Videos Of The Week

Labor Day Special: Offshore Oil, Commodities Supercycle & Inflation

This week I have three videos as a Labor Day special of sorts. The first is a video from 5 months ago on the offshore sector. It covers offshore and is a good primer on many of the offshore basins for those that aren’t familiar. The second and third videos are both from Wall Street For Main Street. Rick Rule is the guest on the first one, which discusses commodities and several other topics. John Williams from Shadow Stats is guest on the final video, which focuses on inflation.

Hopefully everyone has something fun planned for Labor Day. I’ll be floating the Boise River this afternoon with friends, but it’s a good chance to relax before fall rolls around. I’ll be back later this week with a post on one of the last companies in my portfolio that I haven’t covered yet.

Global Offshore O&G Production Overview + Development Forecast w/ Shubham Garg

I watched this one last night, and it was a great summary of the offshore space. Shubham Garg runs White Tundra, an investment firm primarily focused on Canadian oil and gas. He discusses the different companies involved, the different basins, and their characteristics. Fair warning, but it is a long video at 3.5 hours. The first hour and a half is a good summary overall, but the more I learn I about oil supply and demand, and offshore’s role moving forward, the more bullish I am on names like Petrobras PBR 0.00%↑, Transocean RIG 0.00%↑, and Tidewater TDW 0.00%↑. I think that oil demand will continue to grow, and offshore is going to be the logical choice to fill the gap that is appearing in supply.

The average EUR per well (expected ultimate recovery per well) for wells in Guyana is 75M barrels of oil equivalent (BOE)… insane, absolutely insane…. When one well can produce 75M BOE, that is going to make you very, very rich with just one discovery. What Exxon has found in Guyana is multiple of these discoveries. You can also see why Guyana is not going to be repeated (when comparing to other offshore fields)….

- Shubham Garg

My speculation on Guyana is Frontera Energy, which is right next to Exxon Mobil’s XOM 0.00%↑ and Hess’ HES 0.00%↑ Stabroek block. Definitely more risky, but if they hit one of those gusher wells Garg is talking about, Frontera will be worth multiples of its current $670M market cap, or it will be scooped up by one of the majors, likely at a significant premium to its current price.

Commodities Supercycle? w/ Rick Rule

Rick Rule is a well known resources and mining investor, and his discussion with Jason Burack from Wall Street For Main Street covers several topics. They talk about the banks and their issues, cost of capital for mining and other resource industries, and how rising interest rates restricts investment in capital intensive commodities industries. They also briefly discuss uranium, which just finished up a very strong month, and the run shows no sign of stopping. They also discuss the bottlenecks for investment in oil, gas, and coal created by ESG, and how that creates a very attractive opportunity for investors.

Here’s an interesting statistic, Jason, for people who believe that alternative energies will fill the void. Humankind has now invested almost 5 trillion dollars in alternative energies, and they have reduced the market share of hydrocarbons from 82% to 81%. That tells you all you need to know about the energy future of humankind.

- Rick Rule

This leads nicely into the inflation topic for my last video, also from Wall Street For Main Street.

Inflation: Still Above 10%? w/ John Williams - Shadow Stats

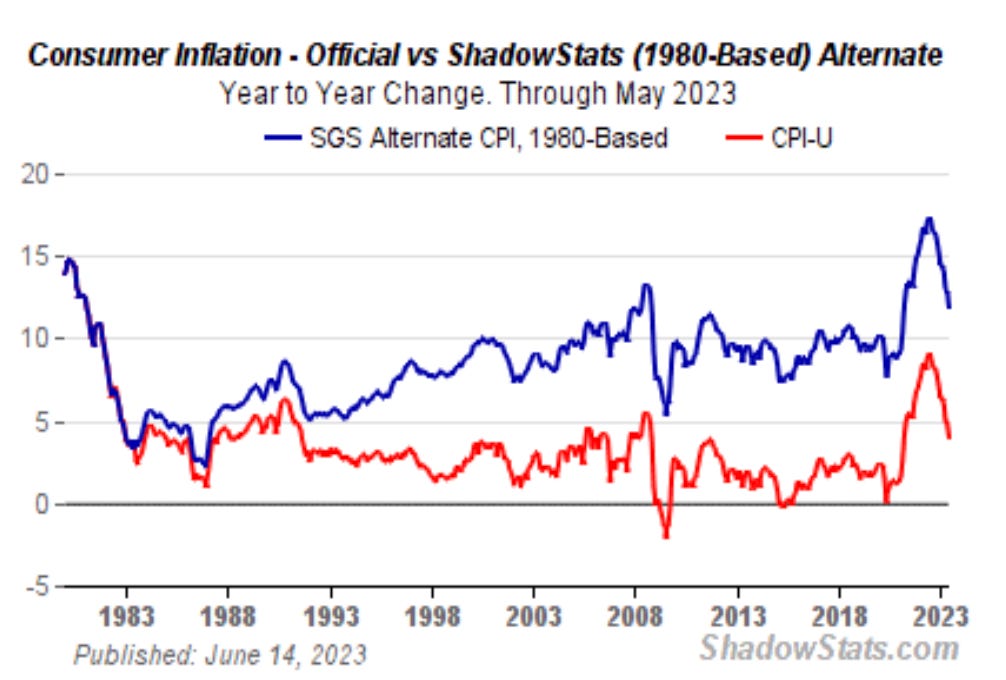

What I do, every month I’ll put out the government’s CPI (consumer price index) and here’s what it would have been had they not made these changes. I have an article that shows where the changes were made over time. The changes that I add back in are nothing more that what the government has taken out and said they have taken out of the CPI. It’s that simple.

- John Williams

I have included a picture from shadowstats.com so readers can visualize what he is talking about. The short version is that when you go to the grocery store and compare what you paid for ground beef or apples or beef jerky (one of my personal favorites) today versus three or four years ago, you can see what actual inflation looks like versus what the government says it is.

They talk about how this impacts cost of living adjustments for Social Security (another government scam, but that’s a separate can of worms). When you compare this to wage growth, you can understand why the only people who have benefited are the same people who benefit from asset price inflation in real estate, stocks, and bonds. They talk about real assets being the best defense against sustained inflation, and both come to the conclusion that it’s going to be a rough decade. I’m not saying it’s time to dump everything to buy gold and silver, but I’m very overweight commodities related stocks because I agree with their assessment that this decade is going to be very different from what we are used to. If you want to go back to one of my earlier posts on inflation to read my thoughts on it in more detail, I have included a link below.

Disclaimer

I own shares of Petrobras (PBR.A), Transocean (shares and calls), Tidewater, Frontera Energy. You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.