Yesterday I was able to talk with Tommy Deepwater, who has been following offshore oil services for more than a decade, with a focus on deepwater. We talked about some of the recent news from the sector, the trend of consolidation and M&A, and where the offshore cycle sits today. His Twitter is a must follow for his weekly updates on the sector. It was a great follow up to my podcast series on oil, and if you’re interested in offshore oilfield services, specifically deepwater, you will enjoy it.

Podcast Summary

Noble NE 0.00%↑ retiring a couple drillships, and why parts of the stacked fleet will continue to be retired.

Why higher spec stacked drillships are more likely to be reactivated.

Why he thinks Transocean RIG 0.00%↑ has the highest quality active fleet.

The Transocean & Seadrill SDRL 0.00%↑ M&A rumors, and future consolidation of the sector.

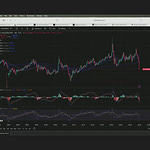

How the offshore bull cycle has been delayed, the picture for 2025/2026, and where day rates have to go to see new builds.

His thoughts on jackups, Borr Drilling BORR 0.00%↑, and their asset quality.

The OSV market, Tidewater TDW 0.00%↑, and how OSVs will benefit from increased activity in the deepwater sector.

Why he finds FPSOs (Floating Production Storage Offloading units) interesting.

Namibia, Colombia, and Suriname as potential geographies for new long-term drillship demand.

Book Recommendation: Chip War by Chris Miller.