On Friday I had Roger LaFontaine (an alias) on the podcast to talk about what is going on in Canada right now. He writes a Substack called Nugget Capital Partners, which is focused on opportunities in Canadian markets, primarily in the Energy and Real Estate sectors. We talked about the upcoming election in Canada, his thoughts on different stocks in Canadian markets, and what he looks for when evaluating those opportunities. He is an entertaining follow on Twitter, especially if you have any interest in the energy sector.

Podcast Summary

What he sees for the upcoming Canadian election, and why he doesn’t think we will see a conservative majority even if Polievre wins.

Why Trump is good for the Canadian energy sector.

“Carbon Tax Carney” dropping the consumer carbon tax but not the industrial carbon tax.

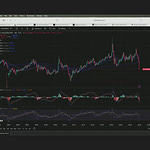

The “in house algo” at Nugget Capital Partners

The total shift in Canadian politics in recent weeks.

The potential to revive the Keystone XL pipeline project.

What he looks for in Canadian energy companies, and his thoughts on buybacks vs. dividends.

Why he’s not a fan of the Whitecap and Veren deal.

Why he likes Strathcona Resources, Precision Drilling, and Total Energy Services as three of his favorites in the Canadian energy space right now.

Canadian real estate, and why there is a big valuation gap between public and private commercial real estate.

Why retail, multifamily, and industrial sectors look attractive right now.

Why Dream Residential, H&R REIT, and Nexus Industrial are three of his favorites in the Canadian real estate sector.

Book Recommendation: The Frackers by Gregory Zuckerman.