Note To Paid Subs: This post is too long for email, so please click on it to read in your browser.

Summary

Millennial Potash is developing the Banio project in Gabon. The stock is up 800% YTD (for good reason), and I think the run is set to continue in 2026.

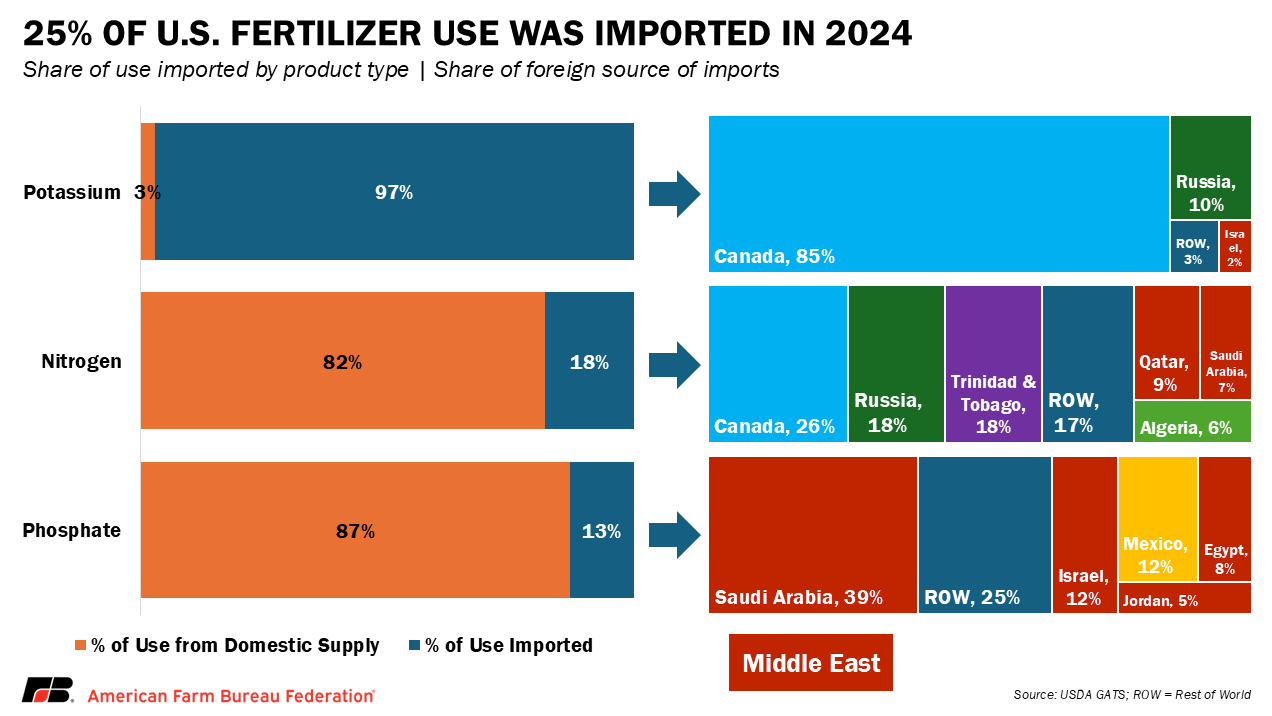

The US imports 97% of our potash. We recently added potash to the list of critical minerals, and the USDFC is directly involved with Millennial’s Banio project.

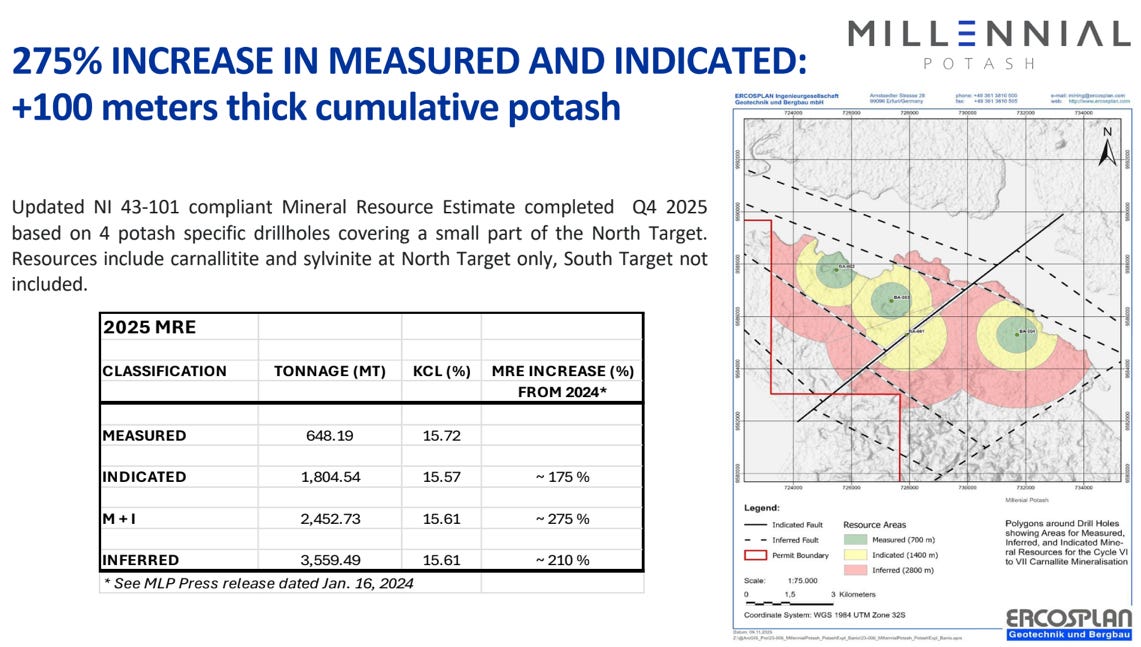

After two new drill holes, Millennial recently released a new Mineral Resource Estimate with ~6B tons of measured, indicated, and inferred reserves. 95% of the project is still unexplored.

One of the insiders has been buying in large chunks since August of last year, and he hasn’t stopped buying even with the run in the stock. The board, insiders, and management own more than 40% of the stock.

The economics of the project already look extremely attractive as far as production numbers, OPEX, and CAPEX from the Preliminary Economic Assessment, and those estimates could prove to be conservative.

Millennial could be an acquisition target after the Feasibility Study next year, but I think there is still significant upside for investors in 2026, even after factoring in jurisdictional and political risk.

Millennial Potash is a small cap potash developer with a market cap of $348M CAD ($247M USD). They own the Banio project in the Western African country of Gabon. The project is 1,238 square kilometers along the coast. The stock is up roughly 800% YTD, for very good reason in my opinion. I understand that the default is to look at a stock that has run like that and assume that the train has already left the station, but I don’t think that’s the case at all. I think there is still plenty of meat left on the bone for investors buying today, even after the massive run it has had this year. It’s also in a sector that doesn’t get much attention, even among investors that focus on commodities or hard assets.

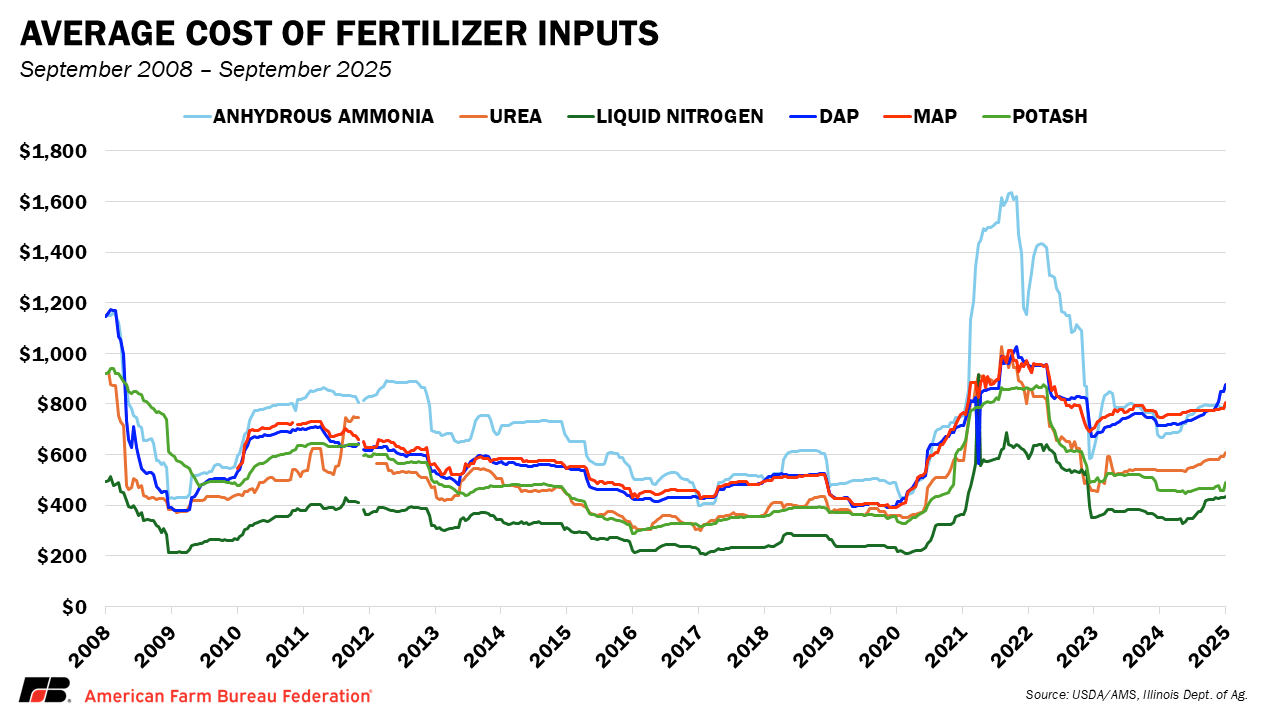

I was looking at charts of some of the bellwether companies in the agricultural sector, and I think it’s an interesting pond to fish in. This is admittedly an apples to oranges comparison with Millennial. Looking at Mosaic MOS 0.00%↑, Nutrien NTR 0.00%↑, and Intrepid Potash IPI 0.00%↑ makes it obvious that you aren’t buying a cyclical peak in fertilizers or potash if you’re buying anything in the sector today. When it comes to agricultural stocks, we are a lot closer to a trough in my opinion. Since the beginning of 2025, investors have obviously started pricing a different future for Millennial compared to some of the larger agricultural stocks.

One Of These Things Is Not Like The Others

Potash As A Critical Mineral

I have been doing more digging on potash this weekend, there are several things worth highlighting for investors thinking about owning Millennial Potash. The US relies on Canada for the vast majority of our potash imports, and this post from Jason is a great look at the overview of situation and the infrastructure of the industry. The US government added potash to the list of critical minerals, and they have also been involved directly with Millennial (more on that later).

Nutrien NTR 0.00%↑ recently decided to build a $500M to $1B potash export terminal in Longview, WA instead of in Canada. Earlier this year, BHP 0.00%↑ also delayed their massive Jansen project due to cost overruns to the tune of $1.7B, which could produce as much as 10% of global potash demand after Stage 2. They now expect Stage 1 to be complete by mid-2027 and have pushed Stage 2 out to 2031, but we will see if they decide to kick the can again in the future.

Potash prices are also rising compared to last year. Global spot values hover around $350 to $360 per metric ton, which is about 21% higher than in 2024. U.S. wholesale prices have been further supported by concerns over tariff actions on Canadian imports. Currently, potash imports from Canada are subject to a 10% tariff….

Potash supply is concentrated in just a few regions, with Canada, Russia and Belarus accounting for more than two-thirds of world exports…. The Russia–Ukraine conflict remains a defining backdrop for fertilizer trade. Russia is a top exporter of nitrogen, phosphate and potash, while Belarus, aligned with Russia, is another major potash supplier. Sanctions and shipping restrictions from other countries continue to complicate trade.

The Recent Mineral Resource Estimate

The recently updated Mineral Resource Estimate (MRE) for Millennial’s Banio project in Gabon is what got my attention, and why I started buying the stock. They recently released new drill results, and the market was a big fan last Monday. They hit thicker seams than their last drill program, with one at 100 meters and the other at 112 meters (last year’s results were 70 meters). With those drill results, the measured and indicated reserves was up to roughly ~2.5B tons, and the inferred reserves was roughly ~3.5B tons. So you have ~6B tons of measured, indicated, and inferred reserves, and they have only explored roughly 5% of the Banio license so far. I’ll get into some back of the napkin math later, but I think Millennial Potash is a very compelling speculation heading into 2026, even after the run it has already had.