I originally had a podcast guest lined up for yesterday, but work roped him in, so he will be coming on next week. There wasn’t anything groundbreaking from Sable Offshore’s SOC 0.00%↑ 10-Q, but there were a couple things worth mentioning in there. I also went into a couple other things with oil, and a couple pieces on broader markets that I found interesting.

Podcast Summary

Thoughts on the 10-Q (nothing earth shattering), mainly that they have enough cash to get things started up without further dilution.

Why I’m not worried about the 10 day waiting period that comes after OSFM signoff, and some of the nuances there.

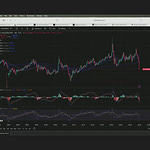

Short interest ticking up at the end of July.

ZeroHedge: How Oil Production Might Help California Meet Its Environmental Goals

Ranting on the recent IEA forecast.

A quick update on Cenovus’ bid for MEG Energy.

Jorge Arjona’s Thread on Oil (a good Twitter account to follow).

Thoughts on what assumptions are baked into market valuations

AI and the massive capex spend, and why I don’t think it will be that much different from previous spending booms.

Tariffs and the restructuring of the economy, and why economists might need to revisit some of their assumptions.