Yesterday I had Rob Connors from The Crude Chronicles on the podcast. If you’re interested in the long term picture for the energy sector, his work is worth checking out below. We got into a bunch of different topics, from the peaking productivity rates in the US, the importance of development costs, and where he sees the floor for oil. One of the other big picture topics that is starting to get more attention is the capex boom in the tech sector, and he compares it to oil and gas capex. For anyone interested in energy, you might learn a thing or two from this podcast. You can also find Rob on Twitter.

Podcast Summary

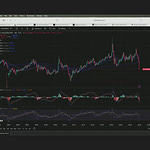

His thoughts on OPEC, why today doesn’t feel like a price war, and why he thinks the floor for oil is in the high 50s to low 60s.

Why development costs are a good predictor of oil prices over the long run.

Why the geology is the most important driver of costs versus new factors like steel tariffs.

Peaking well productivity rates in the US and why we are on the last leg for technology advancements and efficiency gains.

The capex boom for the tech companies on AI spending, and capex for the energy sector.

His view on natural gas over the next several years, and why we aren’t seeing a rise in development costs for natural gas.

Why he likes the refiners, and which energy subsectors perform best in different parts of the cycle.

Factors he is watching to see if we are heading into a recession.

Book Recommendations: Apple In China by Patrick McGee, Together We Roared by Steve Williams & Lords Of Finance by Liaquat Ahmed & Trillion Dollar Triage by Nick Timiraos.