Navios Maritime Partners: Diversified Shipping Exposure At A Steep Discount

A Great Way For Generalist Investors To Own Shipping In 2026

Note to paid subscribers: This post is too long for email, so please click on the post to read it in your browser.

Summary

Navios Maritime Partners is a diversified shipping company with exposure to Dry Bulk, Tankers, and Containers.

The valuation is extremely cheap no matter how you slice it. Shares trade at roughly 3-4x 2026 earnings, and 0.35-0.4x NAV. It’s dirt cheap on an absolute basis, and it’s cheap relative to other shipping companies.

The company has a token dividend payout, but capital returns have mainly come in the form of buybacks. They have bought back 1.4M shares since Q2 of last year.

Dry bulk is setup for a great 2026, and Navios is mostly exposed to spot rates for that sector. Tankers have been strong lately as well. For containers, the sector where I’m not as bullish, Navios has locked in charters for the fleet for more than 90% of 2026.

Navios’ diversified fleet is a great way for generalist investors to get exposure to shipping for 2026 and beyond. I’m expecting post-COVID highs in 2026, and a share price in the triple digits if the discount to the rest of the sector closes.

Navios Maritime Partners NMM 0.00%↑ is my favorite way to own a piece of the shipping sector. Their diversified exposure to dry bulk, tankers, and containers spreads risk across what is a notoriously cyclical sector of the market. I know it has “Partners” in the name, but for anyone worried about tax treatment and the K-1 tax forms that come with MLPs, you don’t have to worry. Owning shares of Navios doesn’t require K-1 form when tax time rolls around. They reported earnings earlier this week, and there is a lot to like as an investor over the next 12-18 months. I think we will see the stock at post-COVID highs sometime in 2026. If it closes the valuation gap with the rest of the shipping sector, that puts the stock somewhere in the triple digits if you’re patient enough.

Fleet Overview

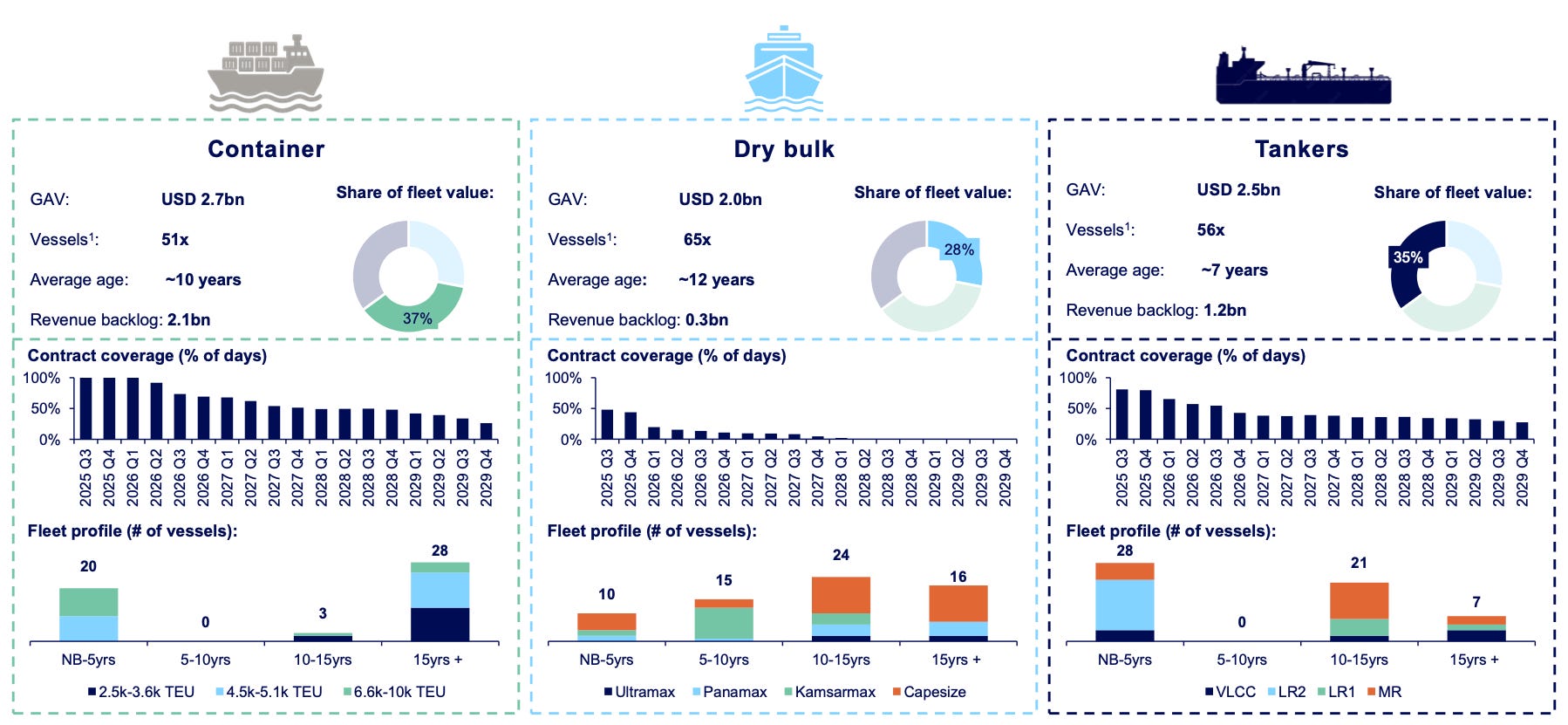

Navios’ fleet is split across three shipping subsectors: dry bulk, tankers, and containers. Below you can see the average age of those ships, the fleet profile, and contract coverage. As you can see, they are more contracted in the container and tanker sectors (more on that later). They have been in the process of refreshing the fleet by selling vessels near the end of their 20 year useful life, and they are expecting the delivery of 25 vessels over the next couple years, mainly product tankers and container ships.