Oil Painting: Miscellaneous News On The Energy Sector

Petrobras Dividends, Transocean Earnings, And Oil News & Charts

I was planning to write a thread on Petrobras deciding to pay special dividends after all, but enough news has come out in the last couple weeks that I decided to dedicate a longer post to recent topics. Transocean RIG 0.00%↑ reported earnings last night (their conference call is this morning), but there is other offshore news to cover. I also saw a couple interesting things on the Permian Basin that was worth relaying to readers.

Petrobras Dividends

I have written about the political risk involved with owning Petrobras a couple times, and at least for now, it looks like the risk was overblown. Shares have rallied about 15% over the last six weeks, so congratulations to anyone who decided to buy the dip. As long as oil is in the $70-90 range, I think Petrobras will continue to pay out $0.40 to $0.50 per quarter in regular dividends. The good news from last week is that it turns out shareholders are getting the cherry on top with special dividends after all.

They have decided to pay out 50% of the special with the next quarterly payout. That puts the payout at $0.55 for May and $0.55 for June. The record date has passed for the regular dividend ($0.21 for each of those), but investors buying before May 2 can still receive the $0.34 special payout for the May and June dividends. It sounds like they will be paying out the other 50% of the special dividend over the rest of 2024, but we will see how that develops in the second half of the year.

Offshore Update

Transocean’s earnings report didn’t do anything to change the bullish thesis on the company or the rest of the sector, but I’m curious to hear what they have to say on the earnings call. I haven’t changed my opinion on the sector or the company, but I do want to hear from management on the recent refinancing and what they have to say on day rates. I have also started to see rumblings on Twitter of longer term contracts with day rates of $550,000 to $600,000 on the horizon. Just like anything you see on social media, feel free to take it with a grain of salt, but new contracts in the $600,000 per day ballpark would be very bullish for the deepwater sector.

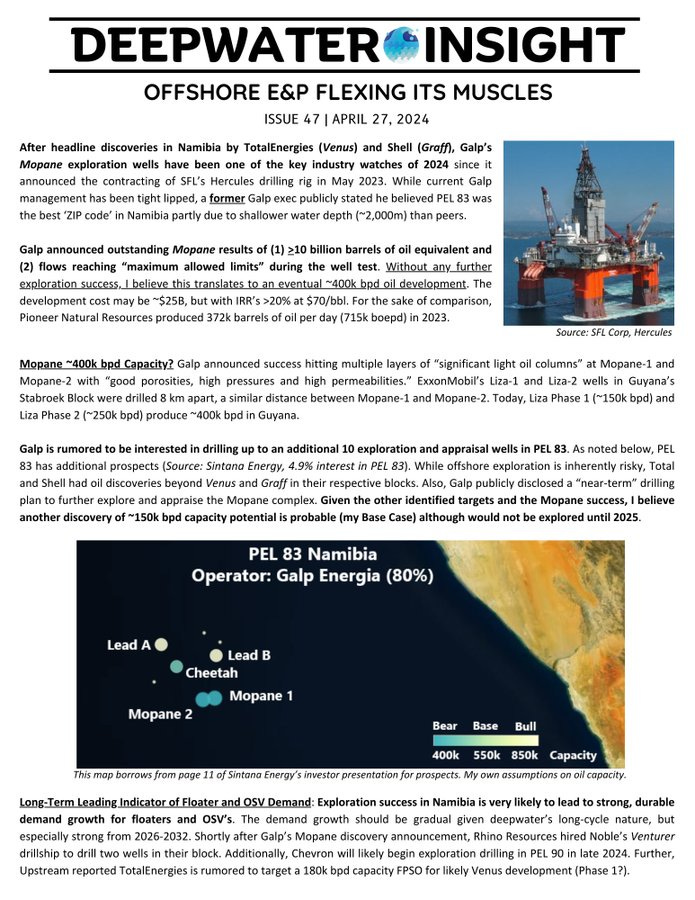

The other thing I wanted to highlight from Twitter is @tommydeepwater’s most recent Deepwater Insight. If you’re on Twitter and you don’t follow Tommy, you should. His weekly updates are must reads for offshore investors. This week’s version was focused on news out of Namibia, where Galp announced very good news with their Mopane drill results. Shares of Galp are up almost 30%, and Sintana Energy (a smaller company which owns a smaller stake of that block, as well as small stakes of other adjacent blocks) shares have more than doubled in the last couple weeks.

We will see how things develop, but if Namibia turns out to be a black gold mine for some of the companies that own offshore blocks, Galp and Sintana Energy are probably still cheap, event after the recent pop. For the deepwater and OSV sector, this is definitely a bullish development. This is more of a long term story than the potential for new contracts at higher day rates in the second half of 2024, but when you look at the relatively fixed supply for the sector, it’s just another reason to be long-term bullish on offshore.

The Permian Basin

The last topic I wanted to touch on is the Permian Basin. A recent Wall Street Journal article was an interesting read, but there were also a couple charts from Twitter I wanted to include as well. The article talks about water use, shifting ground, and earthquakes in the area.

The number of earthquakes in the Permian with magnitudes greater than 2.5 jumped from 42 in 2017 to 671 in 2022, according to B3 Insight. In late 2022, a 5.4-magnitude earthquakein Reeves County, Texas, sent tremors felt as far as Dallas, El Paso and San Antonio, where it damaged a historical building.

- In America’s Biggest Oil Field, the Ground Is Swelling and Buckling, Wall Street Journal

I’m not sure what to make of more earthquakes and shifting ground in Texas, but the charts I saw on Twitter were more interesting to me, and probably have bigger implications for investors.

I’m curious to see what this chart looks like by the end of the year. I’m not here trying to call the exact timing on production in the Permian Basin rolling over. I have said it before and I’ll say it again: trying to time this perfectly is a fool’s errand in my opinion, especially using government statistics. I’m not a geologist or someone with hands on experience in the oil sector, but I think it’s highly unlikely that we get through 2025 or 2026 with investors still talking about production growth from the Permian.

The other chart is from Luke Gromen, who is one of my favorite podcast guests to listen to, and he has been all over the chain reaction that a shale production decline could set off. I’m not going to reiterate that here, but I think this will be something to watch for the rest of 2024 and beyond. Poking through the replies was interesting, where some of the people closer to the industry said breakevens for US shale is closer to $85. For me, these charts reinforce the idea that the offshore sector will be the place to be for investors in the energy sector. It’s much harder to put a timeframe on it, but as long as I can keep a three to five year time horizon, I don’t think I have to nail the timing to nail the landing.

Conclusion

It’s been a bumpy start for my portfolio this year, but I think the rest of 2024 is going to be an interesting ride. It looks like the decision to hang onto Petrobras will turn out to be the correct one for now with the payout of half of the special dividend. I’m curious to see how the rest of 2024 turns out for the company, but as long as the dividends keep flowing, it will be hard to sell any of my shares. I continue to remain bullish on the offshore sector, and I think some of the recent developments just reinforce the bull case. The offshore sector is very long cycle, so it’s not going to happen overnight, but I think the sector is going to richly reward patient investors.

Disclaimer

I own shares of PBR.A and RIG. I also own calls on RIG. I do not own shares of Galp or Sintana Energy (unfortunately). Any time I talk about Petrobras shares I am referring to the American Depository Receipts (ADRs). You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.

I had 15,000 shares of PBR prior to the political BS that dropped the price as low as $14.53. I held my shares. I also began buying again. Now I own 31,255 shares. That last 16,255 shares were purchased under $15.50 a share. As long as the dividend remains strong it’ll be tough to sell. Dividends pretty much paid for the first 15,000 shares.