Laying The Foundation For The Next Leg Higher In Oil

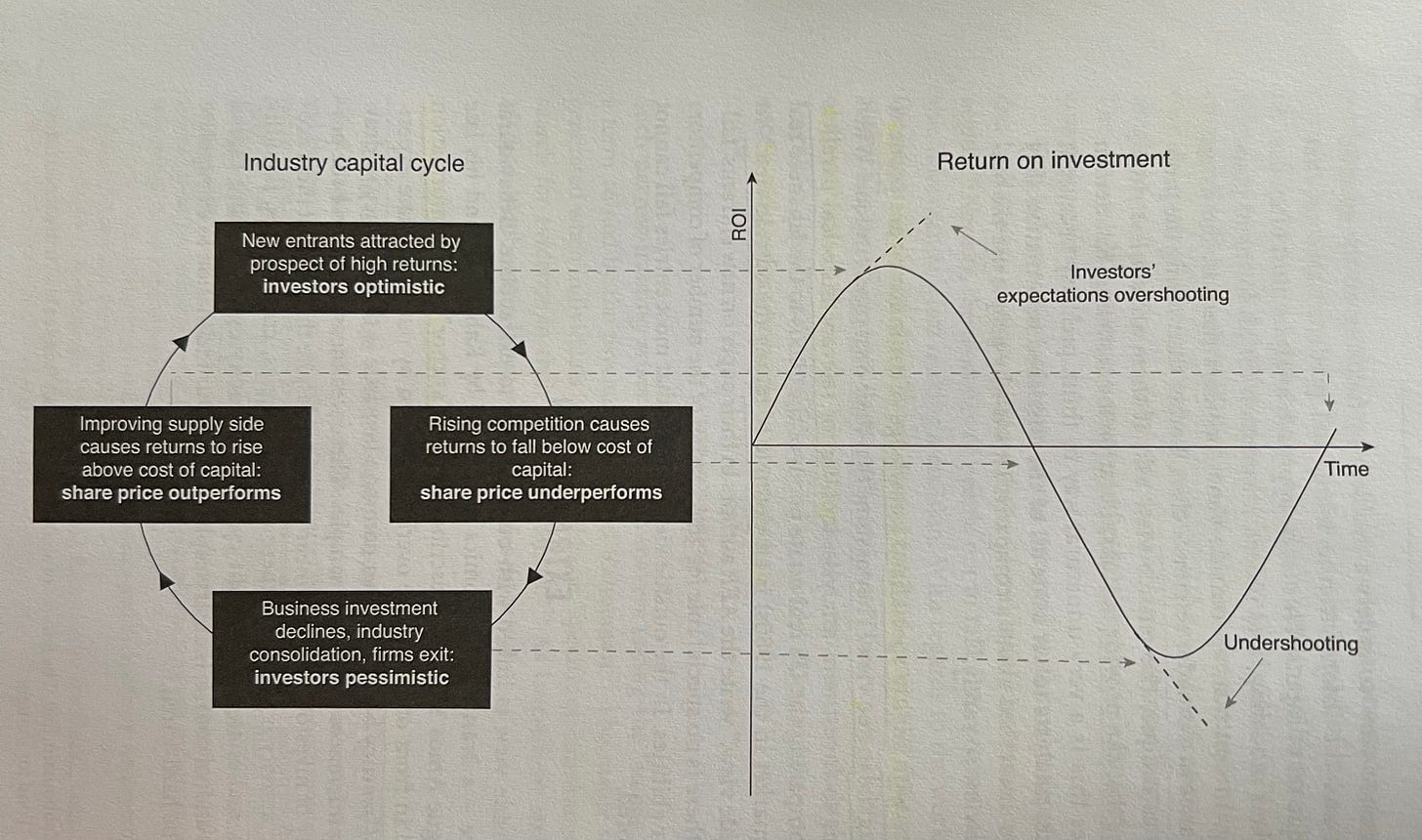

Bubbles Create Anti-Bubbles: The Capital Cycle In Action

Note to paid subscribers: This post is too long for email, so please click on the link to read the post in your browser.

From a 30,000 foot view, everything moves in cycles. Anyone who is a student of history will know that history doesn’t move in a straight line. Civilizations rise, typically growing through conquest, and bring prosperity to the whole society. Hard times create strong men, and strong men create good times. This lasts for a while, but generations will change, society will decay, and a plethora of bad ideas will be implemented. The good times roll until they are running on fumes, and then the weak men will create hard times. The empire gets overextended, and typically the civilization has to collapse, usually in a spectacular display of violence and/or degeneracy, before the cycle can start anew.

I’ll try to avoid getting derailed on a political rant (I’ll save that for a later date), but I hope the US can avoid the collapse part of the cycle, or skip straight to the rebirth. That might be naive to think it’s possible, but I’m optimistic about the direction of the US over the next several decades. If you look hard enough, you can see cycles all around us. At the highest level, for civilizations and cultures, all the way down to the individual. You also see it for the changing of the seasons, and you definitely see it in financial markets if you look closely. The problem is that many investors are myopically focused on short-term movements, and they lose sight of the big picture.

Bubbles Create Anti-Bubbles

Since I started writing the Substack a couple years ago, I have explained why I think we are in a secular bull market for commodities, but today I want to focus in on oil. I think we are nearing the end of a cyclical pullback in that secular bull market. I’m reluctant to call a bottom, but I think we are going to see the start of the next leg higher in oil in the back half of this year or sometime in 2026. Oil has spent the better part of the last three years bouncing around the $70 level (give or take 10 bucks), and the consensus narrative has been bearish pretty much the whole time. Price drives narrative, and once investors realized that the situation in Ukraine wouldn’t stop the flow of Russian oil to the market in summer of 2022, it was downhill from there, and quickly.

That was the end of the first wave of inflation, and the market has started to price in a “return to normal” over the last couple years. The S&P is back to grinding higher, many investors think rates are going to come down, inflation is going back below 2% (CPI is fake anyway, but I won’t get distracted on that here), and commodities are going to stay cheap. That would be great, but gold has been sounding the alarm over the last couple years, and has doubled since October 2022. Gold tends to lead commodities bull markets by 12-18 months, and some of the other commodities are starting to wake up. Platinum and silver are just a couple examples.

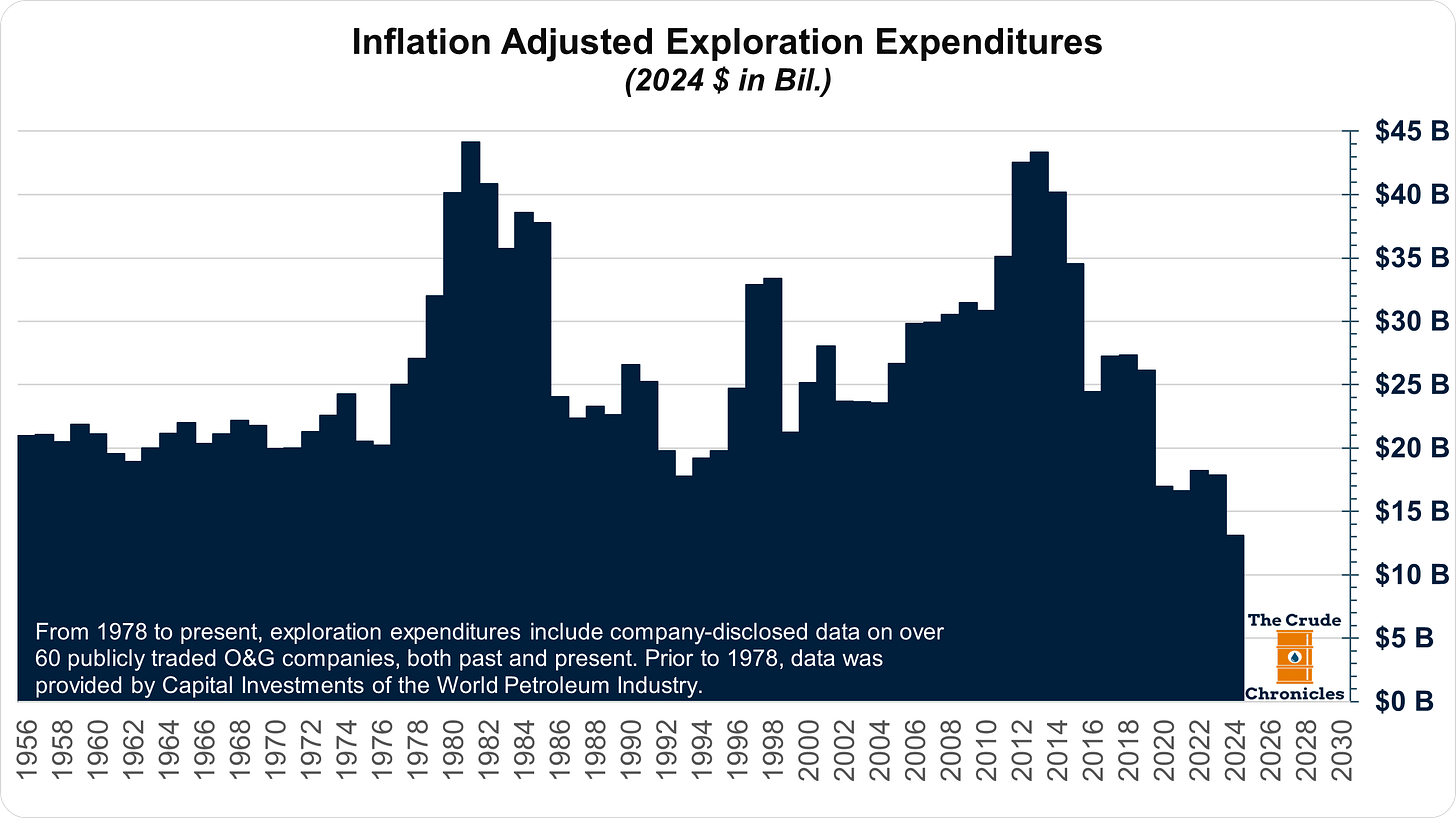

A lot of people focus on the demand driven commodities bull markets, like we saw in the 2000s driven by Chinese growth. I think what we are going to see over the next decade will look more like that 1970s, where supply constraints and bottlenecks are a bigger driver for commodities than rapidly rising demand. It might not be the whole commodities sector moving higher in unison. This is where if you zoom out again, you can see how bubbles create anti-bubbles. Years of ZIRP created a bubble in bonds that is deflating now (the US bond market is in its longest drawdown in history), and stocks keep going higher as passive investing and flows keep pumping money into equities. For the most part, commodities are on the other end of that spectrum, and many sectors have been starved of capital for the better part of a decade.

The Bearish Consensus & The OPEC Boogeyman

Bull-markets are born on pessimism, grow on skepticism, mature on optimism and die on euphoria.

- John Templeton