Dumpster Dive Candidates For 2024

Why I'm Looking To Take Advantage Of Potential Tax Loss Selling In Several Unique Opportunities As We Head Into The New Year

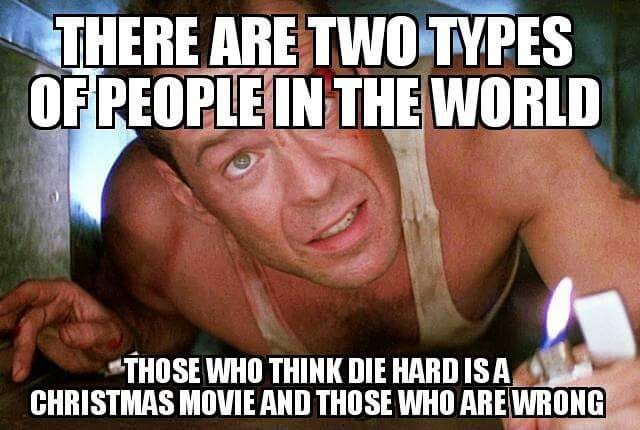

I have been considering selling one of my larger holdings in recent weeks, and there are a lot of interesting candidates for reinvestment as we head into 2024. I wanted to write a piece on several dumpster dive candidates as 2023 comes to a close. To get myself into the Christmas spirit, I watched the greatest Christmas movie of all time, Die Hard, which had another run in theaters recently.

On the topic of markets and seasons, one of the things that happens near the end of every year is tax loss selling. A lot of investors take a look at their portfolio when December rolls around and consider if it is a good time to cut bait on some of their losers to offset gains from the winners. Stocks that have had a rough stretch are good candidates to look at in December, if you think the actual prospects of the business look better than the share price might indicate. Today I’m going to talk about several opportunities that have had a rough year for a variety of reasons, and the depressed prices have me interested in some bargain shopping for the new year. I came across a couple of these ideas listening to the recent Value Hive podcast, but I have been watching three of the four ideas for a couple months to see if the margin of safety gets wide enough to pull the trigger.

You don’t get any points for originality in public markets. The returns aren’t different if someone else came up with the idea and bought at the same price. Is it satisfying to find something that the market overlooked? Sure. However, when you consider how much investment flows through passive indices, I don’t think it is all that difficult. In my opinion, the idea that markets are efficient is a complete joke, especially after some of the stuff we have seen over the last couple years.

You also have the issue of passive investment flows into indices like the S&P 500 and Nasdaq 100. The amount of investment flows that are passive have continued to increase, and in my opinion, this actually makes financial markets less efficient, not more. I don’t want to get too sidetracked, but I plan to write a piece on this topic due to the way markets are being driven by passive flows, institutional investors, and high frequency trading. Now let’s get into the first stock on my watchlist.