Peabody Energy: Buybacks & Dividends On The Way

A 30,000 Foot View of Coal & Why I Own Peabody Energy

Summary

While the energy sector is vilified, the coal sector is viewed even more pessimistically. In my opinion, there is a disconnect between the reality spun by the media and the reality on the ground when it comes to coal.

Coal use reached record levels in 2022, and developments overseas lead me to believe that we will see continued demand for thermal and metallurgical coal.

Peabody Energy recently announced that it has dealt with their surety agreement which had covenants to restrict shareholder returns.

Management announced a $1B buyback program and a small fixed dividend (1.25% yield), and they plan to return 65% of free cash flow to shareholders.

Peabody is a large position in my portfolio and I have been adding shares over the last couple weeks.

In my post on Thursday, I talked about inflation and how I think inflation will be higher for longer. While inflation rates are bound to fluctuate, I think they will be consistently higher than in recent memory. One of the sectors that I think will perform well in an inflationary decade is the energy sector. Today I will be writing about Peabody Energy BTU 0.00%↑, a coal company with a market capitalization of $3.5B.

Now, I know what you’re thinking. The first stock he writes about is a coal company? The energy sector has been vilified over the last decade, and the coal subsector in particular is viewed as the dirtiest part of the energy sector. Before I get into company specifics, I wanted to give a couple highlights on the coal industry and why I think a coal company like Peabody Energy represents a good risk/reward proposition.

Coal: A 30,000 Foot View

Despite the continued push towards so-called renewable energy like solar and wind, coal accounted for more than 20% of America’s electricity generation in 2021. This varies depending on the region. In Washington, we rely heavily on hydro power, while there are eight states that still generate more than half of their electricity from coal.

“West Virginia, Wyoming, Missouri, Kentucky, Utah, North Dakota, Indiana, and Nebraska accounted for just 11 percent of U.S. power generation in 2020, but 38 percent of its coal-fired generation.”

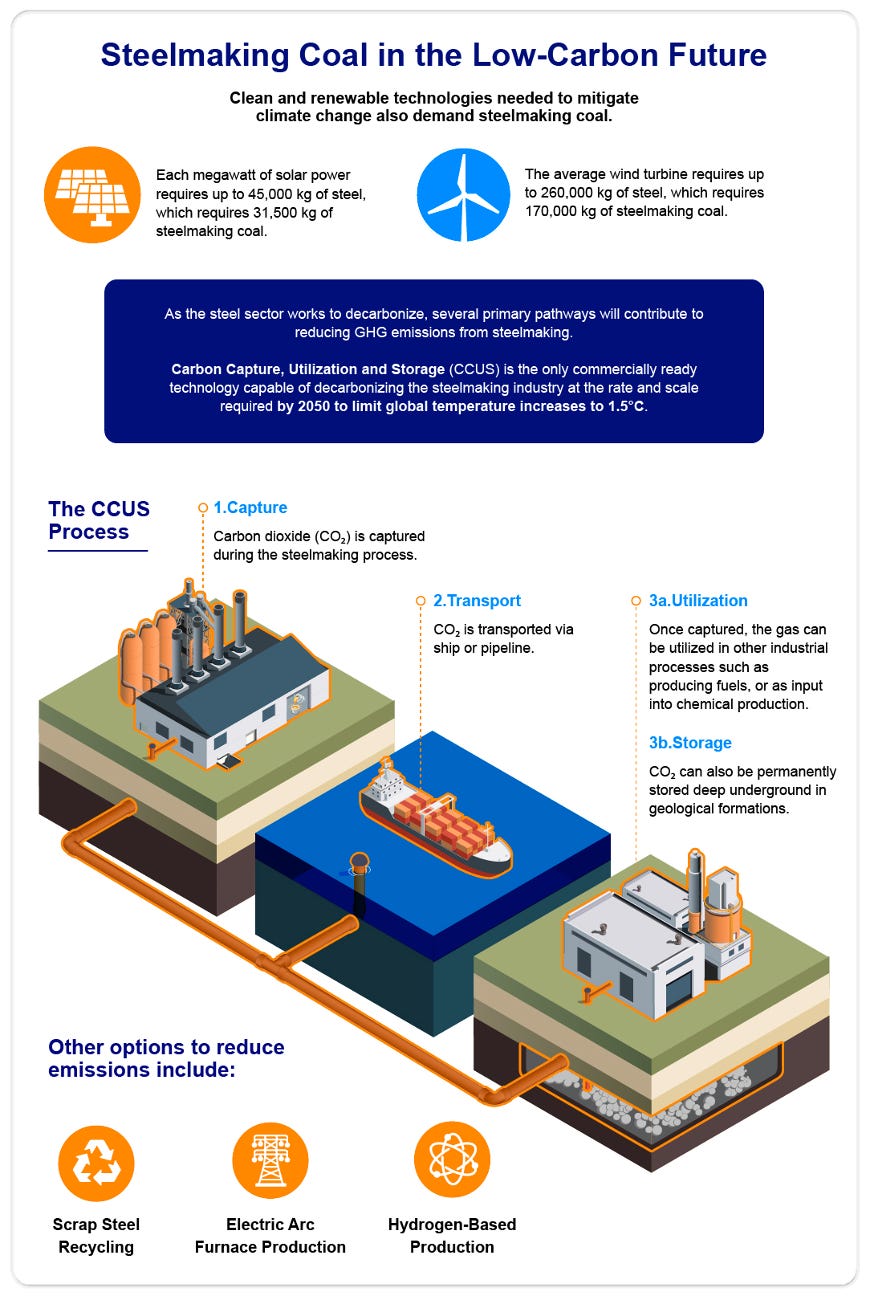

2022 was the highest year on record for coal consumption around the world. While the narrative is that the world is transitioning away from coal, the facts paint a different picture. Coal isn’t just used for power generation (thermal coal). It is a critical input in the steelmaking process, with over 70% of steel production around the world relying on coal (called metallurgical or coking coal).

Not only is coal use actually increasing around the world, but it is also a significant part of the manufacturing process for solar (31,500 kg of coal per megawatt) and wind power (170,000 kg of coal for the average wind turbine). Solar and wind are called renewable, but when you look at what it takes to create solar and wind, they look more like a grift for massive government subsidies instead of the best investments in our society’s electric grid.

“Solar and wind (and EVs) are just transformed oil, coal, and natural gas. One day we will look back and wonder why we used an insane amount of energy and oil to create batteries for electric motor vehicles, then charged said vehicles with coal and natural gas, instead of just using the gasoline or diesel to fuel the vehicle itself.”

- Praetorian Capital Founder, Harris Kupperman

Looking Overseas

While it is easy to focus on what is going on in the United States as Americans, it is worth looking at countries around the world to see how their energy transition is going. Germany has been shutting down nuclear plants in recent years in favor of solar and wind. In the last year, they were forced to bring coal plants online to meet energy demand after the Nord Stream pipeline bringing natural gas from Russia was sabotaged. They now have the “dirtiest” energy grid in Europe.

As we type this piece, more than 40% of Germany’s electricity is being produced by coal.

- Energy Expert Doomberg in January

China has taken a different approach for their energy grid. They are rapidly building nuclear plants as well as coal plants. China doesn’t have access to abundant natural gas like we do here in the US, and they are building the equivalent of two new coal plants per week. Natural gas is a cleaner power source than coal and a better long-term solution for baseload power for those concerned about the environment. It is also a pain in the ass to transport and store, which means it isn’t practical for every country. Coal doesn’t have either of these issues.

Peabody Energy

Now that I have given my view of the coal industry from 30,000 feet, let’s dive into Peabody Energy. Peabody has operations here in the America as well as Australia. In 2020, investors assumed Peabody was on its way to bankruptcy (again), and shares were trading under a dollar. As coal prices increased dramatically in 2021, Peabody became extremely profitable, earning over $360M in 2021 ($3.21 in EPS) and $1.3B in 2022 ($8.31 in EPS). They earned just under $270M in 2023 Q1, or $1.69 per share. Coal prices have come down a bit since 2022, but they are still well above where they were in 2021 (and before).