Videos Of The Week

Peabody Scoops Up Anglo Coal, A Potential False Flag Before Inauguration Day & Closely Watching Ukraine And The Middle East

I hope everyone here in the US is recovering from their Thanksgiving food coma, but there are a lot of things to catch up on heading into December. There were a lot of good videos and podcasts this week, but a couple stood out. One covers Peabody Energy’s BTU 0.00%↑ recent deal for Anglo’s coal assets, while the other takes a look at the geopolitical big picture. The Middle East has taken a back seat in the news cycle recently to what is going on in Ukraine, even with the announcement of a ceasefire. We will see how long that lasts, but I would recommend checking out Mark Wauck’s recent post with his thoughts on why Israel and Hezbollah both agreed to a ceasefire.

You can also check out some Daniel Davis’ recent videos on the topic. I did find his video on the use of the Oreshnik Missile by the Russians in Ukraine to be interesting, where they also discussed the pace of Russian advances increasing in recent weeks. His daily videos with a variety of guests are a great way to stay up to date on what is going on if you have the time. The second video below also covers Ukraine and some of the potential events that could be coming in the next couple months, but the geopolitical situation is one of many things I’m watching right now.

Money of Mine w/ Matt Warder & The Koala

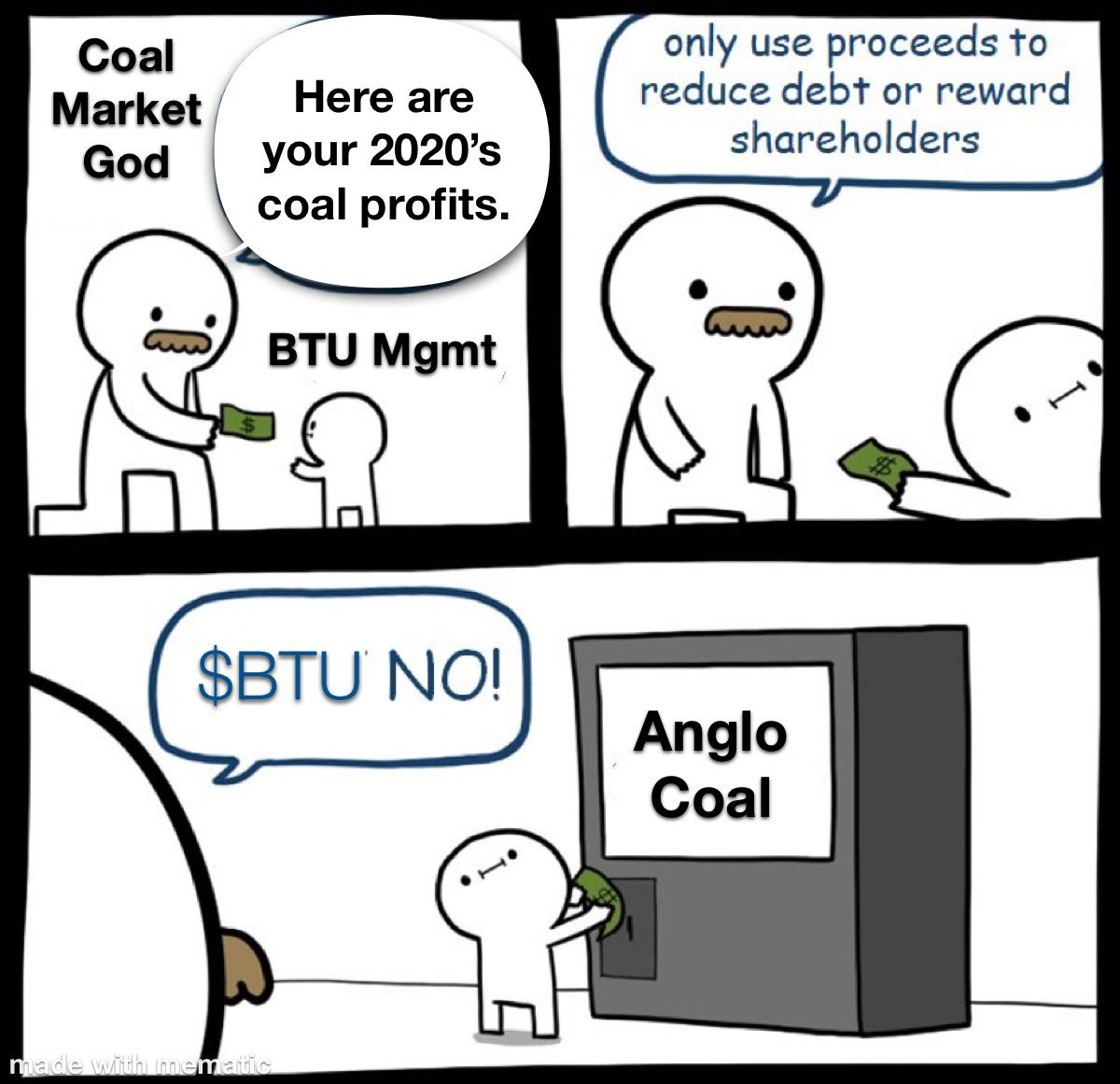

If you’re interested in Peabody Energy, and their recent deal for the Anglo coal assets, this is the video for you. The Koala was more pessimistic on the deal than Matt was, but it was a very interesting conversation with two coal experts on Peabody’s recent deal. He preferred Whitehaven’s Blackwater/Daunia deal to Peabody’s, but they discussed the changing investor attitude towards coal. They both agreed that the deal was more favorable to the seller than the buyer, but one point Matt made is that companies don’t control when large coal assets come up for sale, they only control their actions when those deals come around. The Koala thinks they overpaid by roughly $500M, and points out the recent fire at Grosvenor, which is one of the assets included in the deal.

They also increased their exposure to an unfavorable royalty regime in Queensland, Australia with the deal. Peabody shares flushed over the last week, so the market seems to agree that Peabody overpaid, and investors will have to wait even longer for the capital returns that management promised in the not-so-distant past.

Can Peabody absorb the assets efficiently and quickly? And can they operate them successfully? If the answer to both of those questions is yes, and I think you should allow for some growing pains, then just on the merits, it’s probably a pretty good deal for them.

- Matt Warder

Shaun Newman Podcast w/ Tom Luongo & Alex Krainer

This was one of the most interesting podcasts I listened to this week on current events and geopolitics. They discuss what is going on in Ukraine and how the British are pushing to escalate things before Trump is inaugurated in January. They talk about how Russia is playing the slow game, and how they are probably trying to run out the clock on Biden administration so they can come to an agreement with Trump when he comes in. They also discuss the potential for a false flag in London, and the weird circumstances where street cameras across the city have been completely turned off for a couple months. It’s going to be an interesting month and a half, but this video definitely will give readers some food for thought on things that could happen before Trump becomes President.