The Cyclical Nature Of The World (And Markets)

Looking At Market Cycles & Picking Assets For The Next Decade

Strong men create good times

Good times create weak men

Weak men create hard times

Hard times create strong men ← (You Are Here)

And on and on it goes.

While nations, empires, and cultures all go through cycles, financial markets go through their own cycles. Sometimes these cycles overlap and influence one another, and it is hard to ignore all the geopolitical events going on and their potential influence on financial markets. This ties in a bit with the Fourth Turning and the generational cycles that lead to a crisis point (which I think we are in right now), but today I’m going to focus more on different assets and where I think they are in the cycle.

Different assets have different cycle lengths and magnitudes, but where something is in the cycle can have a dramatic impact on the returns for investors. The best time to invest in a company or a sector is often when the sentiment is at its worst, while the worst time to invest is when sentiment is great, and it is priced for perfection. Like everything else in life, there are times for everything, and I think investors should keep in mind the cyclical nature of markets when making investment decisions. When one sector or asset class leads in one cycle, the next cycle is almost always led by another sector or asset class.

Assets Near The Peak

Bonds

We are coming off a long and massive bull market for bonds. For four decades, we had declining interest rates combined with huge deflationary crosswinds. The offshoring of manufacturing, improving technology, and cheap access to abundant energy all offset declining interest rates. In short, the last forty years were the Goldilocks period for bonds where investors benefited from significant tailwinds.

While bonds are not where they were when interest rates were stuck at zero, I think that bonds will be a poor place to be invested moving forward due to inflation and the reversal of the tailwinds of the last four decades. Investors looking at a conservative option might consider bonds in some form, but I think the real returns (returns adjusted for inflation) will not be much to write home about over the next decade.

Big Tech

This is going to be hard to criticize due to recency bias, but big tech has been among the best performers since the 2008/2009 financial circus. They benefited from many of the same tailwinds as bonds, which pushed the valuations up to levels that are unsustainable in my opinion. Part of this is due to passive investing, which I talked about in my post on the 60/40 portfolio, but the big tech companies have provided something like 95% of the S&P 500’s return for 2023, while other stocks have lagged.

To be clear, some of these stocks are more overvalued than others, but I think we are closer to the peak for big tech, which makes me think returns will not be anywhere close to where they were over the last decade. We might see these stocks continue to perform well, but I have a hard time believing investors will be satisfied owning the big tech heavy indices over the next decade. It reminds me of Stein’s Law: If something can’t go on forever, it will stop.

Residential Real Estate

Homes are a large investment for many Americans, but I think we are closer to the peak on residential real estate as well. I don’t know if it’s as egregious as it was leading up to 2007, but if you look at home prices, I have a hard time believing home prices can continue to increase 10% per year like clockwork. To be clear, residential real estate depends heavily on the characteristics of the property (location, location, location), but many cities and suburbs have real estate markets that are overvalued in my opinion. This brings me to homebuilders.

Homebuilders

Homebuilders are a very cyclical business, and they are actually one of the better performing sectors this year despite the rise in interest rates, and by extension, mortgage rates. We still have a housing deficit in the US, but I think the homebuilding sector is probably closer to the peak. The valuations look cheap, but they also looked cheap heading into the Financial Crisis along with the banks. I don’t have the same conviction here as I do with bonds and big tech due to the valuation and other factors, but I would be cautious with the homebuilding sector. Basically, there are pros and cons for the sector, but for me it just ends up in the too hard pile.

Financial Market Themes Near The Peak

Passive Investing & 60/40 Portfolios

Asset classes have cycles, but I think we are also seeing investment themes go through their own cycles. I have talked about passive investing in other posts, but I think we will see more investors take an active role in their investments or look for advisors to do it for them over the next decade. Passive investing has exploded due to low fees, but I think the concentration this has created is not sustainable. I’m not saying you should look for expensive hedge funds over a low-cost index, but I think taking the time to look for undervalued stocks and sectors has the potential to seriously outperform the major indices over the next decade.

The same goes for the 60/40 portfolio. Just because something has worked in the past doesn’t mean it will work as well in the future. Personally, I find investing to be an inherently forward-looking exercise, and passive investing with a 60/40 portfolio looks like a strategy formed by using the rearview mirror.

ESG & Renewable Energy

ESG (which stands for environmental, social, and governance) has been a push from on high incentivizing investors to crowd into green energy and other investments that would otherwise look like a poor risk/reward. I could rant on ESG and the impacts it has on our economy, but my overarching thoughts on the idea is that it creates malinvestment in various ways that we will be paying for over the next decade.

If look at energy for example, banks restricted investment in traditional oil and gas, often forcing higher interest rates for debt and creating investment funds that avoided the sector altogether. This increased cost of capital has led to underinvestment in hydrocarbon energy (which provides something like 84% despite trillions poured into solar and wind) and is one of the reasons I find the traditional energy space so attractive for the next decade. This is another rabbit hole, but the energy return on energy invested is much better for oil and gas compared to solar and wind (nuclear is far and away the best option, but that’s a topic for another post). In my opinion, renewable energy like solar and wind only works at zero interest rates with subsidies from government and real forms of energy.

Assets Near The Trough

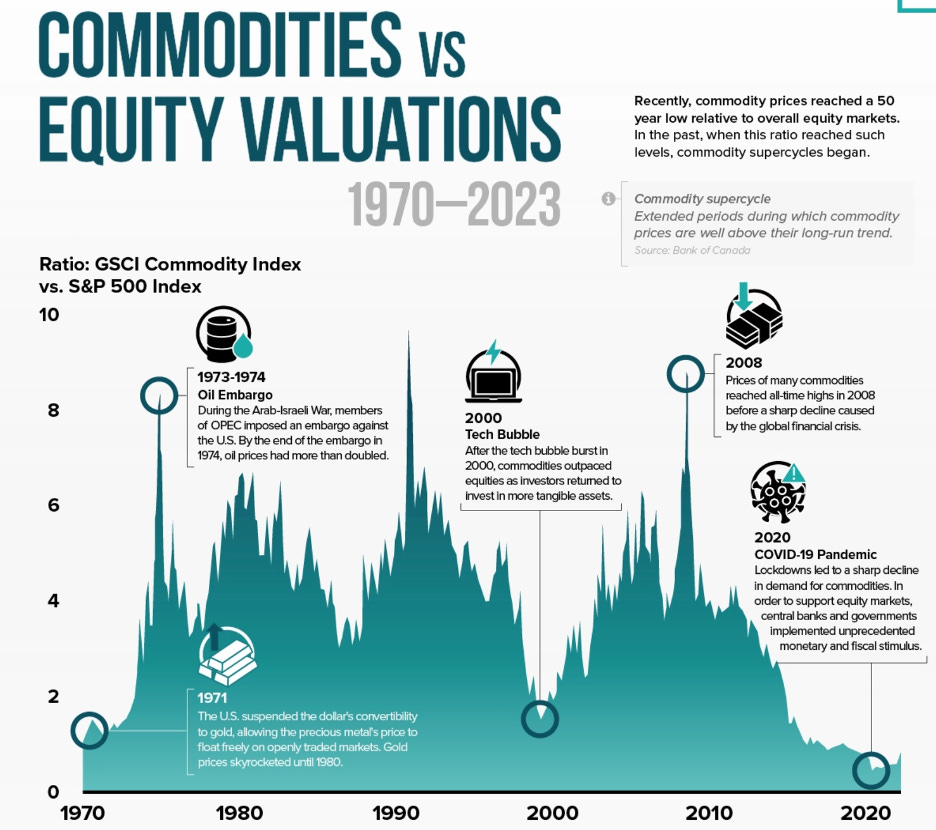

Commodities (and related stocks)

The cyclical nature of markets is part of why I’m so bullish on energy for the next decade. I think we are going to see much higher commodity prices across the spectrum, including oil, precious metals like gold and silver, as well as agricultural and other commodities. I would love to tell you that these prices will rise consistently, but commodities are notoriously volatile. Rumors of a recession? Sell oil and copper. Real interest rates are rising? Sell gold.

The prices of these commodities can go all over the place in the short term, but I’m confident that over the long-term (5 years plus), most commodities will be at much higher prices. I think different parts of the energy sector are at different stages of the cycle, but overall, I think the commodity related businesses will be a good place to be invested for this decade. Over the next couple weeks, I will be talking about several energy companies which I think will benefit from the commodity cycle. These companies are also dealing with poor sentiment for political reasons (another cyclical part of markets), which could lead to huge returns for investors.

Commercial Real Estate

Just because residential real estate looks like it is closer to the peak doesn’t mean that it applies across the real estate sector. One of the other sectors that looks like it is closer to the trough are parts of the commercial real estate. Office buildings in particular are out of favor due to the obvious work from home trend, but I think there will be assets that investors can scoop up for pennies on the dollar as the next couple years play out. Many parts of commercial real estate are in serious trouble due to leverage, so this isn’t a sector call like commodities, but I will be writing on this sector in a future post.

Financial Market Themes Near the Trough: Inflation

While deflation has been the dominant theme in recent decades, I think we are in for an inflationary decade. Like commodity prices, inflation won’t be a consistent rise (we have actually seen inflation coming down in recent months), but I think we are going to see higher average levels of inflation for years to come. Many of the deflationary currents that I mentioned on bonds are set to reverse over the next couple years.

We are seeing manufacturing coming back to the US across several sectors. I’m not going to call for peak oil (which some people have been calling for decades), but I do think we are not going to have the same cheap access to abundant energy. I also think demographics and other things will play a part, but I think there are a lot of things that will drive an inflationary decade.

Conclusion

I think we will also see a comeback in active investing over the next decade. This is obviously the inverse of passive investing, but I think stock pickers and fundamental investors will be rewarded over the next decade. These cycles will continue, and I’m sure in the future we will be looking at different assets and themes at the peak, while others will come back down to the trough. For now, I do think we are in the early innings of a changing investment cycle.

Investors in recent years rode passive investment and 60/40 portfolios heavy with big tech and bonds to solid performance over the last decade. Near zero interest rates also helped residential real estate and homebuilders, along with so-called renewable energy. While this worked in the last cycle, I think that these things will lag over the next decade. In my opinion, commodities and the other things that are out of favor will outperform as sentiment improves and money starts to flow in.

They say that history doesn’t repeat itself, but it often rhymes. We see this in geopolitics at the national level, but we also see it in financial markets with different sectors and asset classes. When it comes to investments, what worked in the past might work in the future, but there is a reason every financial product comes with the disclaimer that past performance isn’t a guarantee of future returns. That’s why I would rather be trying to look into the future to see where things are heading instead of looking to the past to see where things have been.

I don’t have a crystal ball, but the cyclical nature of markets leaves clues everywhere. For the next decade, I think it points to commodities and related stocks. It will almost certainly be a bumpy ride, but I think investors that can stomach the volatility will be richly rewarded. Over the next couple weeks, I will be talking about companies that are near the trough for several reasons. Not only are their businesses tied to commodities, but there are other things that make them more attractive than their North American counterparts.

Disclaimer

You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.