bought "transportation assets" from Flores, who as the company CEO he will still have full access to use of those assets.