Sable Offshore: More Drama From The CCC

Q3 Earnings Release, The CCC Cease & Desist & A Big Name Buyer Shows Up

I was venting on Sable Offshore SOC 0.00%↑ with a buddy last night on the phone, so I will keep this post brief, and avoid including a bunch of memes and clever alliterations for what the CCC in the California Coastal Commission actually stands for. They do have a meeting this morning, complete with a rally from the Center for Biological Diversity, but there are a couple pieces of news worth touching on this morning. The first piece is the latest drama cooked up by the CCC, but I also briefly touch on Q3 earnings, Li Lu buying shares of Sable, and a summary of Judd Arnold’s most recent Twitter space on the company and the CCC.

A Last Ditch Effort From The CCC

The piece of news that probably will lead to a decent selloff this morning in Sable shares is the recent Executive Director Cease and Desist from the CCC. The first Cease and Desist in September put a stop to all activity in the coastal zone. Sable has cooperated and has focused on repairs on sections of the pipeline outside of the coastal zone. If you read between the lines of the press release below (and the 10-Q), the CCC has put themselves in a position of weakness, which is why I think the most recent Cease and Desist is a Hail Mary to stop first production in my opinion.

The reader’s digest version of the Executive Director Cease and Desist goes something like this: actually, we want you to bury the pipeline without finishing repairs. Do not pass go, do not collect $200 (I added that part). Anyway, I think this is a last ditch effort to stop first production, and I don’t think we will have to wait too long for a resolution. The two most likely outcomes in my opinion are Sable settling with the CCC, or the Fire Marshal steps in and says enough is enough. We’re not going to make Sable bury the pipeline without repairs, dig it up again to repair it, and then bury it again after it’s ready for operations. They have state supremacy, and state and federal regulatory oversight.

Judd’s Twitter Space

If you have a half hour to spare, it’s worth going and listening to Judd Arnold’s space from last night on Sable. Judd talks about some of the points I discussed above, along with other points on the potential for delay damages for example. We also had a guest appearance from Jason Strom with his thoughts on the legal situation, and how things might play out over the next couple months.

Summary

CCC ceded authority to the county and the state over three decades ago when the pipelines first started. This is why the CCC isn’t on the 2020 consent decree.

Sable’s existing Coastal Development Permits, the settlement with Santa Barbara County, and cooperation with the Fire Marshal is enough to finish repairs and check valve installation without any additional permits from the CCC.

The Fire Marshal (OSFM) has state supremacy over the county and the CCC.

The company and CCC both agreed that the current state leaves things exposed to erosion, which puts some time pressure and a sense of urgency with the pipeline exposed to resolve things sooner rather than later.

What an interim work plan might look like.

The potential for delay damages against the County and the CCC if this drags on and ends up in court.

Why a settlement or the Fire Marshal stepping in (like they did with the county) is the most probable resolution.

Q3 Earnings & Li Lu Buys Shares

There’s not much to say about Q3 earnings (there are no earnings, for now), but there are two things worth noting. Management said they still expect production to restart this year in the fourth quarter. I’m optimistic that the company will be able to do that, and we will see how the drama with the CCC gets resolved, but I think being patient here will be rewarded. The other thing worth paying attention to is the company’s cash balance, which sat at $362.9M as of 11/13 after the warrants were exercised.

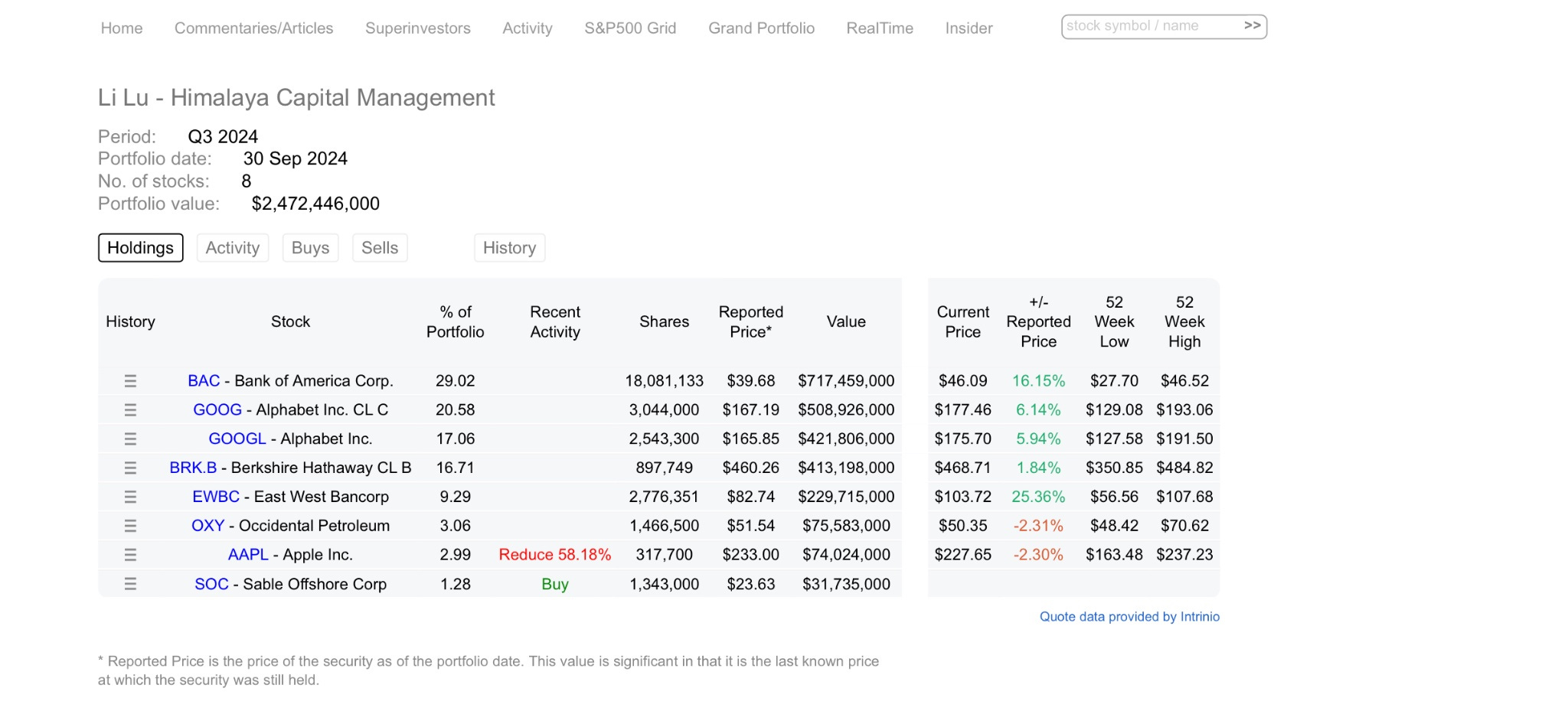

The other thing that has been making the rounds is that Li Lu added shares of Sable. For those who are unfamiliar with him, he’s the only outside investor that Charlie Munger ever gave money to. He bought more than 1.3M shares of Sable, so not a huge position for his portfolio, but over 1% of the company. This will probably be overshadowed by the Cease and Desist news from the CCC, but we could see some of the Berkshire fan club start to take a closer look at Sable. I won’t be changing my position, but I think we are getting close to first production despite any last ditch efforts from the CCC to be a nuisance. We should know more in the coming weeks.

Disclaimer

I own shares and calls on Sable Offshore. You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.

Appreciate the update

Hi what are your thoughts on OSFM's latest update on the 6 steps for Sable to restart? Seems like only step 1 has been completed by Sable

Link: https://osfm.fire.ca.gov/what-we-do/pipeline-safety-and-cupa/pathways-for-restarting-pipelines

Also seems like the locals are applying pressure on OSFM to stop the restart so its unlikely that sable will restart by year end?

Link: https://www.independent.com/2024/11/26/state-fire-marshal-claims-it-does-not-have-unilateral-authority-over-whether-to-restart-sable-oil-pipeline/