Videos Of The Week

Precious Metals Pause, Oil Perking Up & How Financialization Broke Markets

We finally got a pullback in the precious metals space that I talked about last week, and I think it’s probably healthy for a bit of a pause with the metals and the miners. I have been starting to look at a couple different ideas in the miner space, but like I said last week, I’m not in a hurry to buy anything yet. I am planning to write a piece on platinum later this week, but I think it makes sense to stay patient, especially on anything related to gold and silver.

On the oil side, we had a nice rally this week after we got news that Trump would be targeting Russian oil companies Rosneft and Lukoil with sanctions. We will see what happens from here on sanctions, and if it has any impact on the conflict in Ukraine, but I think it is a good time to start taking at ideas in the energy space. We got a pretty sizable move in some of the energy stocks last week, but the whole sector is still cheap and out of favor. The video below goes into detail on some of the topics worth thinking about as far as sentiment, positioning, and the narrative on the expected oil surplus from now into 2026.

Wall Street For Main Street w/ Elliot Gue

The sentiment on energy, specifically oil, has been awful for most of 2025, and it doesn’t seem like that is going to change before the end of the year. Gue points out that the sentiment you have now is not what you see at the start of prolonged bear markets, and it’s close to as hated as it has been near other oil price bottoms. He points out that the projected IEA surplus of more than 4 million barrels a day would be bigger than the oversupply during the shutdowns in 2020.

They also talked about several individual names, and why they expect continued M&A in the Permian Basin. Offshore exploration and trends was another focus, and they explained why any potential new supply won’t come online fast enough. The energy transition, or electric vehicles, aren’t going to put a big enough dent in oil demand either. He thinks it might take some time for oil to really get moving, but the setup for 2026 looks pretty attractive to me. If you’re interested in energy, or buying out of favor investments, this one is worth a watch.

Weekly Roundup w/ Hunter Hopcroft

For anyone interested in the financialization of the economy, this is the podccast for you. They talk about several things I have covered before, as well as a couple things that are outside of my wheelhouse. Whether its distortions created by passive investing, or the short term dislocations created by large multi-asset managers, the last several years have seen major structural changes in financial markets. They also talked about how private credit and private equity have created new incentives for debt and equity markets, and how it impacts the allocation of capital.

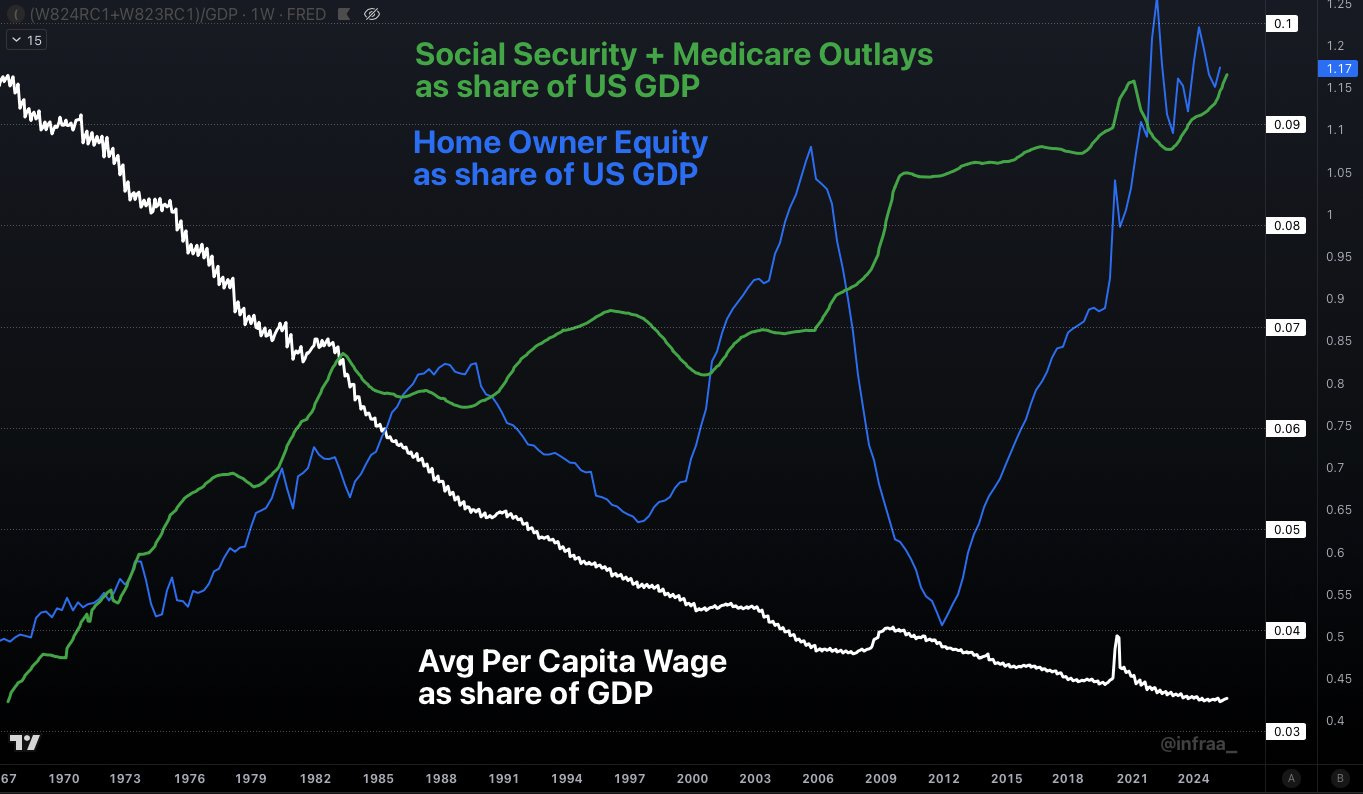

Another thing they got into was the lack of trust in institutions, whether it’s the media or financial institutions. My favorite chart they shared talked about the “Boomer retirement complex”, which looks at Social Security and Medicare, Home Equity, and Wages as a percent of GDP. They point out that the chart above is how you get Mamdani in New York. I’m not a fan of Mamdani or his politics, and I don’t think he should even be in the country in the first place (that’s a topic for another time), but if you don’t see wages start to rise, he’s not going to be the only politician of his ilk to appear in coming years.