Podcasts Of The Week

A Follow Up To My Conversation With Vince Lanci On Gold And The LBMA & A Trader's Look At The Market And Different Sectors

There has been a lot going on in recent weeks on the geopolitical stage with Ukraine and the Middle East, but that has been on the back burner for me. I have been hearing rumblings that the Middle East could flare up again, and Europe seems to be panicking over what could happen in the near future with Ukraine. If you have the time the piece below is worth a read, but Zelensky is in an interesting predicament. The other thing to keep an eye on this week is German elections. It will be an interesting signpost for the direction of things in Europe, but I’m curious to see how things turn out.

Gold Goats n’ Guns w/ Vince Lanci & Eric Yeung

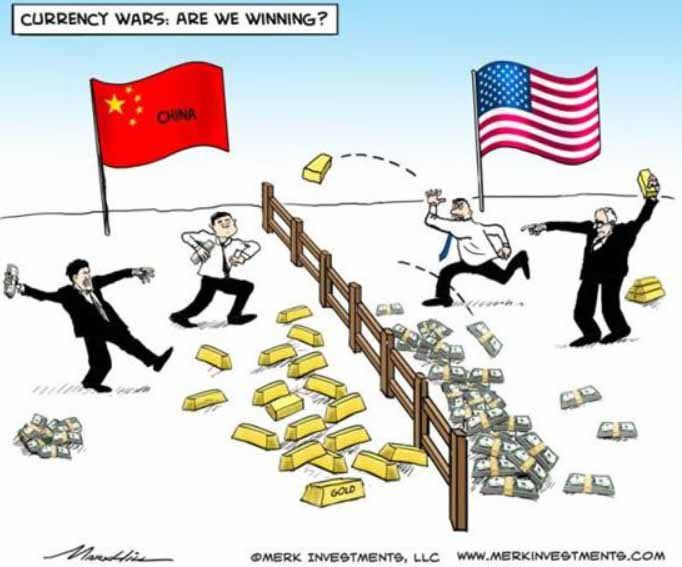

I had Vince Lanci on the podcast recently, but if you want a follow up to our conversation, you will enjoy this podcast. They talked about what is going on with the LBMA and the gold flowing into the US. Eric pointed out that the US wouldn’t be draining the LBMA of gold if powerful groups in the US didn’t want it to happen (JP Morgan and the Fed being at the top of that list). I have seen the meme below a couple times over the last couple years, but today you can move the US to the left with China, with the City of London on the right.

They also talked about gold backed treasuries, a sovereign wealth fund, wage inflation returning, and tariffs. The rumblings of a Mar-A-Lago accord with perpetual bonds (or 50/100 year maturities) with no coupons were also covered. If you want more on that, you can go watch Macro Voices with Jim Bianco from last week. One of the more interesting topics was the conversation around the US tapping into the home equity of US citizens, and the terms of what a hypothetical home equity backed treasury bond could look like. There are a lot of things on the drawing board right now, but basically America is going to start investing in America again.

The Business Brew w/ Le Shrub

If you want to listen to a very entertaining podcast on the golden age of grift, you will enjoy this one. Le Shrub goes into his investing (and trading) strategy, China and Alibaba BABA 0.00%↑, and how he factors valuation into his process. They also talked about biotech being bombed out, Shrub’s barbell portfolio strategy, and how he uses options. It’s always entertaining to listen to him talk about financial markets, whether it’s about small nuclear startups, emerging markets, or flying taxis.