The State Of The Coal Stocks

AMR's Rollercoaster Ride & A Look At Peabody Energy & Warrior Met Coal

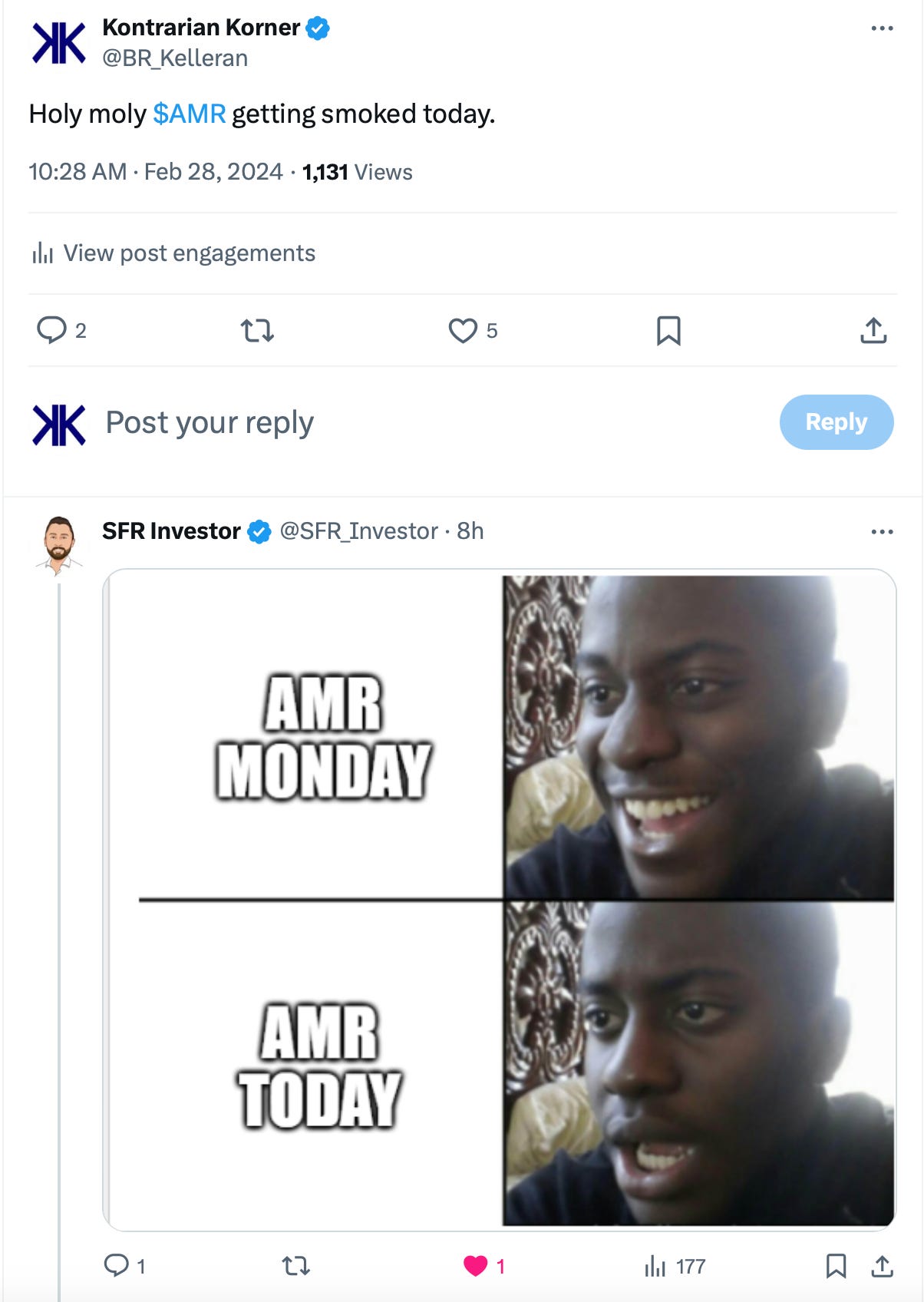

Earnings season is coming to a close, and I wanted to write an update on a couple coal stocks I follow. I’ll lead off with Alpha Metallurgical Resources AMR 0.00%↑, but spend more time on Peabody Energy BTU 0.00%↑ and Warrior Met Coal HCC 0.00%↑ since those are the two coal stocks I own. AMR reported earnings on Monday, and the market obviously liked it, sending the stock up more than 10% from approximately $390 to more than $440 per share. Yesterday, AMR gave all of it back and then some, dropping more than 17% to $362.62.

Looking at the SEC website shows a wave of insider selling for AMR. I don’t think it’s bearish for the stock long-term, but it’s not surprising to see some insiders start to take some chips off the table after the run the stock has had. We will see if shares bounce from here, but I still think long-term investors will do just fine owning AMR over the next three to five years (if you can stomach the occasional bouts of volatility).

One of the things that stood out from their earnings call is that they are planning to reduce the pace of buybacks and let cash build up on the balance sheet. They have spent $1.1B repurchasing 6.6M shares since they started the buyback, and they will continue to buy back shares, even if it’s not at the breakneck pace of the last couple years. As I have said before, hindsight is 20/20, but I should have been buying AMR last spring instead of Peabody. They have bought back approximately 1/3 of shares outstanding, and even after the recent pop and drop, shares are still up more than 100% over the last year.