Free Money? Two Odd Lot Trades Worth A Look

Celebrating The 1,000 Subscriber Milestone With A Potential Gift To All Subscribers

Yesterday, I crossed the 1,000 subscriber mark, something that I have been looking forward to for a while. I would love to get to 2,000 by the end of the year, but I’m optimistic about the way things have been going for the Substack. I appreciate all of you and hope you find my work valuable. I wanted to write a quick piece on a couple short term odd lot trades that could be profitable for all my subscribers with relatively low risk.

Monster Beverage MNST 0.00%↑ and Talen Energy (ticker: TLNE) both announced modified Dutch auction buybacks. You can read the terms of the Dutch auctions here for Monster and here for Talen. Odd lots (99 shares or less) get priority, so it’s a small trade, but something worth considering if you’re sitting on some cash. If you have 100 shares or more, you don’t get that same priority, so it’s not a trade to put on with hundreds or thousands of shares. It might take some time to understand the situation, but it’s a relatively simple trade that could earn a couple hundred bucks. I will go into the Monster odd lot trade in more detail, since that is the trade I have on. I might add Talen shares later in the month, but don’t own any yet. If they drop into the $110 range over the next couple weeks, it’s a trade that looks like a layup to me.

Monster Beverage

It’s not going to be some hugely profitable trade in terms of dollars, but 3% in a week is worth taking the time in my opinion. I bought shares of Monster a couple days ago around $52, and I tendered all 99 shares without specifying price. I assume with the way the stock has been trading that the tender price will be closer to $53 than $60, but we will find out next week. I did the same for the accounts I manage. I will walk through the process for Interactive Brokers and Charles Schwab, but I imagine the process would be similar for any other brokerage platforms you might be using.

Interactive Brokers & Schwab Process

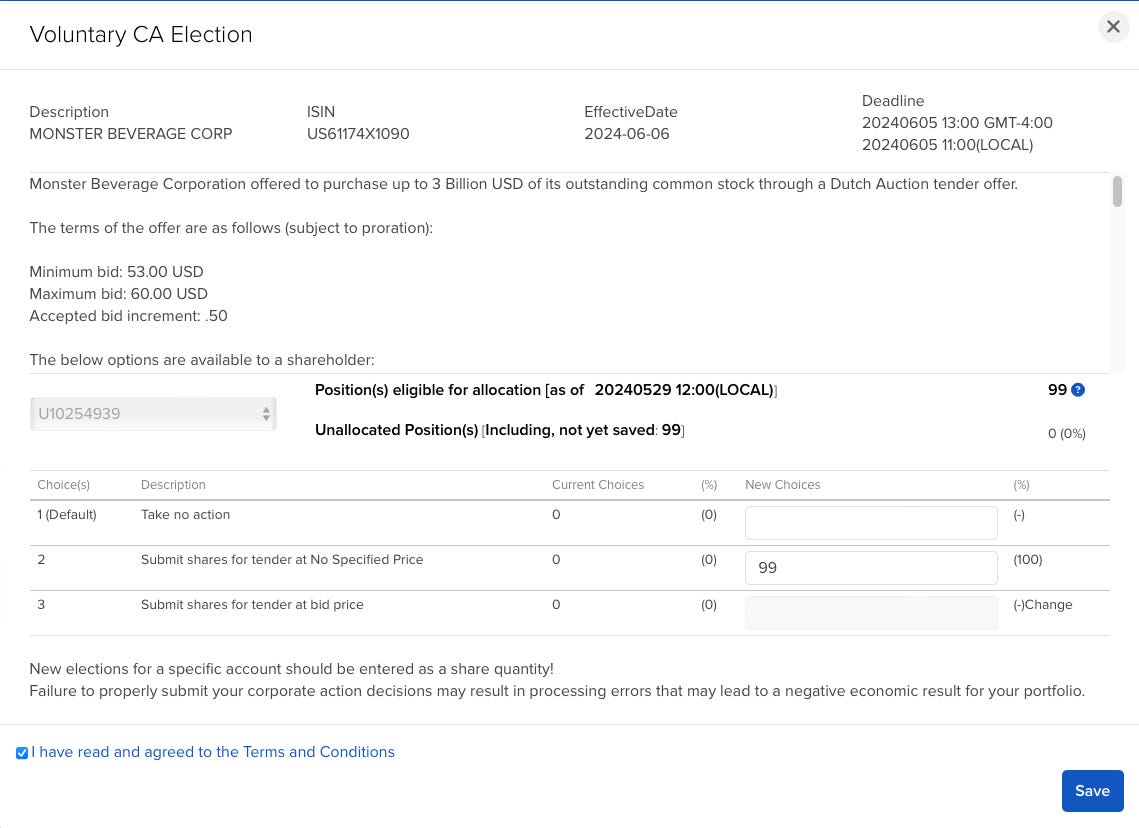

If you click on corporate actions for IBKR and go to the Monster corporate action, it should take a screen like the first image below. Clicking on corporate actions on Schwab should take you to the screen in the second image. For IBKR, pick option 2 and tender the shares at no specified price. For Schwab, pick option 2 to submit your shares to tender without bid.

Conclusion

Once you go through these steps, it should just be as simple as waiting until the expiration of the auction next week on June 5th. If you want to do some more digging, it’s worth checking out the conversation on Twitter around Monster (just type $MNST into the Twitter search function). I haven’t put the same trade on for Talen Energy yet, but it’s something on the watchlist that I would find very attractive if shares drop in the next couple weeks. If you put the Monster trade on, it should fund a steak dinner or two. If you’re feeling generous, maybe you will consider signing up to be a paid subscriber to Kontrarian Korner. I hope everyone has a good weekend, and I’ll see you next week.

Disclaimer

I own shares of Monster Energy, which are set to be tendered next week. You should do your own research before making any investment decisions. Different investment strategies have different risk/return profiles which should be considered before making any decisions.

Thanks for the small trade. I have not participated in a Dutch action before. When will we know the result of the tender? Like right after the tender deadline?

Did you get your full fill for MNST? Fidelity gave me the normal proration factor (48%) and I'm scratching my head as to why I didn't get my entire odd-lot preference filled