Patria Investments: A Potential Latin American Compounder

Why Patria Is Near The Top Of My Watchlist Today

Summary

Patria Investments is an asset manager focused on Latin America.

AUM has grown quickly since their 2021 IPO, from a combination of organic and external growth.

The dividend has been lumpy, but the trailing yield sits at 7.7%, and the 2023 payout was more than 25% larger than the payout for 2022.

Patria currently trades below 10x forward earnings, which is a material discount to larger asset management peers.

I don’t own Patria yet, but it is near the top of my watchlist right now.

One of the things about my investment process is that I’m constantly looking for new ideas to potentially add to my portfolio. Most of the stuff I look at is written off quickly for a variety of reasons, but one of the tough things about my portfolio is that I have more ideas than I have money. Hopefully that will change over the next several years, but sometimes I come across interesting ideas that I think are worth writing about, even if I don’t own the stock. One example of this was Natural Resource Partners NRP 0.00%↑, which is one I regret passing on.

Today, I’ll be writing about Patria Investments PAX 0.00%↑. It has been on my radar for awhile, and I don’t own the stock yet, but it is near to the top of my watchlist. Patria has a long growth runway for several reasons, but I think the risk/reward is compelling today for long-term investors. I think a lot of money is going to flow into South America over the next three to five years, and I would like to have some exposure to those financial flows outside of the energy sector. Patria is one of the ways I’m looking to do that. Patria trades at a significant discount to asset management firms like Blackstone BX 0.00%↑, Ares Management ARES 0.00%↑ and Apollo Global Management APO 0.00%↑. It also pays a nice dividend that has the potential for future growth.

Overview

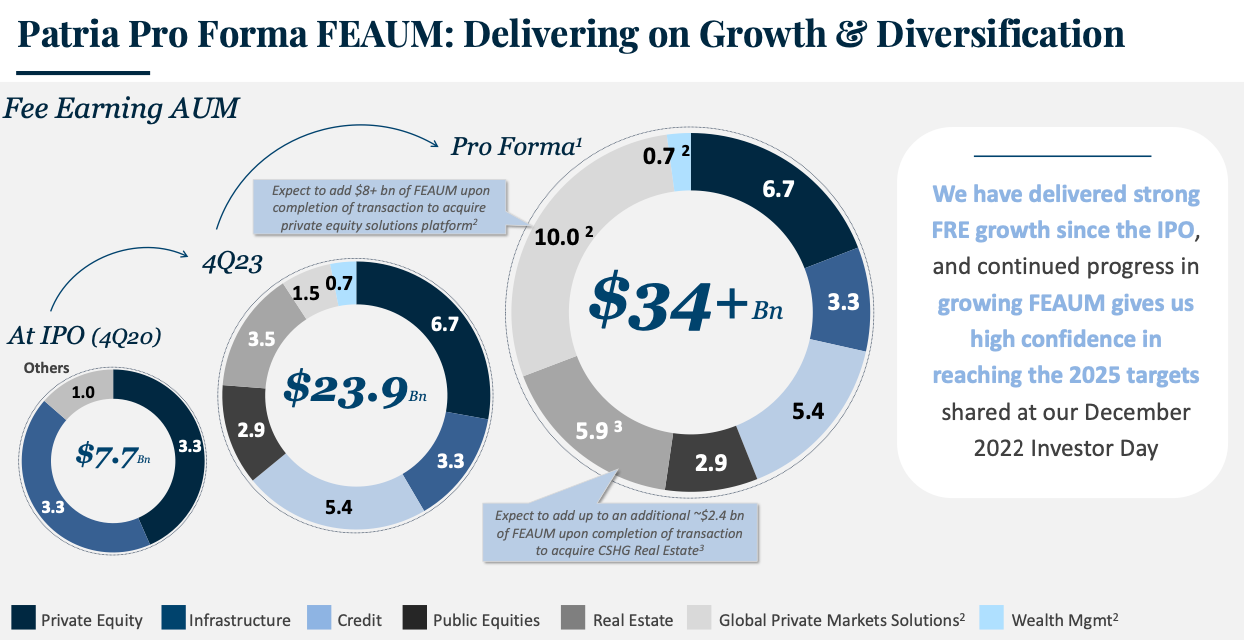

Patria is a growing asset management company focused on South America. The company went public in 2021 and is based in the Cayman Islands. They have been growing quickly in recent years through a combination of organic and external growth. Approximately three quarters of Patria’s assets under management (AUM) is categorized as Fee Earning AUM (FEAUM). When outstanding acquisitions close, they are looking at approximately $34B of FEAUM and $40B of total AUM.

Management was busy in Q4 2023 on the external growth front. They announced the acquisitions of Private Equity Solutions (adding ~$8B of FEAUM) and Credit Suisse’s Brazil Real Estate Fund (adding ~$2.4B of FEAUM). Both of these acquisitions are expected to close in the first half of this year, so we should be getting an update on those relatively soon. They also added $1.4B of permanent capital in Q4 with the joint venture with Bancolombia CIB 0.00%↑ (51% Patria, 49% CIB ownership split).

As you can see, Patria has diversified exposure to many of the major asset classes, including private equity, public equities, real estate, credit, and infrastructure. The incentive and performance fees will fluctuate, but I think the trend will be up and to the right as long as AUM continues to grow. AUM has been growing fairly quickly since the IPO, and I expect that will continue over the next couple years. They are well on their way to their goals of $35B of FEAUM and $50B of AUM by 2025.