Shoot First, Ask Questions Later

Answering Questions On Sable Offshore, The Preliminary Injunction & The Path Forward From Here

It’s been an interesting couple of days for Sable Offshore SOC 0.00%↑ and investors, but I guess I shouldn’t be surprised at this point. Never a dull moment, as they say. I have been getting enough questions that I’ll be making this post free for everyone to read, but I have to say that I appreciate all of the support from new paid subscribers. The chaos started on Tuesday night with the tentative injunction, but it continued yesterday with the court hearing and the decision to issue a preliminary injunction.

While I was watching the court hearing yesterday, I thought I would be able to write a quick update in the afternoon, and we could move onto the next step in the process (obtaining the Certificate Of Operations from the Fire Marshal). Sable’s lawyer, Jeffrey Dintzer, did a good job in articulating Sable’s position, and I thought as things progressed that there was no way an injunction would be issued. The reader’s digest version of the important pieces went something like this:

He laid out the permits, and got into the legalese that explains why the CCC doesn’t have jurisdiction.

Pointed out that Santa Barbara County has explicitly stated that all repairs are authorized by existing permits.

Explained that repairs and hydrotesting are already complete.

When the Judge still decided to issue a preliminary injunction, my first reaction was “Did I watch the same hearing?” I also had some choice four letter words that I will keep to myself, but I digress. I wouldn’t be surprised if Sable appeals the decision in short order. Shares ended yesterday down roughly 15%, but there was another thing that I wanted to point out before moving onto the mental gymnastics of the last 24 hours. The judge seemed determined to figure out when the case would progress to trial, and I’m certainly curious to see how long it takes for the legal process to play out in the background of the Santa Ynez Unit being fully operational. That catalyst is still coming, and soon, but more on that later.

Repairs Are Done & Hydrotesting Is Complete

The most important piece from yesterday that got lost in the shuffle with the court hearing and the injunction was the 8-K that was released yesterday morning. The fact that hydrotesting is complete means we are one step away from a fully operational Santa Ynez Unit. The last puzzle piece to fall into place is the Office Of The State Fire Marshal (OSFM) giving Sable the Certificate Of Operations.

On May 27, 2025 Sable Offshore Corp. conducted a successful hydrotest of the final segment of Line 325 and has now successfully hydrotested all segments of Line 324 and Line 325 (collectively, the “Onshore Pipeline”), satisfying the final operational condition to restart of the Onshore Pipeline as outlined in the Consent Decree. Therefore, no more repairs are required to the Onshore Pipelines prior to restart.

Mental Gymnastics: Starting With The Fire Marshal

I spent several hours on the phone yesterday afternoon, but I think it makes sense to zoom out and look at this situation from the perspective of every party involved. Starting with the Fire Marshal is the simplest way to clarify things from my viewpoint. At a 30,000 foot view, the OSFM basically has two options at this stage. Option A is fulfilling their end of the Consent Decree by giving Sable the Certificate Of Operations. This might or might not result in a lawsuit from the California Coastal Commission (CCC). Option B for the OSFM is withholding the Certificate Of Operations (or delaying for an unreasonable amount of time), which would almost certainly result in a lawsuit from Sable for specific performance of the Consent Decree.

Option A: The Most Likely Outcome

I’m not going to rehash the entire Consent Decree again, but the abbreviated (and oversimplified) version in this case goes something like this: if you do X, Y, and Z (in this case install additional safety valves, finish all repairs, and perform a successful hydrotest to make sure the pipeline is safe and ready for operations), then we (the OSFM) will give you the Certificate Of Operations. It does not say that we will withhold the Certificate Of Operations if the Banana Republic of California issues an injunction for work that is already done, even if you have already completed X, Y, and Z. It does not say that we will withhold the Certificate Of Operations until all legal controversies are resolved, even if you have already completed X, Y, and Z.

As a reminder, the OSFM is not just the state regulatory oversight on this project. They are the sole regulatory oversight at the State and Federal level, instead of the Pipeline and Hazardous Materials Safety Administration (PHMSA) having federal oversight. There are several other excerpts that I highlighted in my original post on the Consent Decree that are worth reviewing on permitting and Force Majeure, but this item below is the piece I wanted to repeat here.

Appendix D, Item 1: Why the Fire Marshal (OSFM) has sole regulatory oversight at the State and Federal level.

All outstanding corrective actions in PHMSA’s closed Corrective Action Order (CAO), CPF No. 5-2015-5011H, as amended, are hereby merged into this Consent Decree, as outlined below, and subject to the sole regulatory oversight of the OSFM.

Could this path result in the CCC suing the OSFM? It’s definitely possible. They have shown that they are willing to play it fast and loose when it comes to this situation. It would certainly be entertaining to see what would happen if you had one California alphabet soup agency suing another. If you’re the OSFM, I’ll paraphrase what they would probably be thinking if the CCC does bring a lawsuit. “You’re suing us, the state and federal regulator on this project, for fulfilling our side of the federally mandated Consent Decree? Good luck.”

With yesterday’s announcement that all segments of the pipeline have been successfully hydrotested, the OSFM has everything they need to give Sable the Certificate Of Operations. I don’t think we will have to wait much longer for that final puzzle piece required for a fully operational Santa Ynez Unit. The people that think a preliminary injunction to stop repairs that are already done (an injunction that will probably be appealed and eventually overturned) is going to stop this thing at the goal line have another thing coming. I think Option A is the most likely outcome for the OSFM because they will be following the Consent Decree, and if it does lead to a lawsuit, they will have a rock solid case.

Option B: The Shitshow Scenario

In the scenario that the OSFM decides to withhold the Certificate Of Operations (or delay for an unreasonable amount of time), things get messy but Sable is still in the driver’s seat. I could explain a bunch of different potential outcomes for Option B, and guess on what it means for delays, but I think it makes more sense to highlight another section of the Consent Decree. This item covers permitting and approval.

Section IX, Item 24: Permitting & Approval Process.

Where any compliance obligation under this Consent Decree requires Defendants to obtain a federal, state, or local permit or approval, Defendants shall submit timely applications and take all other actions reasonably necessary to obtain all such permits or approvals. Defendants may seek relief under the provisions of Section XII (Force Majeure) for any delay in the performance of any such obligation resulting from a failure to obtain, or a delay in obtaining, any permit or approval required to fulfill such obligation, if Defendants have submitted timely applications and have taken all other actions reasonably necessary to obtain all such permits or approvals.

I think Option B is the extremely unlikely. Sable would have a very strong case in a lawsuit for specific performance of the Consent Decree, and I wouldn’t be surprised if that case ended up in a Federal Court versus a California court (again, I’m not a legal scholar, so feel free to take that opinion with a grain of salt). If the OSFM sees the potential for a lawsuit with either path from here, I think they would choose the Option A, which follows the Consent Decree. This gives them a much higher chance of coming out on top if lawsuits do start flying.

The CCC & The Judge

I don’t have a lot to say about the CCC. It seems like their strategy in dealing with Sable is just flinging turds all over the place to see if anything will stick. I could go into more detail on the various Cease & Desist Orders (CDOs), their lack of jurisdiction, or the fact that they have ignored Santa Barbara County saying that repairs are authorized by existing permits, and that the County is superior to the CCC in this matter, but I think looking at this thing from the Judge’s perspective is more interesting.

My initial reaction to Judge Anderle issuing the injunction was one of shock. I’m pretty sure I wasn’t the only one. I don’t think he missed the nuance on the timing of issuing the injunction though. Issuing an preliminary injunction for repairs and hydrotesting that are already complete (and will have no impact on the OSFM’s decision to grant the Certificate Of Operations) isn’t something that would happen in a more business friendly state, but this is California (if you haven’t noticed over the last nine months). It seems a little bit like a consolation prize for the CCC with the Santa Ynez Unit operations being right around the corner.

The other piece I could understand from the judge’s point of view is him having a different view on damages. Sable mentioned $2.5M a day in damages ($75M a month), but if the current situation doesn’t actually stop the company from getting the Certificate Of Operations from the OSFM, I can see how the judge would look at those numbers and be skeptical. If the court drama doesn’t impact the OSFM giving the green light or Sable’s operations at this stage, it’s hard to claim $75M of damages. If repairs and/or hydrotesting weren’t already done, and that was the main obstacle remaining for Sable, then it might be a different story. His focus on the timing of the trial was also interesting, but I don’t have a strong view on that, and I don’t think it changes the big picture.

Sable: Still In The Driver’s Seat

Oddly enough, I think it makes sense to look at Sable’s position last. If you’re a fan of game theory, I think Sable has a second mover advantage in this situation. Their strategy is primarily going to be dictated by the option chosen by the OSFM. With oil flowing into the Las Flores Canyon processing facility now, the potential Takings Claim that would result if the CCC does somehow manage to make a last minute goal line stand would be a be a big problem for the state of California. That’s probably an understatement as far as what the damages could be.

The OSFM goes with Option A, and fulfills the Consent Decree by giving the company the Certificate Of Operations in the near future. In this scenario, the Santa Ynez Unit is ready for full operations very soon, and we are off to the races.

The OSFM goes with Option B, and Sable would have a very strong case in a lawsuit against the OSFM for specific performance of the Consent Decree. Again, I think this path is very unlikely, but I like Sable’s chances in a Federal Court if we do go down this path.

If the Judge grants an injunction like he did yesterday, it doesn’t impact Sable’s operations or plans because repairs and hydrotesting are already complete. They will almost certainly appeal and try to overturn the injunction, but Sable’s strategy moving forward will probably depend more on the path that is chosen by the OSFM.

Short Interest: What Are They Thinking?

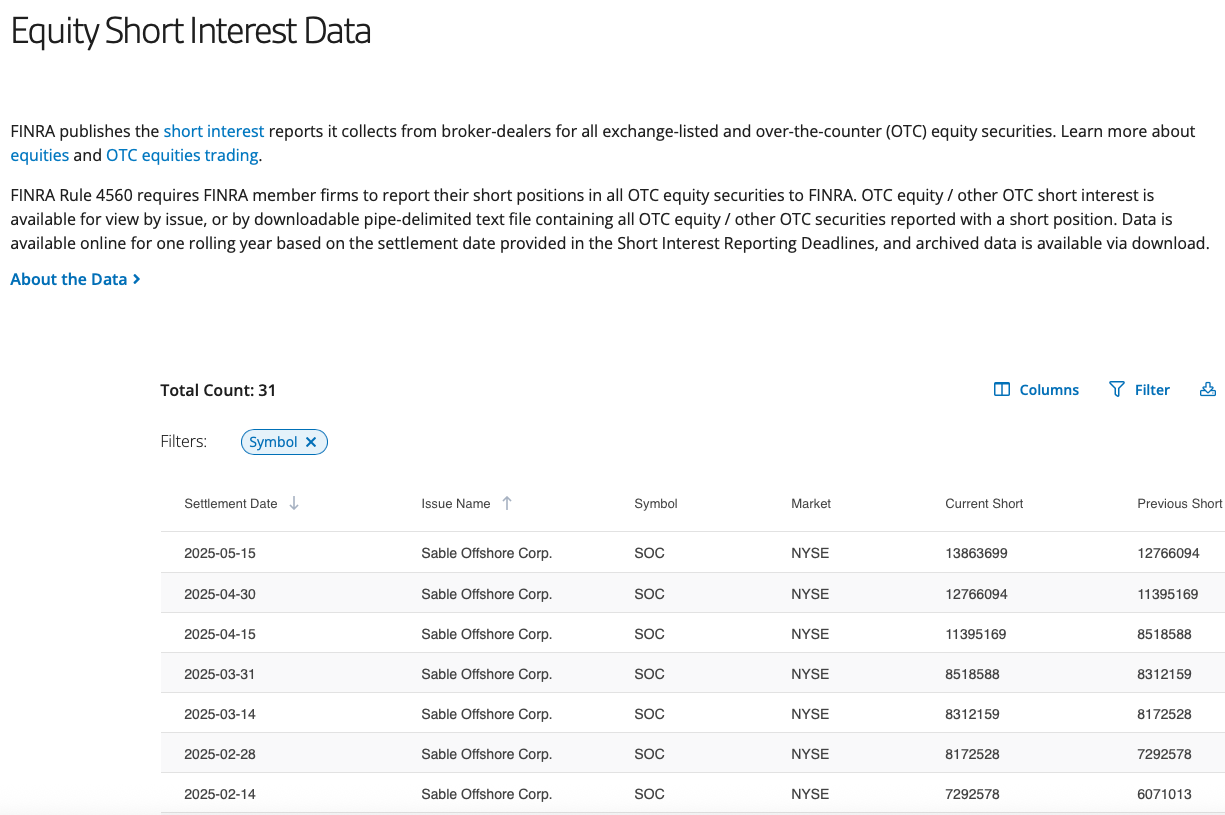

To answer my own question, most of the shorts aren’t thinking in my (very biased) opinion. I don’t have much to add to what I said on short interest in my Narrative Shift post from a couple weeks ago. If there are somehow fundamental shorts still around vs. pod shops and algorithmic traders, the only thing I could think of is that they believe that the OSFM will not give Sable the Certificate Of Operations. Short interest ticked up again to just under 13.9M shares (as of 5/15). I would assume that there was some short covering after Sable announced the production restart on 5/19, but I’m still amazed at the high short interest in the stock. It will be interesting to see where short interest is at the end of May, but we will have to wait for a bit for that data.

The Latest Jefferies Note

I still think most of the institutions covering Sable are going to keep chasing the stock higher with their price targets for the rest of 2025, but I figured I would also share the latest note from Jefferies (from May 26) that was passed along to me. It’s a quick read if you have the time.

Conclusion

The most important point I want to get across with my post today is what I have been saying this throughout the twists and turns with Sable: the OSFM sign off and granting the Certificate Of Operations is not a discretionary decision. From my understanding, as long as Sable fulfills their end of the Consent Decree, the Fire Marshal will give the green light, and I don’t think we will have to wait much longer for that 8-K with the good news. All the repairs are complete, the hydrotesting is done, and the final puzzle piece for a fully operational Santa Ynez Unit is the Certificate Of Operations from the OSFM. The Fire Marshal, who has kept a close eye on this project from start to finish, has State and Federal oversight authority. I know I included yesterday’s 8-K earlier in the post, but I think it makes sense to double dip here to hammer the point home.

On May 27, 2025 Sable Offshore Corp. conducted a successful hydrotest of the final segment of Line 325 and has now successfully hydrotested all segments of Line 324 and Line 325 (collectively, the “Onshore Pipeline”), satisfying the final operational condition to restart of the Onshore Pipeline as outlined in the Consent Decree. Therefore, no more repairs are required to the Onshore Pipelines prior to restart.

There is one other piece from the injunction worth mentioning that doesn’t fit neatly into another section of the post. In the off chance that the pipelines (the same ones that were just repaired and hydrotested) require emergency work, there is an exemption in the injunction for that work. It’s an extremely low probability event in my opinion, even if the injunction proves to be more durable than my expectations. With that said, I think the path forward gets much clearer for Sable in the coming weeks. I don’t think this thing will end up in Federal Court, but depending on how things develop, it is definitely a potential outcome.

How Sable approaches this situation will depend on the other parties involved. When I went back to reread the Consent Decree last night, I keep coming back to the conclusion that the most likely path from here (by a wide margin), is that the Fire Marshal gives Sable the Certificate Of Operations in the very near future, and yesterday’s move in the stock will look like a short term blip by the end of 2025. Like I have said before, I can’t give investors my conviction in an idea, and I certainly can’t hit the buy or sell button for anyone. What I will say is that if you have an itchy trigger finger on the sell button, I think it might be a good time to have some patience.

Disclaimer

I own shares and calls on Sable Offshore. You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.

Truly amazing that the CCC thinks it is appropriate to call a NYSE publicly traded company a 'fly by night oil company'

Everyone is used to this type of rhetoric but this is from a regulatory agency. Not from a politician or an activist group. It is beyond acceptable and their needs to be legal and financial repercussions for anyone involved in signing off on this statement. This was an ethical breach by the CCC that should not be overlooked. Completely unprofessional and I'm going to guess violated multiple laws and ethics policies. Regulatory bodies have legitimacy for calling balls and strikes. Once they cross the line into advocacy we all have a major problem. CCC crossed the line with this statement.

That said, anyone investing has to understand, Sable is attempting to breach a firewall that many forces in the state of California believe should not and can not be breached. I think our host has approached this issue logically and with respect for the letter of the law. But this is bigger than Sable and law be damned if powerful groups have their way. We are dealing with zealots. They have no fear of a multibillion dollar judgement years from now. Taxpayers will have no choice but to fund this negligence when/if the bill comes due.

That's my biggest callout from this post. You are assuming rational actors that care about costing taxpayers billions if they lose at some federal trial years from now. Not their money they are gambling with.

My position: Dumped at $32+, was surprised I could get out but it appears everyone waited for the hearing. Would love to get back in but right now I need a price in the teens. Too many indicators of darker political forces at play. Just my take. Best of luck to Sable and their investors. Going to watch for now.

Also, the best advocacy you can do for Sable is not buying shares but calling your politicians and writing your local newspapers.

Id love to hear your thoughts on the lease renewal Sable will have to obtain for the 3 mile stretch of water covered by the SLC ( State Lands Commission) and if that lease renewal is in jeopardy due to CCC permits or political activism.