What's Phase Two? A Look At The Platinum Miners

The Incoming PGM Bull Market, Why I Prefer Impala Platinum To Sibanye-Stillwater & A Portfolio Update

Summary

The supply and demand picture for platinum and PGMs is very imbalanced, and I think it will lead to significantly higher prices in coming years.

Sentiment on the platinum miners is bombed out today, and I think it provides an interesting setup for long term investors.

Anglo American Platinum is the low cost producer and pays a dividend, but shares could see selling pressure over the next six months due to the spinoff planned by parent company Anglo American.

Sibanye Stillwater is highest octane option among the platinum miners with its leveraged balance sheet. It comes complete with an assortment of assets around the world, including battery metals.

Impala is closer to a pure play on a PGM bull market, and their balance sheet reduces the potential downside if it takes longer than expected for a PGM bull market to develop.

The Bull Case For Platinum

Just like the coal sector has parallels to tobacco in the early 2000s, platinum has some parallels to where uranium was four or five years ago. Sentiment on the sector recently has gone from bad to worse, and I think it’s an interesting pond to be fishing in right now. The supply and demand picture for Platinum Group Metals (PGMs) shows a very imbalanced setup moving forward, but if I laid it out in detail this post would turn into a novella. Instead I’ll point readers to several other investors that have made the same bull case for platinum.

The reader’s digest version goes something like this: there is no new PGM supply coming online anytime soon (and it takes about a decade to get a new project up and running), and the projected cliff for demand due to electric vehicles isn’t going to materialize. To say the pie in the sky adoption projections for EVs are unrealistic is an understatement. Another thing worth noting is that hybrids actually require more PGM material to cold start and shift between the internal combustion and battery motors.

Mihail also pointed out that Sibanye-Stillwater’s SBSW 0.00%↑ Stillwater mine in Montana could go into care and maintenance if palladium prices don’t recover soon. That’s the only PGM mine operating here in the US, so we could see supply getting tighter unless PGM prices tick up. In short, you mix this cocktail up and I think it leads to much higher PGM prices three to five years out. Platinum and palladium are thirty times scarcer than gold, and the other PGMs are even scarcer. There’s a reason the platinum tier credit cards are above the gold tier.

So When Is This Going To Happen?

PGMs are more of an industrial metal than a precious metal like gold, so there are different dynamics there, but I’m definitely a bull on PGM prices over the next three to five years. Valuation ratios like gold to oil, gold to platinum, and gold to palladium might not be a great timing mechanism, but it is an interesting signpost with all three bumping around near lows (assuming you take out negative oil prices in 2020). I’m still bullish on gold, so I would expect some catchup from the PGMs at some point in the next couple years.

Timing is always something to consider for investors, and it’s something I discussed in a recent podcast with VBL (starting around the 44 minute mark). He talked about why he only compares platinum to palladium, platinum being a broken futures contract, and when he’s looking to get bullish on platinum.

Here’s what I’m waiting for to buy platinum. I’m waiting for platinum to go backwardated. Now this is a tactical thing. When platinum futures go backwardated, I think the market’s gonna rip. And until it does, it remains a broken market that will make you buy the highs and sell the lows.

- Vince Lanci

The Miners: Different Strokes For Different Folks

For the high octane play on PGMs, the miners offer a lot of upside from the current bombed out valuations. Investors buying the miners will be exposed to South Africa, which isn’t the image of peace and stability, even after favorable election results. I’ll be focused mainly on the bigger, more liquid names, which include Anglo American Platinum (ANGPY), Sibanye Stillwater, and Impala Platinum (IMPUY). Smaller names like Sylvania Platinum (SAPLF) and Northam Platinum (NPTLF) are ones that I might look at in the future, but let’s get into the miners.

Anglo American Platinum (Amplats) is the low cost producer (h/t to Unemployed Value Degen), but arguably more expensive than Sibanye and Impala. It pays a small dividend currently, but the situation with Amplats worth noting is that parent company Anglo American (NGLOY) is planning to spin off (or demerge) its stake in Amplats by early 2025, which could create an overhang on the stock. That also could be a future buying opportunity depending on how things play out. So Amplats is on the watchlist, but I’m not in any hurry to buy today.

Sibanye Stillwater: So What’s Phase Two?

Of all the platinum miners, Sibanye is the one with the most hair on it. It’s sort of a Frankenstein’s monster of different assets. It also comes complete with a levered balance sheet ($1.4B in cash vs. $2.2B in debt) compared to Amplats or Impala. With their maturities I don’t think it will be an issue, but it is worth noting.

Looking at Sibanye reminds me of the Underpants Gnomes from South Park (I’ll give a language warning in advance on that clip). Phase one for Sibanye was to put together a bunch of different assets. The focus is the PGM operations in South Africa, but they managed to stitch together battery metals and recycling operations around the world, with US PGM operations to boot.

Phase two is a little bit of a mystery to me. Are they going to pour millions into battery metals (something that is on the opposite end of the capital cycle from PGMs in my opinion)? Are they going to pause production at Stillwater here in the US? Are they going to sell some of these assets or attempt a spinoff? They have a lot of decisions to make and that creates some uncertainty on what management will do moving forward. Yes, I know about their uranium. Yes, I know they’re not getting much (if any) credit for their gold production or their stake in DRD Gold. I’m not here just to take potshots at Sibanye. I’m just pointing out that there are a lot of moving pieces with the company even if it is arguably the cheapest large PGM miner.

I understand if the view on Sibanye is that they have an impressive asset base, the sum of the parts is way too cheap, and we are headed into a bull market for PGMs. Add in balance sheet leverage for good measure, and I wouldn’t be surprised to see shares trading at all time highs if we do get a huge bull market for PGMs over the next several years. To be fair on Sibanye, I do think phase three is profit, and I think patient investors will probably do well buying shares today. We will see if shares get cheaper, but I might have to throw a couple bucks at some 2027 LEAPS at some point. That would be stacking lottery tickets, but there were other things in the portfolio that I wanted to buy more than I wanted to hang onto my Sibanye shares. Impala is closer to a pure play miner for a bull market in PGMs, and I think it’s a better (and less complicated) option.

Impala Platinum: A Pure Play With A Better Balance Sheet

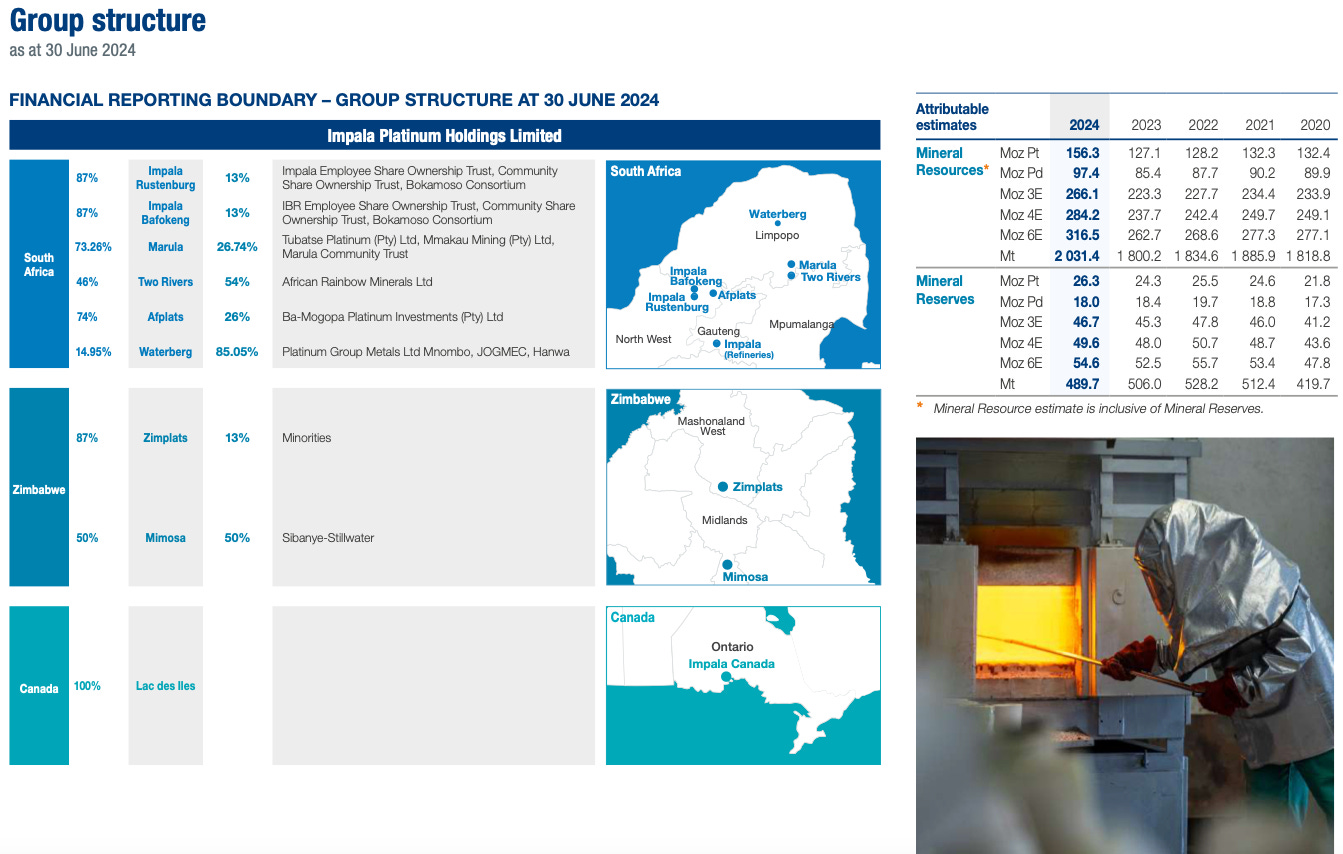

The biggest difference between Impala and Sibanye is that they have a cleaner balance sheet. With the Q2 report, Impala’s cash balance was at $529M versus $77M in debt. Admittedly this means less torque on the upside, but they are less likely to have issues if PGM prices take some time to get moving. Below is an overview of their assets, which are primarily focused on South Africa and Zimbabwe. Zimplats in Zimbabwe and the Rustenburg and Bafokeng mines in South Africa are the lion’s share of Impala’s asset base.

They do have one asset in Canada, but is a small slice of the overall pie. Like Sibanye, I think shares have a good chance of surpassing the highs in 2021 if we do get the PGM bull market I’m expecting. Impala has had operating losses in 2024 due to depressed PGM prices, but they fall in between Amplats and Sibanye as far as production costs. Impala is only a small piece of my portfolio, but I think you get similar upside to Sibanye without the exposure to battery metals (which I’m not a huge fan of) or the balance sheet risk. In short, I think investors buying Impala are taking on less risk than Sibanye while the potential upside is still very attractive today.

Conclusion

While I think we are going to see meaningfully higher PGM prices in coming years, the platinum miners do come with the added complication of geopolitical risk with their exposure to South Africa. I do think you get a lot of bang for your buck with the platinum miners, but position sizing is your friend in this sector in my opinion. I don’t think we are going to see EV adoption anywhere close to some of the projections, and I think a bet on the platinum miners is taking the other side of the so-called green energy bet. We will see how long it takes, but I think the supply and demand picture for PGMs could lead to a huge bull market for the underlying commodities.

Amplats is on the watchlist, but I’m not going to step in front of some of the selling that could come with the spinoff. Sibanye provides the most torque, but it’s far from the cleanest balance sheet in the sector, and to say the asset mix is complicated is an understatement. I think the whole sector is going to provide outsized returns for long term investors, but Impala Platinum is the closest thing to a pure play PGM producer with a clean balance sheet. It doesn’t come with the complexity of Sibanye or the potential overhand of Amplats, and I think the risk/reward for Impala is the most attractive of the three major platinum miners today.