Christmas Eve: Santa Comes Early For The Precious Metals

A Comparison Between US And Chinese Markets As Precious Metals Hit All Time Highs & Thoughts On A Couple Stocks

Summary

The importance of the physically settled Shanghai platinum futures contract that started trading in late November, right before platinum started to run.

How platinum is still cheap relative to gold and other asset classes, even if it is pretty overheated short term.

A couple narrative pieces on the tight silver market, and a quick update on a couple stocks, including a late addition to the silver miner basket.

I thought I was going to take a couple weeks off, but I wanted to write a quick update on a couple things that have been on my mind over the last couple days. Parts of this will be a little preview of the 2026 post, but we have seen gold touching $4,500 in after hours trading, platinum continuing to rocket higher over the last couple weeks, and silver grinding higher on a 45 degree line since we had “data center cooling issues” on Black Friday. It seems like the physical market has come knocking for the precious metals, but this market feels different over the last month.

There have been some interesting sign posts for the different markets, and the silver price in China has been leading the US price higher. Platinum is also on a tear, and I think the primary cause is that we are finally seeing the physical market for these metals assert dominance over the house of cards we have built in the West with paper markets. Gold hasn’t run in the same fashion recently but it is at all time highs as well. We will see if this continues once 2026 starts, and I would guess the pace would slow down, but I still think we have a long way to go in the precious metals.

Platinum: Don’t Fade Price Discovery

I said last week that I wouldn’t be surprised if we played round number bingo with $2,000/oz and we went through that line like a hot knife through butter. So is it overcooked now? Yes, but I thought the same thing last week 20% lower. We will have a red day again at some point on platinum, but it seems like something has changed and it doesn’t get as much attention as silver. I have had two conversations yesterday with investors that own some platinum, and they both have itchy trigger fingers on selling some, but if you can wait 6-12 months I think we are still heading way higher.

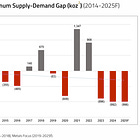

I didn’t have a nearly 50% move and all time highs by year end on my bingo card when I wrote my last post on platinum, but I’m certainly not complaining. One thing I noticed on the chart above is that platinum basically started its big move when the platinum futures started trading in Shanghai. The important piece is that these contracts are physically settled. Ferg also pointed out in his recent piece that there are different purity standards between the US and China. If you step back and look at where platinum is relative to gold, it shows that this move could just be getting started. Until 2014, platinum hadn’t spent any significant amount of time cheaper than gold. Like silver, we have seen some interesting gaps in the platinum price when you compare US prices to Chinese prices. I wanted to include a post from November below on what might be contributing to the recent move in platinum.

The pressure building beneath the physical platinum market is only just beginning.

China may now be signalling what the real clearing price for platinum should be. Prices on Chinese exchanges are currently trading around US$250 per ounce above Western markets, and during the launch of the Guangzhou Futures Exchange (GFX) on the 27th November, platinum even traded at a premium of US$270 per ounce.

Such an extreme arbitrage can only do one thing: pull more physical platinum into China, further tightening an already severely undersupplied global market.

China has already established itself as the world’s largest consumer of platinum, spanning industrial applications, jewellery, automotive catalytic converters, hydrogen technologies, and investment demand. The country now sets the marginal bid for physical metal, and with that comes pricing power.

A Structural Shift: China Launches Physically Settled Platinum Futures

On 27 November, the Guangzhou Futures Exchange began trading physically settled platinum and palladium futures and options. Crucially, these contracts allow delivery not only of bars but also of platinum sponge, the preferred form for industrial and automotive end-users. This is a major evolution: until now, exchanges worldwide only permitted delivery of ingots or bars.

According to Edward Sterck, Research Director at the World Platinum Investment Council, opening the GFX to international participation allows China’s real demand expectations to enter the global price-discovery process, a shift he describes as potentially “very beneficial to the market”.

Why Guangzhou Matters More Than the SGE

The Shanghai Gold Exchange (SGE) only facilitates one-way trading (buying and taking delivery).

Guangzhou, by contrast, supports two-way trade with physical settlement, making it vastly more attractive for industrial consumers, financial participants, and arbitrageurs. It is strategically positioned to become China’s true price-setting venue for platinum.The Numbers: China Is Paying Real Physical Premiums (my note: old numbers)

• SGE platinum price (25 Nov 2025):

¥410.57/gram ≈ US$1,804.08/oz

vs.

Western price: ~ US$1,554/oz• Guangzhou Futures Exchange (27 Nov 2025):

¥430.30/gram ≈ US$1,890.77/ozA premium of US$250 to 270 per ounce represents more than temporary dislocation, it reflects genuine physical scarcity.

Conclusion: China May Be Exposing a Major Mispricing

The persistent premium suggests that Western futures markets may no longer reflect the true cost of acquiring physical platinum.

With China pulling in more metal, structural deficits widening, and new physical delivery mechanisms coming online, platinum’s global supply chain is under far more strain than markets currently acknowledge.In short:

China may have just fired the starting gun on platinum’s repricing, and the squeeze is only beginning.- Has China Just Revealed Platinum’s True Price?, by David Mitchell

On top of that, we also had news a couple weeks ago that the EU is planning to reverse the ban on internal combustion engines that was set to start in 2035. Some investors over the last couple years have pointed out that we are probably going to see Eastern markets like China have more pricing power for precious metals moving forward. That certainly seems to be the case over the last couple months. If you own it (and want to own it for 2026 and beyond), forget the chart and hold on. If you don’t own it yet, it’s really hard to look at the chart and say this is a great entry buying today. The bigger the base the higher in space, as they say, and platinum has spent more than a decade consolidating until the breakout earlier this year. I think we will go to parity with gold at some point, and I wouldn’t be surprised if platinum beats gold in the race to $10,000.