2026: The Rotation Continues

Things To Watch This Year, Commodities Broadening Out & Areas To Avoid For 2026

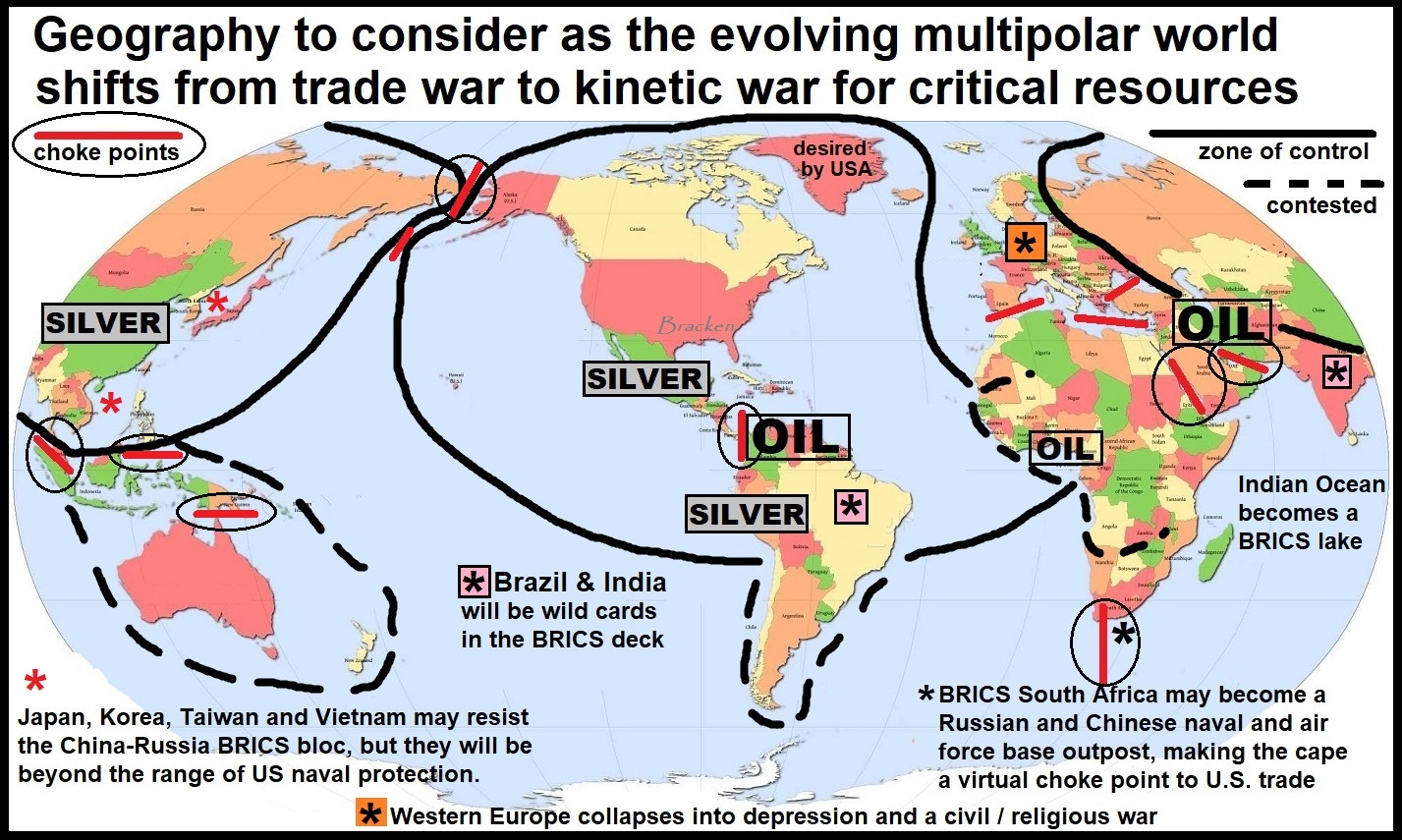

2025 was an interesting year, and less than a week into 2026, we are off to a fast start on that front. Apparently Trump got tired of hearing about Somalians in Minnesota and decided it was time for a different news cycle. I’m being a little flippant, but I think we are going to continue to see how geopolitics impact financial markets, and I think the frequency and magnitude of those impacts will increase. I will talk more about the Venezuela topic tomorrow, but the US is flexing its muscle in the Western Hemisphere. There are geopolitical bottlenecks in several strategic commodities, and we have seen what can happen when major powers decide they need to get their hands on supply of those commodities. In some cases, China has advantages (rare earths and refining for example), while the US has advantages in others (oil and gas is the obvious one), but we are going to see competition between major powers to secure the supply of different important resources.

Looking back on 2025, I was too zeroed in on one specific situation and missed plenty of better opportunities that should have been obvious at the time. Some things haven’t changed since last year. I’m still bearish on Europe, and I’m still bullish on South America. I think we could see major political unrest in major European countries this year, and I still think the European Union will break apart by the end of the decade. I have mixed feelings about what happened in Venezuela, but there have been major political changes in South America in the last year, and Brazil and Colombia are set for elections in 2026. I still think investors will still look at the US as one of the primary destinations for capital, despite highly valued equity markets.

Last year I was too bullish on oil, and not bullish enough on precious metals and the miners. I still hold the physical metals that I have bought over the last couple years, but I should have had more exposure to the miners and the leveraged expressions on precious metals. I’m not planning on making the same mistake this year because I think we are far from the end of the run in precious metals, and we are also seeing signs of life in other commodities and sectors as well.

Major Themes For 2026 (And Beyond)

One of the biggest themes from 2025 that I think will continue in 2026 is the physical reality asserting dominance over paper markets. You have already seen this in gold, you’re starting to see it more recently in silver, platinum, and palladium, and I think you will start to see signs of it in other commodities. The big one is obviously oil, and I think we will eventually see the Brent Crude contract become irrelevant. That piece isn’t a 2026 prediction, because it will take years to play out.

I will put my tin foil hat on for a moment for this next piece. I think we will continue to see London, including the City of London (the corporation, and yes, they are different things) have less influence over financial markets as a center of gravity, just as we have seen Europe continue to decline. That’s a rabbit hole for another time, but it’s an interesting intersection of markets, politics, money laundering, and the international crime syndicate that has significant influence across the West.

This is not a 2026 prediction either, but eventually the LBMA and their paper games with precious metals will blow up. I think we will also see the end of the SWIFT system. The crypto types are convinced that the blockchain will replace it, and some think that Ripple (XRP) has the bank backing to make it happen. If that version of events does come to pass, the City of London can say goodbye to the vig on the forex market they currently enjoy on 38% of global forex transactions ($4.7 trillion daily).

I think this year will also be interesting for debt markets, especially when it looks like the Fed will become an arm of the Treasury when Powell is replaced this year. Short term rates might come down, but I still think we are in a secular bond bear market. Inflation (not CPI) isn’t going to really bite until energy prices start to rise, but it will be interesting to see how the “run it hot” thesis plays out. The real purchasing power of fiat currencies will continue to decline, and there are several different ways to protect that purchasing power as an investor.

Gold: The New Measuring Stick

As far as risk/reward, if you have a time horizon of three to five years, I think the new measuring stick is gold. I think we are still going to see strength in the precious metals this year, but I don’t know if it will match 2025 in percentage terms. I’m sure everyone is familiar with central bank buying in recent years, and the argument for a neutral reserve asset as trust has broken down since Russian reserves were seized, but I don’t see any reason for a wipeout in gold. If we do see fiscal responsibility from politicians around the world, then I might reevaluate, but for now, that seems highly unlikely. I will be curious to see what happens with gold paper markets (especially in London), but I think we will see at least $5,000 an ounce. $6,000-$7,000 is more likely in my opinion, unless we see some major geopolitical and economic changes.

Silver: Triple Digits?

Over the last month, silver has started to get a lot more attention, for good reason. I wrote a month ago that I thought we would see gold/silver at 60 at some point in the next couple years, and here we are a month later sitting at that level. My guess is that we will go below 50 on that ratio in the next couple years, but I will talk more about that tomorrow. We will probably have some periods that frustrate bulls, but I think we see triple digits on silver this year. I do think we will see the miners catch up at some point in 2026 as well. Many of the miners aren’t even pricing silver at $50 an ounce, and I like to think that none of the miners that I own aren’t anywhere close to pricing $60 or $70 an ounce.

This is one market where you’re seeing the market for physical exert significant pressure on paper markets. People that are plugged in have talked about the US cutting off Chinese supply of silver concentrate from Latin America, and you even have public company CEOs talking about how they are calling all of the producers in the area. Does silver need to digest the recent run a little bit? Probably. But I’ll ask the question again: when a commodity breaks out to fresh 45 year highs, what happens to the price over the next three to five years?

Platinum: $3000 Incoming

Silver gets way more eyeballs than platinum, but I wouldn’t be surprised to see platinum outperform silver this year. I wrote about platinum in more detail in a couple posts below, but I think this run is far from over. It’s amazing what can happen when you get a physical market pressuring Western paper markets as far as price discovery. Martin Armstrong mentioned recently that platinum has not had capital controls in the past like gold and silver, and that is part of the recent run. I don’t know if we will get capital controls for platinum, but I wouldn’t be shocked to see platinum showing up in the news more as a important commodity as powerful countries scramble to secure the supply of different resources.

My guess is that we will continue to have stretches where platinum chops sideways, and then the price will run hard for a couple weeks or a month. I think we will end the year over $3,000 an ounce, but I feel pretty confident about new all time highs for platinum this year. I’m not as bullish on palladium, but as long as platinum and palladium are trading at significant premiums in Chinese markets, I think we are going to see prices grind higher. If those premiums close, then it’s probably time for caution near term.

The Base Metals: Copper Leads, But Others Follow

Copper has been rolling lately, and I think that is going to continue in 2026. I don’t have a guess on where price might go, but I don’t think we will break out to all time highs above $6 per pound and then get stuck in the mud. I don’t know if that’s $7-8 per pound or more, but a lot of investors have seen what has started in precious metals and wonder what’s next. Copper is at the top of that list. I think the miners will continue to run, and all it takes to move some of these stocks is a trickle of investor capital. Some of them will be acquisition targets, but I think investors will take a look at what has happened in the precious metals space and start to move down the size ladder fairly quickly for copper and other base metals. Spreading out from there, you have several different base metals that are interesting for different reasons.

The only one that I think might struggle is iron ore, because you have Simandou ramping up to 5% of global supply over the next couple years. For anyone that follows shipping, it’s definitely going to be a tailwind for dry bulk companies. Nickel is getting more interesting as Indonesia is planning to cut production, which is kind of a big deal for a country that produces more than 60% of global supply. Some investors have highlighted aluminum as a place to look, and I think zinc is interesting here as well. I have a couple silver miners that have a zinc byproduct, but I haven’t found any companies that I like in these areas, or they have just run too much already. Tin probably has the best supply and demand of any of the base metals, and it’s definitely under the radar, but the problem is that there are very few options for investors in the sector. I do have a podcast that will be focused on one of them, so stay tuned for that.

Oil & Gas: Rotation Within The Sector

I will talk more about what happened in Venezuela tomorrow, but sentiment on the oil price is probably about to go from bad to worse after recent events. Increased production from Venezuela is obviously not going to happen overnight, but it could delay the bull case for oil prices. This is where the narrative could be important in coming weeks. For the producers, you’re probably going to see the market be a lot more excited about American majors like Chevron CVX 0.00%↑ and Exxon-Mobil XOM 0.00%↑ compared to Canadian companies.

If the US does effectively take over Venezuela and the supermajors can move into Venezuela, they will certaintly benefit, but there is a healthy debate on the impact on the Canadian companies. It will take months if not years to see the fundamental impact, but the Canadian energy sector might not be much fun to own in the near term, even if it turns out to be just fine on a fundamental basis.

Narrative driven investors will take one look at recent events in Venezuela and say “buy OIH 0.00%↑ and Schlumberger SLB 0.00%↑” or some other variation of that trade, even if it will take two quarters (bare minimum) to see any material change in the underlying businesses. This goes back a bit to the flows argument, but Schlumberger is 20% of that ETF. As far as natural gas, I still can’t bring myself to be super bullish long term, but I do have a bit of a shorter term trade on. Fingers crossed for a cold snap here in the US in the next month (and maybe a little bit of snow for the skiers out there).

Assets Classes To Avoid

I’ll wrap up by talking about some of the assets that I’m avoiding for a variety of reasons. The first three fall in the toxic sludge category. This includes private equity, private credit, and long duration bonds. I’m grouping the first two together, and I’m sure there are individual funds that will be the exception to the rule, but I think the next couple years won’t be kind to private equity and private credit as an asset class. As far as long duration bonds, I can understand why some investors like it as a shorter term trade, but it goes back to the Dave Collum question: what interest rate would you require to hold this until maturity?

For me, it’s a lot higher than 4%. Real estate is a mixed bag, and it depends on location and the type of real estate, but I think the asset class as a whole has significant headwinds. My recent conversation with Melody Wright for anyone interested in residential and commercial real estate is worth a listen, but I think 2026 could bring cheaper real estate prices. As far as equities, they certainly aren’t cheap, but on a nominal basis, the government seems determined to make sure everyone gets their S&P welfare. I would rather own equities than long duration bonds and real estate, but I think the truly undervalued opportunities are still in the commodities space.

Conclusion

With all of the stuff that has happened over the last twelve months, 2025 seemed a lot longer than a year. I think 2026 will be more of the same on several fronts. We certainly live in interesting times as they say, and I’m sure there will be plenty of geopolitical events to follow up on what happened this weekend in Venezuela. Major powers will continue to jockey for position when it comes to resources. We will see if it turns into a hot war between major powers, but I think there are certain areas to avoid geographically when it comes to investments, as well as a couple sectors.

I’m bullish on precious and base metals, and some of the miners in those areas, and while we might see new leadership this year, the risk/reward is very attractive for investors. As far as energy, I’m waiting to see what happens in Venezuela, but certain subsectors will benefit massively from a production ramp in the country, while others could struggle. Trump has certainly created some volatility in the last year, but I think there are plenty of opportunities for value investors to choose from as markets continue to rotate in 2026.

Ben like your work and yes you did waste too much time on SOC. I made a few $ shorting it and glad to get out of the way of its move recently. I really think small and micro value and to some degree small growth will be the play in 2026. It doesn't take much to move them and some do benefit from lower rates. MAGA will benefit these plays as well since they are US centric. Infrastructure will have another good year. Think the precious metals will have another good year, but will be prone for a pull back that will shake people out. GDX and GDXJ are the best plays. The big short will be the MAG & and if not down 10% They will under perform. That is definitely a place to avoid. Last VZ is going to be a problem for the administration in 2026. This is medusa all over again. Chop one head off but there are lot more to chop. Trump will get bogged down on that. Lastly Cannabis will be a huge winner next year. Very much a wild card. Good luck and be flexible since it will be a very interesting year.

Interesting and well written article. I have added some longer duration emerging market bonds and remain bullish on components of real estate. I think Trump Will succeed in bringing down rates and inflation which may be bond bullish which is probably the most contra idea for 2026. Good luck in the new year