Why Watchlists Are Important For My Investment Process

How Making A Stock Watchlist Helps Me Take Advantage Of Opportunities

I’m making a list, checking it twice, gonna find out which stock is naughty or nice, Santa Claus is coming to town.

I understand it’s August, but I was thinking about my stock watchlist and I couldn’t help myself with the comparison to the Christmas wishlist. Now if you listen to some of the stuff I have been writing, you might end up with coal stocks in the stocking instead of just coal, but I think making a watchlist (or two) is a key part of being an investor in individual stocks.

Two Watchlists

I have two watchlists: one that I run in the background, which is stuff that I check about once a week. The other I’m more active with, checking on a daily basis. For my second tier watchlist, it includes all of the stocks that are currently in my portfolio and other stocks that I follow closely. This could be because they are in a sector that I like (coal or offshore oil, for example), or other situations that I find interesting. My first tier watchlist is much shorter and includes trades or options that I’m actively looking for if I see an opportunity.

I haven’t made any trades in a couple months, but there are a couple things that this filtering system helps with. I’m constantly looking for new or existing ideas to bump up to the top tier watchlist, and this can range anywhere from 0 to 5 stocks. Right now, I will write a quick summary of several things I’m watching right now describing why they are on the watchlist.

VinFast Auto

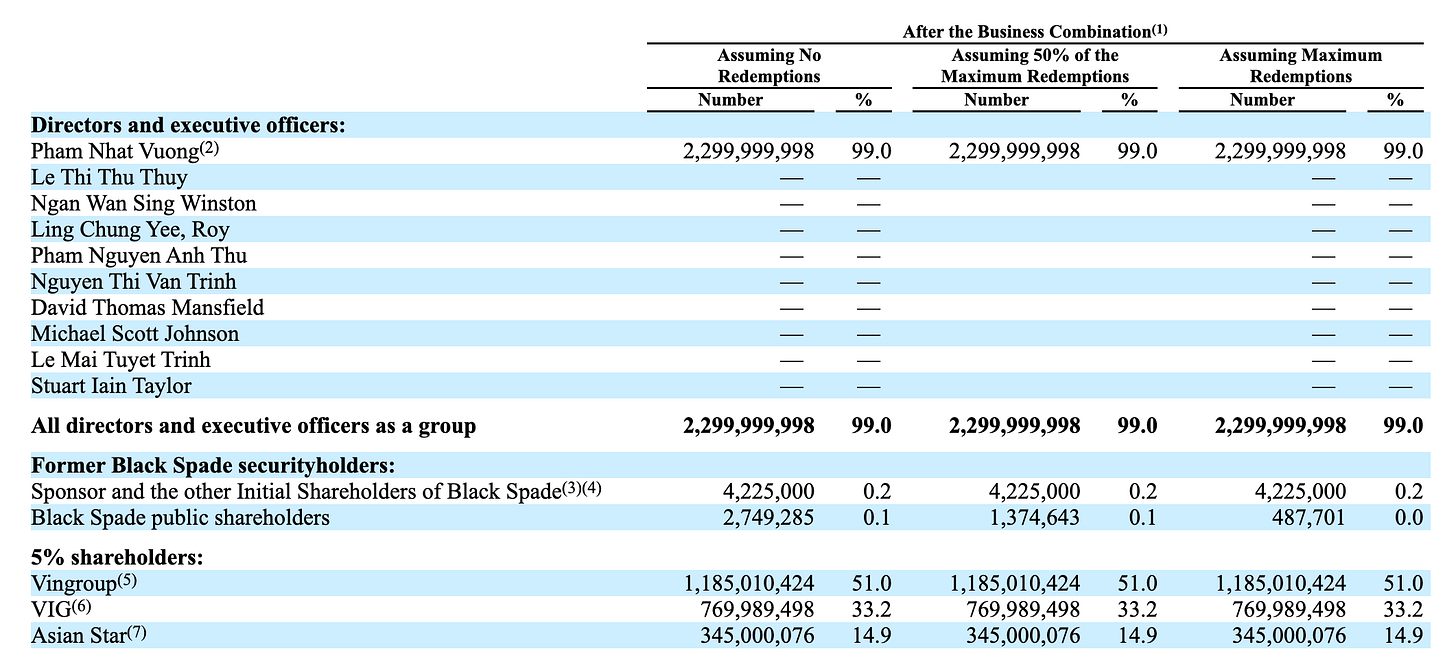

VinFast Auto VFS 0.00%↑ is an electric vehicle SPAC merger that is closely controlled by a Vietnamese billionaire Pham Nhat Vuong. Basically, it has more red flags than a Chinese Communist parade. Even after the SPAC merger, he controls 99% of the company through several investment groups. I’m not sure why Nasdaq lists this crap on their stock exchange, but shares have gone from $20 to $82.35 in two weeks. This puts the market cap at nearly $160 billion.

I don’t know if the fair value of this cash burning machine is zero, but I don’t think going short makes sense when it’s hard to predict what shares will do short term. I can tell you shares were very overvalued last week at $35, but that doesn’t stop it from more than doubling. I have looked at some options chains and I’m considering buying puts, but the premiums are very expensive due to the insane volatility. There is a 180 day lockup period, and there is a March 15, 2024 options chain (199 days away). If the options get cheaper, I will probably put a couple thousand bucks into puts because I don’t see any reason that shares levitate months from now, especially after the lockup. This one is at the top of my watchlist now, but I’m not going to rush into it if the opportunity isn’t there.

Nvidia

Unlike VinFast, Nvidia NVDA 0.00%↑ is a fantastic company. They have been caught up in the AI bubble as shares are up well over 200% year to date. I won’t be looking to short this one purely on valuation, but if it looks like shares are going to roll over, I might look to buy some put options for a year out. Shares could decline by more than half if 2022 is any indication. I don’t know when this one will turn but I don’t think it’s worth more than one trillion dollars or 40x revenue.

Enovix

I have already written a post on Enovix ENVX 0.00%↑, but I’m looking to potentially buy more shares. CEO Raj Talluri bought more shares on the open market recently after the share price decline, but I also wanted to include another article I read recently on the company’s battery technology.

Nova Royalty & Metalla Royalty

These two are still in the research pile, but they are smaller royalty companies that could be interesting in a commodities bull market. The basic idea behind Nova Royalty is that have bought royalties on several copper mines that are in the early stages of development, but once they start producing, they can be very long lived assets. Metalla is primarily a gold royalty company, which typically are a better business than gold miners. These two are definitely more speculative and I still have more research to do on them before buying any, but I think they could be two interesting stocks for a commodities bull market.

Conclusion

Outside of Enovix, I haven’t been able to pull the trigger on any of these, but I think VinFast is near the top. Those two are probably on the first tier watchlist, while Nvidia, Nova Royalty, and Metalla Royalty are examples of stocks on the second tier watchlist (along with several other stocks). Individual stock investors that are looking to outperform the market should keep track of what is going on and prioritize a couple at a time depending on the opportunity.

Disclaimer

I own shares and calls on Enovix. You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.