Kuya Silver: Ramping Production & Exploration Upside In 2026

Lotto Ticket Upside & Plenty Of Torque To Silver Prices If Management Can Execute This Year

Summary

A quick rant on the disconnect between the silver miners and the price of silver over the last couple months, and why the western price of silver is still an illusion.

Kuya Silver is working to ramp production at their Bethania asset in Peru, and they stand to earn their entire market cap (~$237M CAD, ~$171M USD fully diluted) over the next couple years if they execute and silver keeps rallying.

The Bethania asset has exploration upside with some extremely good drill results, but they also have an exploration asset in Ontario with associated nickel and cobalt, and carried interest on a project in Saudi Arabia with very attractive recent drill results for gold and silver.

The recent dilution and the share structure is a reason that it is a smaller position, but they have some big name investors on the shareholder list.

Even after a big run over the last year, there is still a ton of torque to a higher silver price if the company can ramp production over the next couple years.

The hits keep coming in 2026, with Jerome Powell being under investigation by the Justice Department and Trump claiming he didn’t know about it yesterday. I said in my year end post that we will probably see the Trump Administration try to make the Fed an arm of the Treasury, but I was surprised that they couldn’t wait until May when Powell’s term ends. Gold and silver are off to a good start in 2026, and I don’t think it takes a rocket scientist to predict that the precious metals will continue to be a good place to hide out if this year turns out to be chaotic.

The Paper Price Of Silver In The West Is An Illusion

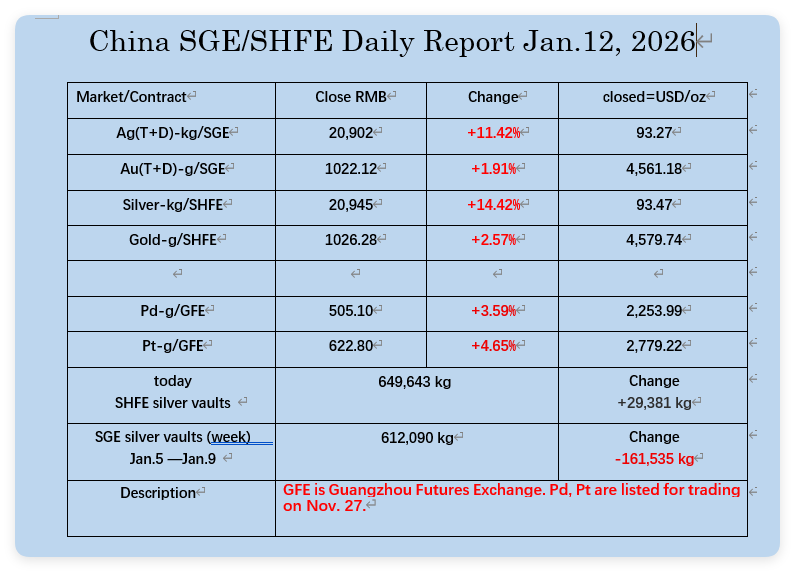

One of the things that has been interesting to watch over the last couple months is the gap in silver prices in the West and Shanghai. I’m not a short term trader, but as long as silver in China is trading at a chunky premium, I think silver’s rally has legs. Will it continue up at the 45 degree angle that we have seen since the end of November? I have no idea, but if we see Western silver prices start trading at or near parity with Shanghai prices, it might be time for a pause in the silver rally. You will also notice that platinum and palladium are trading at an even larger premium, and I think that logic applies to those metals as well. I’ll ask the same question that I have repeated a couple times: when a commodity like silver breaks out to fresh 45 year highs, what happens to the price over the next three to five years?

I think we will also start to see more demand from investors for physical silver, and there has been talk of many of the bullion dealers having delays and significant premiums outside of what is normal. The Silver Eagles I helped my grandma purchase a week ago for roughly $85 now go for $98.51, but if I anyone can get their hands on silver anywhere near spot prices, I would love to hear about it. Over the last couple months since I started buying silver miners, we have continued to see the stocks in the sector lag behind the move in the metal.

The thing to remember with all of the silver miners is that they are all about to report a Q4 with a record average silver price well above $50 an ounce. We are only two weeks into Q1, but silver hasn’t spent any time below $70 so far. I have been surprised that we haven’t seen any real corrections or pauses for silver since November, but even if we chop sideways for a while to start 2026, any of the companies currently producing are going to have blowout numbers if they execute on production, and Q1 is going to look even better. I have been a broken record on this, but many of the silver mining stocks aren’t even pricing silver at $50 an ounce, and I like to think that none of the miners that I own aren’t anywhere close to pricing $60 or $70 an ounce.

Kuya Silver Overview

One of the more recent (and more speculative) purchases in my silver miner basket is Kuya Silver. They have three main projects in different stages. The Bethania project in Peru is in the process of ramping up production, and they are shooting for ~1.2-1.5M ounces of silver equivalent production annually in the first phase. They have a large surrounding land package, and nearby drill results have been very high grade. They also have the Silver Kings exploration project in Canada, and carried interest in the Umm Hadid project in Saudi Arabia.