America's Gold & Silver: Operational And Exploration Upside In Idaho & Mexico

Massive Torque To Silver & Why Production And Margins Will Expand While Costs Drop Dramatically In 2026

Summary

America’s Gold & Silver is a silver miner that has producing assets in Idaho and Mexico. Their assets also have significant exploration upside.

They recently bought the Crescent Mine for a song, which is right down the road from the existing Galena operations in Idaho’s Silver Valley.

They are currently the only producer of antimony in the US, and there are rumblings that we could see a new antimony circuit in Silver Valley.

I think USAS will be able to meaningfully increase their silver production over the next couple years, especially from their mines in Idaho, which will drive costs down and lead to much better margins.

Every silver miner obviously has torque to the silver price, but the operational changes coming in 2026 for USAS add a huge kicker for investors.

Even though we hit all time highs for silver on Friday, I’ll spare everyone the rant on silver because I have been beating the drum on it recently. If you share the view that silver is going to continue higher in 2026, a lot of the silver miners have meaningful upside from here. Americas Gold & Silver USAS 0.00%↑ is one of my favorites, and like Vizsla Silver VZLA 0.00%↑, they have a district scale asset with their Galena complex in Silver Valley. We will see if they turn into a major, but I think the stock is still extremely mispriced today. I will be on the road for the next couple weeks for the holidays, but I will be working on my outlook post for 2026 while I’m traveling. That will take some time to get together, so don’t expect a bunch of new posts until the new year. In the meantime, I hope everyone has a Merry Christmas and Happy New Year. Let’s get into America’s Gold & Silver USAS 0.00%↑. I think it makes sense to start with Silver Valley, and why I find USAS so interesting.

Silver Valley Background

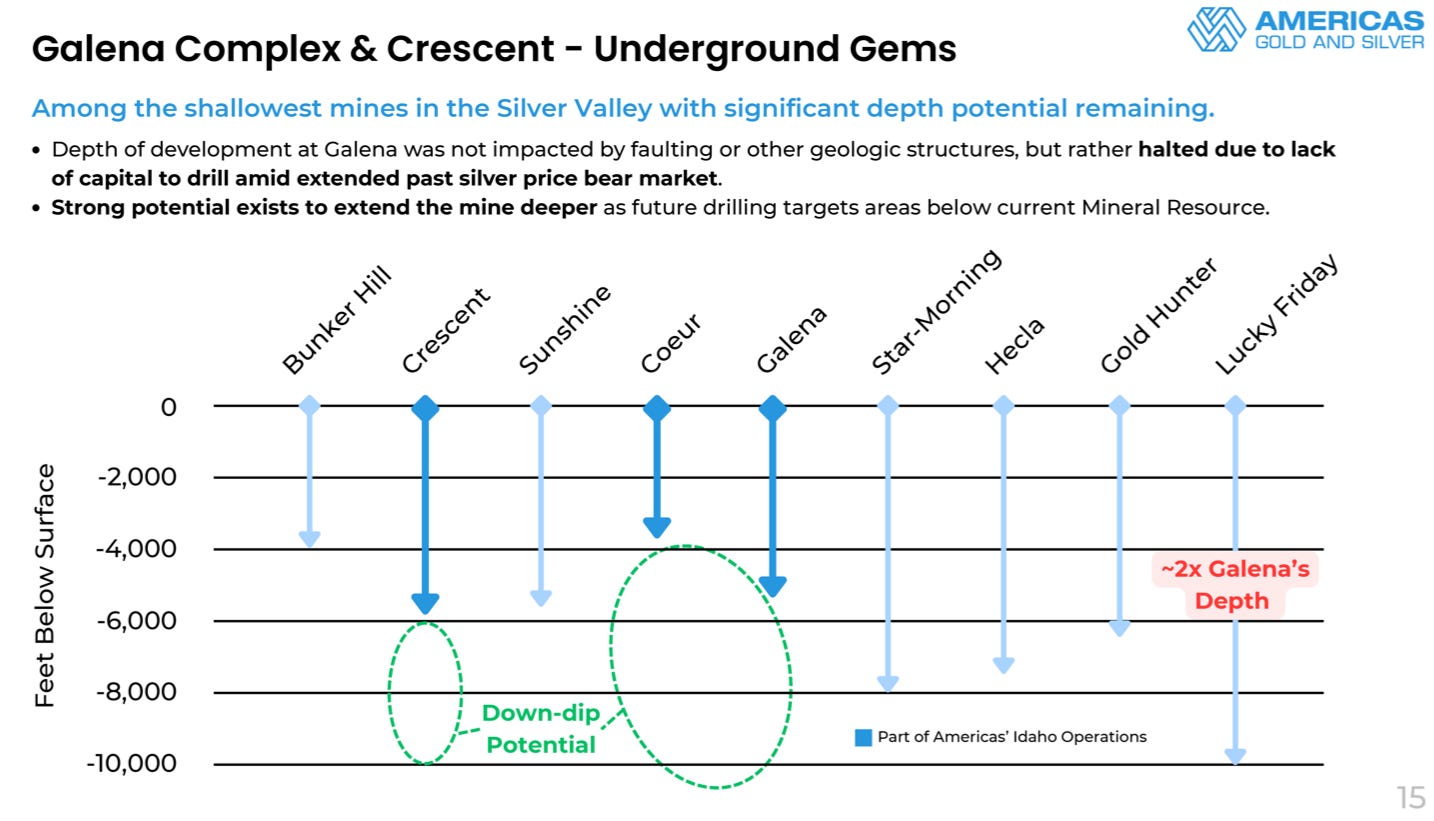

The USAS mines in the Galena complex have significant exploration upside in my opinion. If you poke around the history of major silver mines nearby, like Hecla’s HL 0.00%↑ Lucky Friday Mine, the Sunshine Mine (which is no longer operational, but billionaire Thomas Kaplan is trying to restart it in 2028), Bunker Hill (with a planned restart in 2026), and the Galena Mine, it shows that Silver Valley is full of long life assets with high grade silver. They also produce some combination of lead, zinc, copper, and/or antimony in significant amounts. Call it closeology or something similar, but I think USAS is worth a look based on their Idaho operations alone.

Lucky Friday: Began operations in 1942, and is currently producing almost ~5M oz/year. Historical production of more than 165M oz of silver, and they expect the mine to last at least until the 2040s. It’s already close to two miles deep.

The Sunshine Mine: This one has a bit of a morbid history as the site of one of the worst mining disasters in US history in 1972 with 91 deaths. The mine began operations in the late 1800s, with historical production of more than 360M oz of silver. Restart is planned for 2028, and they expect more than 7M oz/year after restart.

Bunker Hill: Began operations in 1885, with historical production of more than 165M oz of silver. Bunker Hill Mining is planning to restart this mine in the first half of 2026.

The Galena Mine: Began modern production in 1947, with a peak production of more than 5M oz of silver. It has produced more than 240M oz of silver, and the management team thinks they can get it back to 5M oz/year.

America’s Gold & Silver Overview

USAS is a silver miner with a market cap of $1.76B. I think investors can expect increasing silver production over the next couple years, with improved costs and margins. One of the main things that makes digging through the silver miners difficult is that many aren’t actually all that exposed to silver. 87% of USAS’ revenue comes from silver, so it checked the box for me on that front. The management team has been successful in the past with their involvement in Klondex Mines and Karora Resources, and they joined USAS in late 2024. They have been busy since then, and they make a compelling case that all of their properties have been starved of capital for far too long.

The highlight of their portfolio is certainly the Idaho operations in Silver Valley, but they also have Mexican operations that have been starved of capital. They just completed the acquisition of the Crescent Mine for $65M ($20M in cash and 11M shares), which is nine miles down the road from Galena. That deal is going to look like a heist in a couple years, and they are planning to restart production at that mine in Q2 of next year. The Galena mine is the only mine in the US that currently produces antimony, and I find USAS more attractive than names like Perpetua Resources PPTA 0.00%↑ and United States Antimony Corporation UAMY 0.00%↑. The mineral has been in focus since China’s export ban, and while that situation remains in flux, it’s worth mentioning even though the company’s main focus is silver.